In the Black Vs In the Red – Meaning

In the Black and In the Red are popular financial terms used to analyze the financial stability of companies and/or individuals. When a company is in the Black, that means that the company is in a profitable stage. The Black companies have revenues higher than their expenses. Similarly, ‘In the Black’ individuals have personal assets exceeding their personal liabilities. These individuals are successful in repaying their personal debts. In the Red means that the companies are in the non-profitable stage. The expenses of the companies are more than the revenues of the company. If the individual’s personal liabilities are higher than their personal assets, they are in the Red stage. Many times, In the Black Vs. In the Red is the biggest question faced by financial analysts and accountants.

History

The history of the terms ‘In the Black’ and ‘In the Red’ traces back to the times when financial statements were handwritten in nature. During those times, Accountants used to maintain Books of Accounts in a physical handwritten manner. They used to differentiate between profitability and non-profitability by using different colored inks. If the company is showing negative results, it would be written with red ink, and if the company is showing positive results, it would be written with black ink. Thus the color of ink is used to indicate the financial strength and health of the company or individual.

These days Books of Accounts are maintained in the computers mostly with the help of software/s. As a result, the terms have lost their importance in practical terms, but they still stand true in theoretical terms. In today’s times, ‘In the Black’ vs ‘In the Red’ terms are used by accountants and analysts while interpreting recent years’ accounting statements. Further, it is possible that the company can be ‘In the Red’ in one financial year and can be ‘In the Black’ in the next financial year.

Often, the country’s economic cycle determines whether the company would end up in the Red zone or in the Black zone. If the economy is in the expansion stage, most of the companies will be profitable and will be In the Black. If the economy is in the contractionary stage, most companies will be in a loss and will be In the Red. Of course, the actual status depends upon the inner strength of the company and the sector to which the company belongs.

Also Read: Solvency

In the Black Vs In the Red: Differences

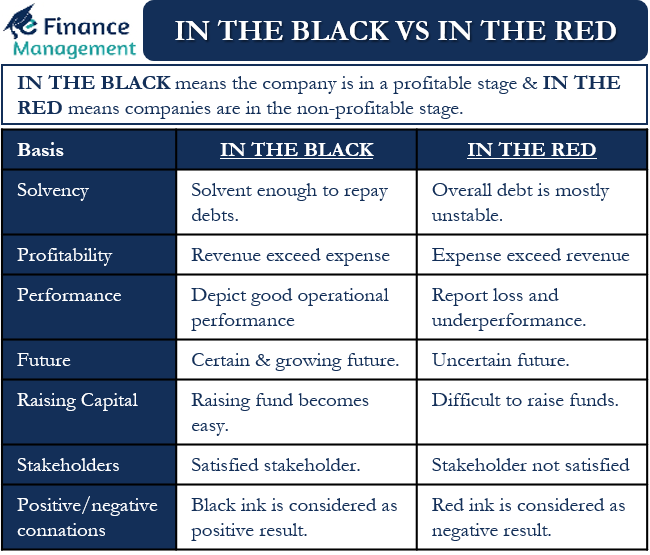

Let’s look at a few differences between the term ‘In the Black’ vs ‘In the Red.’

Solvency

‘In the Black’ Companies are solvent in comparison to the ‘In the Red’ Companies. The companies with ‘In the Black’ financial statements mostly have higher assets than liabilities. The amount of debt is lesser and is mostly stable (manageable) in nature. These companies are solvent enough to repay their debts timely and comfortably.

The companies with ‘In the Red’ financial statements mostly have higher liabilities than assets. Overall debt is more in these companies and is mostly unstable in nature. Hence, these companies struggle and usually default in payment of their liabilities instead payment of its regular expenses also timely.

Profitability

The revenues exceed the expenditures in the companies with the ‘In the Black’ remark. These companies have positive earnings and show profitability. In the case of companies with the “in the Red’ mark, the expenditures are more than the revenues. These companies have negative earnings and show a loss.

A company can swing between the Red and the Black over the years with the change in profitability. And that again depends on the various external and internal factors.

Performance

The companies with the ‘In the Black’ remark mostly have depicted good operational performance in the last financial year. Higher profitability is the result of good operational performance. The companies with the ‘In the Red’ remark have reported loss and so can be concluded as it has shown underperformance.

In the Black companies have exceeded or met the targeted operational performance. In the Red, companies have performed below the targets.

Uncertain/Certain Future

‘In the Black’ companies mostly have a certain and growing future. According to the experts, these types of companies have a certain (known) future and are capable of continuing the normal course of operations in the future.

Companies with In the Red financial statements mostly have an uncertain future. There are a lot of questions regarding the growth, future, and stability of the company.

Raising Capital

For companies with ‘In the Black’ financial statements, it becomes easy to raise funds through private placements, the general public, Banks, or Financial Institutions. Since these companies have good credibility in the market, raising funds through various platforms becomes easy.

In contrast to the same, it becomes difficult to raise funds for ‘In the Red ‘companies. And even if they are raising funds, they have to pay a higher interest rate because of their low credibility.

Stakeholders

Stakeholders of the company majorly include creditors, debtors, customers, suppliers, shareholders, employees, etc. If the company is ‘In the Black’ stage, mostly all stakeholders are satisfied. Since the company is profitable, it generally releases dividends frequently, and so shareholders are happy. Similarly, the customers get good quality products with timely delivery, so they are satisfied. The suppliers get timely payment and increasing volume orders, so they are satisfied. The employees get timely payments, good increases, and bonuses, so they are also quite satisfied.

Stakeholders of In the Red companies are mostly not satisfied. Suppliers might not get timely payments, and shareholders might not get their dividends because of less profit. Employees may also have to be content with delayed payments, lesser annual increases, and bonuses.

Positive or Negative Connotations

In the Black is a Positive Connotation. Black ink on the financial statements was considered a positive result in history. Similarly, In the Red is a Negative Connotation because, in the past, Red ink on the financial statement depicted a negative result.

Bankruptcy Risk

There is a high risk of Bankruptcy when companies are ‘In the Red’ for a longer duration of time. Shortage of funds and funding of losses means the inability to pay their dues in time and all the more chances of default. If such a situation continues for a longer time, it may also lead to bankruptcy. Similarly, ‘In the Black’ companies have a low possibility of making defaults. If other things remain stable, the companies with the ‘In the Black’ remark have a low risk of defaulting and Bankruptcy.

These differences are non-exhaustive in nature.

Final Words

‘In the Black’ vs ‘In the Red,’ in the black is better, but it is not always true. In the Red for, year on year is a bad sign, but for one or two years is not that much serious. Sometimes the companies are investing heavily in the Research and Development (R &D) processes, or sometimes the companies in the initial stage of business often tend to be ‘in the Red’ for a few years. These companies may show negative earnings in the current financial year, but in the long term, they will reap fruits. There are times when the companies are profitable but have higher debts or have less liquidity.

Completely relying on the ‘In the Black’ element in these situations is not advisable. And so, it is viable to use the ‘In the black’ elements along with other financial tools while interpreting the financial health of a company or an individual.

Also, read about other Methods of Financial Statement Analysis

Frequently Asked Questions (FAQs)

Individuals having personal assets more than their personal liabilities are considered ‘in the black,’ and if their personal liabilities are higher than their assets, they are said to be ‘in the red.’ This would basically tell us the repayment comfort level for an individual.

If the economy is in the expansion stage, most of the companies will be profitable and will be ‘In the Black.’ And if the economy is in the contractionary stage, most of the companies will be in the loss and will be In the Red.

It means individuals or companies are successful in repaying their debts and continue to generate profits and thus increasing the wealth year on year.

In the Red means that the companies are in the non-profitable stage. The expenses of the companies are more than the revenues of the company. The company is not able to generate profits or earnings to defray its routine expenses and falter on debt repayments.