What is Interest Service Coverage Ratio?

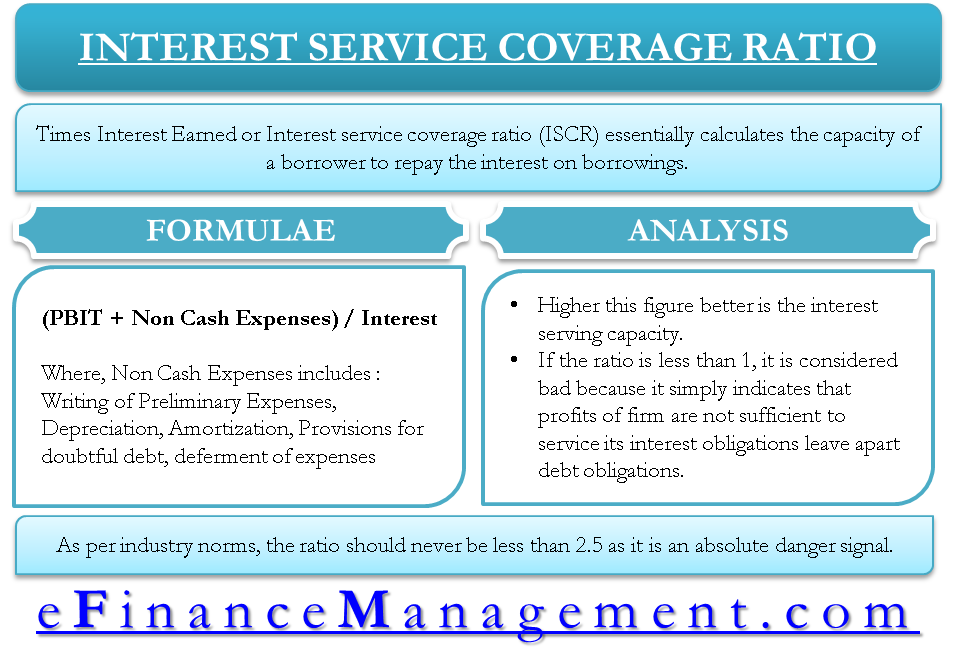

Interest Service Coverage Ratio (ISCR) essentially calculates the capacity of a borrower to repay the interest on borrowings. One can also call it an Interest Coverage Ratio. ISCR less than 1 suggests the inability of the firm’s profits to serve its interest payments due on debts and obviously the principal amount of debts. ISCR is a tool for financial institutions to judge the capacity of a borrower to repay the interest on the loan.

Interest Coverage Ratio (ICR) is one of the leverage/coverage ratios which is calculated in order to know the availability of cash profit to repay the interest on debts. Generally, ICR is determined when a firm/business borrows a loan from a bank/financial institution or any other loan provider.

This ratio explains the ability of cash profits to meet the loan’s interest payment. It is an important ratio for the financial analysis of a business or firm, especially from a lender’s point of view. This is because the ratio indicates the repayment capacity of borrowers to repay interest.

It is also referred to by the term Times Interest Earned.

To have some concrete results, one needs to calculate this ratio for the entire loan period. The calculation of this ratio depends on the forecasted financial figures. It is evident in the moratorium period, which is the initial period in which cash inflows are sufficient. Even an excellent borrower with great credibility will also not be able to service the interest and principal amount in that period.

Also Read: Interest Coverage Calculator

ISCR Formula

There is a simple calculation of the formula. We require the following items from the financial statements:

- Profit before interest and tax (PBIT)

- Noncash expenses (e.g., Depreciation, Miscellaneous expenses are written off, etc.)

- Interest for the current year

Sometimes, these figures are readily available, but at times, one has to determine them using the company’s financial statements.

The formula for Interest Service Coverage Ratio is as follows:

| Interest Service Coverage Ratio (ISCR) = (PBIT + Non-Cash Expenses) / Interest |

Profit Before Interest and Taxes (PBIT)

PBIT is easily available in the Profit and loss account. Just find out the PAT, which is readily available on the face of the profit and loss statement. From the PAT, deduct the income tax and interest, and the result is PBIT.

Interest

It is the amount paid or payable on the loan for the financial year.

Non-cash Expenses

Non-cash expenses are those expenses that we charge to the profit and loss account. Also, we have already paid for these expenses in the past years. Following are the non-cash expenses:

- Writing off preliminary expenses, pre-operative expenses, etc.,

- Depreciation on the fixed assets,

- Amortization of intangible assets like goodwill, trademark, patent, copyright, etc.,

- Provisions for doubtful debts,

- Deferment of expenses like an advertisement, promotion, etc.

Note: Most resources like books, websites, etc., do not add non-cash expenses in the numerator of the formula. We have added it to believe that interest payment can be made from cash, not profits. Hence, non-cash expenses like depreciation do not reduce the cash balance.

Note: In the same way, to make the formula more cash logic-driven, we can reduce the taxes from the numerator. Because a firm would not have a choice of making tax payments, they are mandatory payments in cash.

You may like using our Interest Service Coverage Ratio Calculator for easily calculating the ratio.

ISCR Example

| EXAMPLE – Interest Service Coverage Ratio | ||

| Income Statement for Company A | ||

| Sales Revenue | 1,800,000.00 | |

| Cost of Goods Sold | (600,000.00) | |

| Gross Profit | 1,200,000.00 | |

| Total Expenses | ||

| Salaries | (120,000.00) | |

| Rent | (240,000.00) | |

| Utilities | (100,000.00) | |

| Bad Debts | (100,000.00) | |

| Depreciation | (150,000.00) | |

| Operating Profit (EBIT) | 490,000.00 | |

| Interest Expense | (200,000.00) | |

| Earnings Before Taxes (EBT) | 290,000.00 | |

| Taxes | 40% | (116,000.00) |

| Net Income | 174,000.00 |

Result:

| Interest Coverage Ratio | 2.45x |

| (Added Non-Cash Expenses) | 3.70x |

| (Deducted Taxes) | 3.12x |

Interpretation of Interest Service Coverage Ratio

Calculation of ISCR is a child’s play, but it makes sense only when it is interpreted in the right sense. The result of an interest service coverage ratio is an absolute figure. Higher this figure better is the interest serving capacity. If the ratio is less than 1, it is considered bad because it simply indicates that the firm’s profits are not sufficient to service its interest obligations, leaving apart the debt obligations.

Also Read: Debt Service Coverage Ratio (DSCR)

The ratio should never be less than 2.5 as it is an absolute danger signal as per industry norms. The ratio is most utilized by lenders such as banks, financial institutions, etc. Broadly, there are two objectives of any lender behind extending a loan to a business: earning interest and securing the principal.

Let’s take an example where the ISCR is coming to be less than 2.5, which directly indicates negative views about the capacity of a firm to repay the interest. Does this mean that the bank should not extend a loan? No, absolutely not. It is because the bank will analyze the profit-generating capacity and business idea. If the business is strong in both of them, the ISCR can be improved by increasing the loan term and providing a moratorium period in which no payments are due for the borrower.

Cautions

We should also note that the decisions about lending will not only depend on this ratio. There are hosts of other factors also. Visit Coverage Ratios and its Types for a more detailed article.

RELATED POSTS

- Loan Life Coverage Ratio – Meaning, Formula, Calculation, and Interpretation

- Debt Service Coverage Ratio Calculator

- How to Analyze (Interpret) and Improve Debt Service Coverage Ratio (DSCR)?

- Coverage Ratio and its Types

- How is DSCR Calculated?

- EBITDA Coverage Ratio – Meaning, Formula, Benefits, and More

good explanation…

regard – CA Kapil Tripathi