What is Management Buy-in (MBI)?

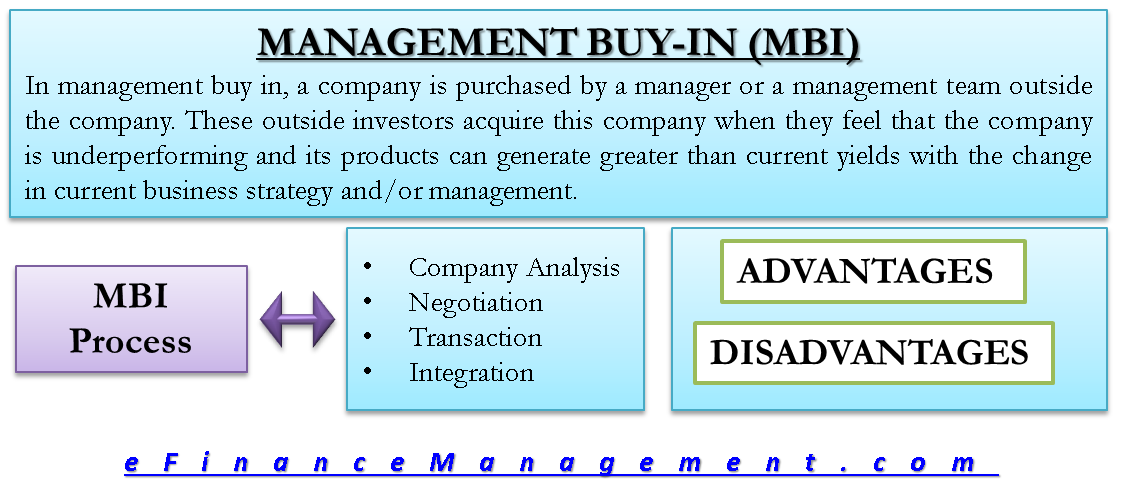

Management buy-in (MBI) is a corporate activity. In management buy-in, a company is purchased by a manager or a management team from outside the company. The target company is acquired by these outside investors when they feel that the company is underperforming and its products can generate greater than current yields with the change in current business strategy and/or management. After the acquisition, the buyer can replace the current board of directors of the company with their representatives. There is often competition among the buyers for purchasing a suitable business. Generally, these management teams are led by experienced managers at the managing director level. The difference between management buy-in and management buy-out is the position of the buyer. In the case of a management buyout, the buyers are working for the target company. After understanding the meaning, let’s understand the process of MBI.

Process of Management Buy-in

Management buy-in is an acquisition tactic. The process is as follows.

Company Analysis

First of all, the buyer needs to gather all information about the company that it wants to purchase. It includes doing a market analysis of the target company, its buyers, sellers, competitors, suppliers, substitutes, products and services, customers, the scope of business, market capitalization, etc. The buyer also needs to know about the number of buyers who want to purchase the target company. Based on such information, the buyer can make an accurate decision about the purchase.

Negotiations

Based on the analysis from the first step, the buyer estimates a certain amount to offer to the target company’s owners. Then, the offer is made to the target company. If the target company feels that the offered price is not fair or reasonable, it can reject the offer. Then both the parties can negotiate the price. In the end, both the parties mutually agree on one price.

Transaction

Once both the parties agree on a price, the transaction moves forward. Also, there are various formalities and paperwork included in this phase primarily guided by the rules and regulations of the country where it took place.

Integration

This is the last phase of this process. Once the transaction is done, the buyer officially becomes the owner of the company’s management. They can implement all the changes which they think are required in the company. They can now nominate their representatives for the company’s board of directors.

Advantages of MBI

- The buyers, in many cases, get undervalued companies in MBI. The value of which can be unlocked and sold at much higher prices later.

- If the current owners of a company cannot manage the company, MBI is a win-win situation for both buyers and sellers.

- The new management team might have better knowledge, contacts, experience, etc. It might actually help the company grow and maximize the shareholder’s wealth.

- Current employees may get motivated because of new changes in the management.

Disadvantages of MBI

- The new management team may also fail to bring the required growth to the company.

- Even after changing the management, there is a chance that companies may not be successful.

- The existing employees of the company may feel demotivated.

- The buyer may end up paying way more than required if they estimate the value of the company incorrectly.

Also, read about other strategies of Corporate Restructuring.