Japanese Auction: Meaning

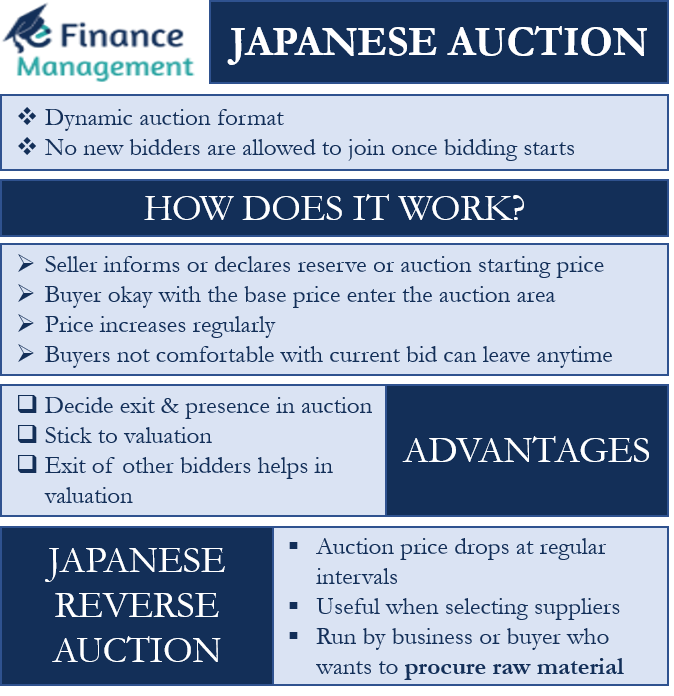

Japanese Auction is a type of English auction. It is a dynamic auction format where no new bidders are allowed to join once the bidding starts. Also, the price of the item in the auction keeps increasing during the bidding process. The bidders who do not want to keep up with the auction price are free to drop out. The same process continues, and it ends when, only when one bidder remains. Usually, the winner is the one that is okay with the final bid amount.

Such an auction results in an efficient auction. Suppose bidder A believes the value of an item is x. So, bidder A will usually remain in the auction if the auction price is less than x. If all the bidders follow the same strategy, then the buyer with the highest valuation wins the auction. Thus, such an auction encourages a truthful mechanism.

How does it Work?

This is how the Japanese Auction works:

First of all, the seller or the auction agent informs or declares the reserve or the auction starting price. This is the minimum or starting price of the auction, and all subsequent bids have to be more than this base price. All the buyers who are okay with the initial price enter the auction area. No new bidders can enter the area in between.

The item’s price continuously increases at regular intervals and by a fixed amount or percentage. Bidders can leave the bidding area anytime if he is not comfortable with the current bid price. And once a bidder leaves the auction, they can not re-enter the auction process.

Also Read: Auctions

The auction gets over when only a single bidder remains in the process. The last remaining bidder wins the auction at the last displayed price.

Advantages of Japanese Auction

Following are the benefits of this auction:

- Bidders will not have to reveal their valuation in advance. They just need to decide whether to exit or remain in the auction area during the auction.

- Bidders need to follow a simple strategy, i.e., stick to their valuation of the item. A point to note is that following such a strategy is important in every type of auction.

- Another advantage is that bidders can see the exit price of the other bidders. This could help them to adjust their valuation accordingly.

Despite the benefits, such a type of auction is scarce. Instead, Japanese Reverse auction is more relevant because it is of use in the business world and helps companies with the procurement process.

Japanese Reverse Auction

As the name suggests, this auction is exactly the reverse of the Japanese auction, which we discussed above. In the reverse auction, the auction price drops at regular intervals during the auction process. Such a type of auction is useful when selecting the suppliers. Or when the buyer faces a competitive market or desires favorable rates for the raw materials.

The important point to note here is that this auction is run by the business or the buyer who wants to procure raw material. All other auctions we generally use and see are for selling an item or product. However, a Japanese Reverse Auction is an auction that works as an elimination game. Here the last remaining buyer wins the procurement contract. In this, the buyer sets the starting price at which the suppliers will enter the auction area. The buyer uses the information from the vendors to determine the starting price.

Also Read: English Auction

All suppliers who are okay with the starting price enter the auction area. The buyer or their agent then reduces the prices by a set amount or percentage. Suppliers need to decide whether or not the current price is okay for them. If not, they can opt-out of the bidding process. The last standing supplier wins the bidding. Also, the bidding will end if a certain number of suppliers remain (if the buyer wants to work with multiple suppliers).

Such an auction aims to help the buyer discover the lowest price for a raw material that they want to procure.