What is a Quick Ratio?

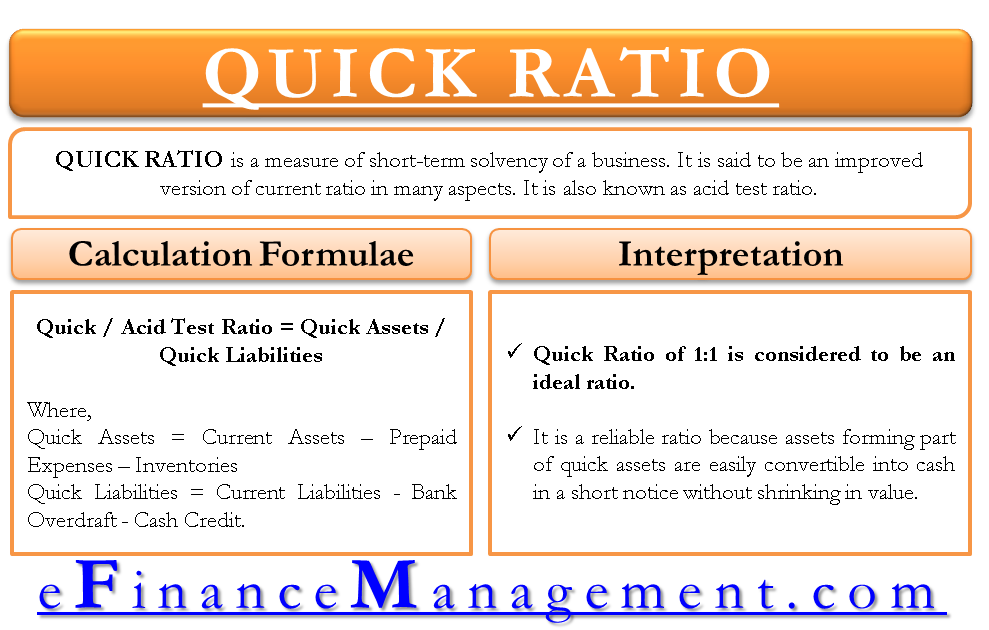

The quick ratio is a measure of the short-term solvency of a business. Quick or Acid Test ratio is the proportion of the quick assets to quick current liabilities of a business. Quick assets include all cash and cash equivalents, easily marketable securities, and AR (Accounts Receivable), excluding inventories. And Quick current liabilities include all current liabilities except bank overdraft and cash credit. It measures the capability of an organization to pay its obligations by utilizing its quick assets. The article throws light on ways to interpret and improve the quick/acid test ratio.

We can also address it as an improved version of the current ratio in many aspects. We also call it the acid test ratio.

This ratio is a type of liquidity ratio and is useful not only to internal finance managers but equally useful to creditors, lenders, banks, investors, etc. Normally, the wide use of the current ratio takes place in bank finance, but for businesses with a liquidity crunch, banks may consider giving more importance to the quick ratio. It is a ratio for taking care of the defects in the current ratio. In other words, we can also say that it is an extended version of the current ratio.

Both these ratios deal with the liquidity position of a business. The quick ratio is also known as the acid test ratio, which is an astringent or tough test of liquidity as compared to the current ratio.

How to calculate Quick Ratio using its Formula?

The calculating quick ratio is a cakewalk if the current ratio is already calculated. It is a ratio of quick current assets and quick current liabilities. Quick current assets refer to current assets less the value of inventory and prepaid expenses, and quick current liabilities refer to current liabilities less bank overdraft and cash credit.

Also Read: Quick Ratio Calculator

For calculation, you can use the Quick Ratio Calculator

Formula:

The formula for it can be in two forms:

| Quick / Acid Test Ratio = Quick Current Assets / Quick Current Liabilities Or Current Assets less Inventory and Prepaid Expenses / Current Liabilities less Bank Overdraft and Cash Credit Or Cash + Marketable Securities + Accounts Receivables / Creditors / Accounts Payable |

Explanation of Components – Quick Assets and Liabilities:

Quick Current Assets

Inventory and prepaid expenses do not form a part of quick assets as they are comparatively less liquid in nature. Quick assets can be easily transformed into cash without lowering their value. The formula for calculating quick current assets is:

Quick Current Assets = Current Assets – Inventory – Prepaid Expenses.

The reason for excluding inventory and prepaid expenses from quick assets is that both of these do not provide actual liquidity. Inventories cannot be converted into cash immediately. They have to go through the route of debtors in order to attain liquidity which can be a time-consuming process. Same way, prepaid expenses are those expenses that are paid in advance. That is before the expenses are incurred. But the benefits of such expenses are enjoyed at a later date. Moreover, these are the expenses already incurred, and they will not affect the cash flow anymore. And hence, both of these are excluded from the calculation of quick current assets.

Quick Current Liabilities

Current liabilities are all the liabilities and payments which fall due and need to pay within the accounting year. In other words, all that is payable in less than a year are treated as current liabilities. Anything payable beyond one year, i.e., beyond one year as on the date of the balance sheet, is not part of the current liabilities. To arrive at the quantum of Quick Current Liabilities, we need to exclude Bank Overdraft and Cash Credit from the given amount of Current Liabilities. The formula is as follows:

Quick Current Liabilities = Current Liabilities – Bank Overdraft – Cash Credit.

The reason to exclude both of these items for calculating quick liabilities is that both such liabilities occur in order to buy inventories or pay off creditors.

A point to note here is that these two items are excluded only when these sources have become a permanent source of funding as an ongoing business. If these are not going to continue on a regular basis, then, in that case, they will not be deducted.

All values required for calculations of quick assets and quick liabilities are easily available on the balance sheet of the company.

For a detailed calculation of current assets and liabilities, refer to the article: CURRENT RATIO.

Example

Example or Illustration for Calculation

Consider the following example to understand the concept well:

| Current Assets |

Amt (USD) | Current Liabilities | Amt (USD) |

| Cash | 35000 | Creditors / Accounts Payable | 95000 |

| Marketable Securities | 20000 | Bank Overdraft | 10000 |

| Accounts Receivable | 90000 | Cash Credit | 6000 |

| Prepaid Insurance | 15000 | ||

| Inventories | 65000 | ||

| Total Current Assets | 225000 | Total Current Liabilities | 111000 |

Solution by Both Formulae

Quick ratio = Cash + Marketable Securities + Accounts Receivables / Accounts Payable + Bank Overdraft + Cash Credit

= (35000 + 20000 + 90000) / 95000 = 145000 / 95000 = 1.53OR

Quick ratio = Cash Current Assets less Inventory and Prepaid Expenses / Current Liabilities less Bank Overdraft and Cash Credit

= (225000 – 15000 – 65000) / (111000 – 6000 – 10000) = 145000 / 95000 = 1.53

And, Current ratio = Current Assets / Current Liabilities = 225000 /111000 = 2.03

What is a Good Quick Ratio?

A quick ratio of 1:1 is considered good because the assets included in the calculation are liquid assets easily converted into cash without shrinkage in value. A firm with a quick ratio of 1:1 is considered to have sufficient liquidity. It is capable enough to pay off all the liabilities/bills on time. A quick ratio of 1:1 simply means that the firm has liquid assets equal to the liabilities that we need to pay off. It is a reliable ratio because assets forming part of quick assets are easily convertible into cash on short notice without shrinking in value.

A detailed interpretation, along with how to improve the ratio, is presented in our following post.

How to Analyze (Interpret) and Improve Quick Ratio?

Cautions

A company is required to maintain its quick ratio equal to or more than 1 but not more than 2. Else it will result in the blockage of funds. In the 2nd example, the ratio is quite high at 3.4. The company should think of proper deployment of these excess blocked funds to earn out it. If there is no opportunity, then it should explore the possibilities of redeeming part of the loans to save the interest cost. But holding it idle is, in turn, increasing its opportunity cost. There are several ways to improve a quick ratio.

Another important point to note is that though the 1:1 quick ratio is the general norm, however, this can vary with the industry or business within which the company is operating. So this is not sacrosanct and needs to be considered together with the industry practices.

Difference between Current Ratio and Quick Ratio

The difference between a current ratio and a quick ratio in terms of its calculation is that the numerator is changed from current assets to quick assets, and the denominator is changed from current liabilities to quick liabilities.

The technical difference or, say, a defect of current assets is that the entire current asset pool, such as cash and inventory, is weighted equally. In view of liquidity, inventory is difficult to be liquidated (without the reduction in value) compared to other current assets such as debtors, etc. The conversion of inventory into cash has a hurdle step of ‘receivables’ in between because normally, the conversion of inventory into cash does not take place directly but via debtors. The current asset gives an understanding of the liquidity position of a firm that will suffer if the inventory needs liquidation because of two reasons – the time of liquidation and the diminution of the value of inventory.

In the above example, the difference between the current ratio (2.03) and the quick ratio (1.53) is positive, i.e., the quick ratio is less than the current ratio by 0.5. This is an alarming situation for bankers because liquidity is hampered by the presence of a higher level of inventory.

Keep reading: Advantages and Disadvantages of Acid Test Ratio.

Quiz on Quick Ratio

thanks sanjay