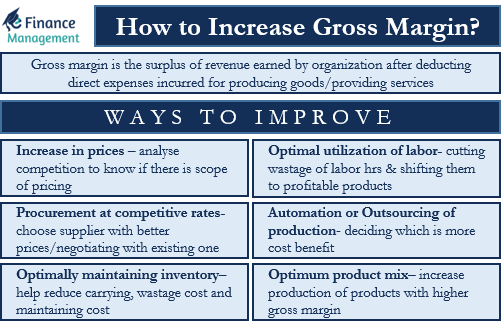

Gross margin is the surplus of revenue earned by an organization after deducting the direct expenses incurred for producing goods or providing services. It is a measure of a company’s profitability.

Why is it Important to Increase Gross Margin?

Gross margin lays the base for a better profitability of any organization. Organizations that have a higher gross margin can get stronger net profits. For new businesses, a higher gross margin would also mean attaining break even at a faster pace. Investors would also tend to invest more in organizations with a stronger base.

How to Increase Gross Margin?

There are various means which can lead to an improvement in gross margin. The organizations need to pick the right measures as per the parameters that suit them the most:

Increase in Prices

Although we know that the price of the product or service needs to be competitive enough to survive the market. There can be two situations – normal competition and tough competition. Let’s see how to achieve this.

Also Read: How to Analyze Gross Profit Margin?

In the first situation, analyze the competition to see if there is a scope for a price increase. So pricing accordingly can give a higher edge towards increasing the top line.

If any particular industry has tough competition where an increase in price is not possible, there can be several ways to deal with it.

- Sales Promotion: It is better to do sales promotion by offering some vouchers or discounts on higher value orders, etc., which tempt the customers to move towards the organization.

- Product Differentiation: Making slight changes in design, features, etc, and making the product not directly comparable with the competitors can create a space for better pricing.

Procurement at Competitive Rates

For improving gross margin, procurement at a better price is also one of the most viable options. Let’s see how we can do it.

- The procurement can be done by choosing the right supplier that offers better or lower prices without comprising the quality.

- Negotiating with the existing supplier to reduce the prices.

- Looking for bulk buying options or entering into long-term supply contracts can also create scope for competitive supplier pricing.

- If the owner has very good market knowledge to be able to time the market. He can buy and store the raw materials at a time when the prices are low and can significantly improve procurement.

Optimally Maintaining the Inventory

A proper inventory mix can also reduce the cost of maintaining the same. Similarly, more quantity of fast-moving inventory can be maintained compared to the slow-moving ones. Also, there can be a negotiation with the suppliers to provide the inventory as and when required. It’s a hint toward Just In Time. This would not only ease the working capital burden but would also help reduce the wastage due to carrying the inventory for a longer period.

Optimal Utilization of Labor

Optimal utilization of labor refers to 2 things:

- First, planning the production in a way that significantly cuts down on the wastage of labor hours. Since, labor salary is a direct cost and impacts the gross margin, saving on labor costs will increase the gross margin.

- Secondly, the utilization of labor can be shifted towards more profitable products. In other words, focusing on products with higher margins and increasing production of such products can lead to an increase in gross margin.

Automation or Outsourcing of Production

Automating the production in-house or outsourcing the same to experienced business partners are also good options to improve gross margin. Where outsourcing can give synergies of price and time, automation can save cost and provide more production in comparatively lesser time. Though automation involves huge costs, a cost-benefit analysis can help take a proper decision.

Optimum Product Mix

The sale and production of products having higher gross margins can be increased as compared to other products. Sales promotion can be shifted towards higher profitable products, and customers can be provided additional benefits to buy more profitable products, thus improving profitability.