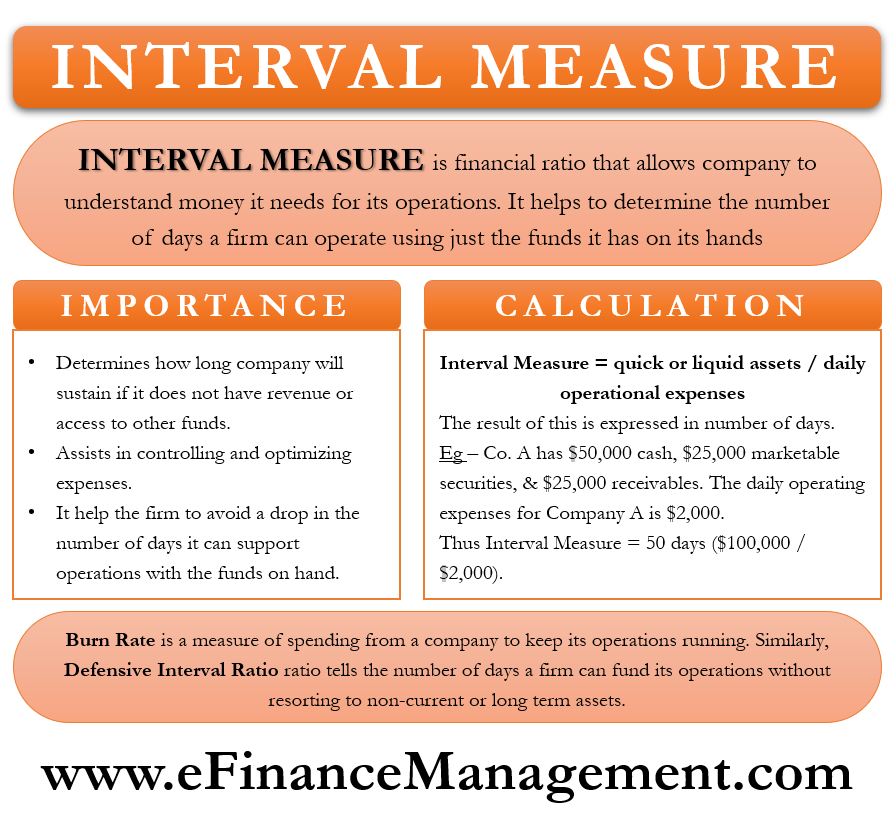

The interval measure is a liquidity ratio that allows a company to understand the money it needs for its operations. It also helps in understanding how much funds a company needs for operations to help in the long-term survival of the company.

The interval measure ratio helps a business get an idea of how long it would survive using the available working capital. Or, we can say this ratio helps determine the number of days a firm can operate using just the funds it has on its hands without accessing the long-term assets. Because in the short term, those long-term assets may not be easily converted to cash.

Importance of Interval Measure

For any business, it is important to know how long it could continue to meet its obligations if it has no revenue or no access to other funds.

Also, it assists businesses in controlling and optimizing expenses so that the operational period can be stretched further. And a business can control its expenses by ensuring it does not exceed the interval measure output. Suppose a firm faces any problems and needs to make emergency expenditures. This, in turn, could push the company to exceed the ratio.

Also Read: Defensive Interval Ratio

Now, the firm should go for cost-cutting measures to meet the interval ratio. It will help the firm avoid a drop in the number of days it can support operations with the funds on hand.

How to Calculate Interval Measure?

The interval measure is easy to calculate. All one needs to do is divide the total quick or liquid assets by the average daily operating expenses. Quick assets are ones that one can quickly convert into cash. Or, it is current assets less inventory. Moreover, it is upto the management if it wants to include inventory in the calculation depending on how quickly the company can sell it and get the cash. This ratio is also known as the defensive interval ratio.

The formula for interval measure ratios is:

| Interval Measure Ratio = Liquid Asset / Daily Operating Expenses |

The answer that we get is the number of days a firm can use its assets to fund its operations.

Example

Suppose Company A has $50,000 cash, $25,000 marketable securities, and $25,000 accounts receivables. The daily operating expenses for Company A are $2,000.

Thus, the total liquid assets for Company A is $100,000 ($50,000 + $25,000 + $25,000).

The interval measure in this case is 50 days ($100,000 / $2,000).

Burn Rate

Burn rate is also a similar concept to interval measure. The interval measure also serves as an input for the burn rate. A burn rate is a measure of spending from a company to keep its operations running. A point to note is that the burn rate does not consider the challenges that a company may face in keeping operations running.

Final Words

Interval measure is important for a business to know how long it could survive with cash and equivalent. However, one must know that the internal measure and burn rate only give a rough estimate of the cash burn. They fail to provide or account for companies’ problems to continue with their operations. Nevertheless, the ratio is still popular among analysts and investors to get an idea of the company’s financial health. Even venture capitalists use this ratio to decide whether or not a business is worth investing in.