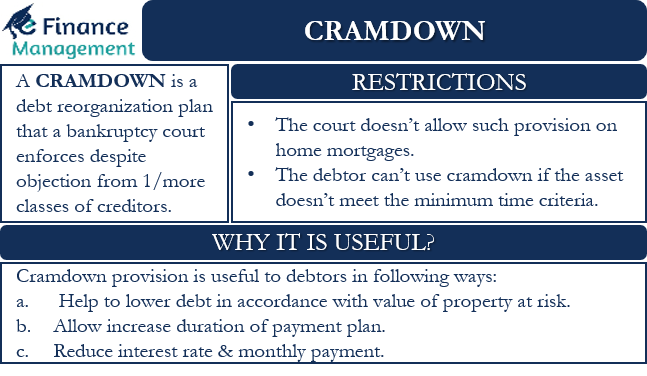

A Cramdown is a debt reorganization plan that a bankruptcy court enforces despite objection from one or more classes of creditors. It is a way for debtors to reduce their debt amount or interest rate, or both. Thus, cramdown is an excellent benefit a debtor can have by filing a bankruptcy application under Chapter 13.

As is evident, the word cramdown here means cramming the reorganization plan down the creditors’ throats despite their objections. We can also call this provision a cram-down or a cram-down deal.

The court approves such a plan involving creditors getting more than they would if the debtor liquidates all its assets to pay the debt. One crucial requisite of cramdown is that the reorganization plan is fair and equitable to all creditors. However, such a reorganization plan lowers the amount that creditors owe to a company. The lower amount generally reflects the market value of the collateral that was used to get the loan initially.

Initially, cramdowns were in use for Chapter 13 bankruptcies. Now they are useful in Chapter 11 bankruptcies as well.

Cramdown – Why it is Useful?

This cramdown provision is very useful when your residence or car is at risk. Using cram-down in bankruptcy would help debtors to lower their debt amount in accordance with the value of the property at risk.

Also Read: Chapter 11 Bankruptcy

Also, it would allow debtors to increase the duration of the payment plan, and reduce the interest rate, as well as the monthly payment. The bankruptcy court decides the interest rate, and it is generally lower than the current rate. Also, the Chapter 13 bankruptcy usually lasts for three to five years. So, you can extend the duration of your loan till the bankruptcy period and thus, reduce your monthly payments.

Moreover, when you file for Chapter 13 bankruptcy, you could be able to keep the ownership of your property.

Basically, when you cram down a loan, the court reduces the amount of debt to reflect the value of the property at risk (collateral). In other words, the outstanding loan amount could be reduced to the extent of the market value of the security given as collateral. The lowered amount will show in the Chapter 13 payment plan. And the remaining loan balance is usually clubbed with unsecured debts and is paid after the reorganization plan completes. Usually, debtors may never pay unsecured debts in a Chapter 13 bankruptcy. Or, at the most, these debts are paid partly in the last leg.

Example

For example, suppose one has a car that is worth $4,000. However, he has a car loan whose balance is $5,000. If the bankruptcy court approves cram-down, his loan balance will reduce to $4,000. The remaining balance of $1,000 will become part of the overall unsecured loans.

Additionally, one has two more options – the debtor can further stretch the loan repayment period beyond the existing payment schedule. Moreover, one can also reduce the interest rate. For example, if the car loan is left for 20 months, but with the court’s approval, one can extend it to 40 months. This could result in you paying more money over time, but it does help you to reorganize your debt. Similarly, the interest rate reduction can also take place. And in that case, the monthly payout will be lower.

Also Read: Bankruptcy – Chapter 13

Restrictions in Using Cramdown

Section 1129(b) of the Bankruptcy Code defines the cramdown provision. This section gives power to the bankruptcy court to go ahead with the debtor’s reorganization plan despite the objections of some of the class of creditors. Provided the plan is “fair and equitable” in the eyes of the court.

The cram-down provision is usually applicable for secured debts, as reduction can be done with reference to the security value. But, the court doesn’t allow such provision on home mortgages, which is also the primary residence of the debtor. However, such a provision is allowed on other personal property, like a car, furniture, etc. Also, you can use this provision on other types of real estate property, including rental homes and investment property.

But, one can only use such a provision after the passage of a certain specific time for that asset. If the asset does not meet the minimum time criteria, then the debtor can not use cramdown. The time period rule ensures that debtors do not cram down their debt immediately after buying a new asset.

For a car, the minimum time period is usually 912 days. This limitation may not apply if the vehicle is for commercial use. For other types of personal property, such as household appliances and furniture, the minimum time period is usually a year.

A point to note is that cramdown is applicable on other investment properties (except for residence), but debtors do not usually go for it. This is because cramming down requires debtors to pay the debt within the bankruptcy period (usually three to five years). But, such real estate mortgages are generally a big amount that may be impossible to pay in five years.

Final Words

Cramdown in bankruptcy could prove very useful. This is because it helps to reduce the debt, extend the payment duration, and/or lower the interest rate. In addition, the balance debt gets transferred to unsecured debt, which is never a concern for those who successfully complete bankruptcy. If you are going for a Chapter 13 bankruptcy and cram-down, it is important to seek professional advice. This will also save on the debtor’s personal residence and where the debtor is in a position to pay back its debts in a reasonable time frame and manner equitably.

Frequently Asked Questions (FAQs)

A Cramdown is a debt reorganization plan that a bankruptcy court enforces despite objection from one or more classes of creditors.

Cramdown provision is very useful in the following ways to debtors:

a. Helps to lower debt amount in accordance with the value of the property at risk.

b. Allow an increase in the duration of the payment plan

c. Reduce the interest rate & monthly payment.

Initially, cramdowns were in use for Chapter 13 bankruptcies; now, they are useful in Chapter 11 bankruptcies as well.