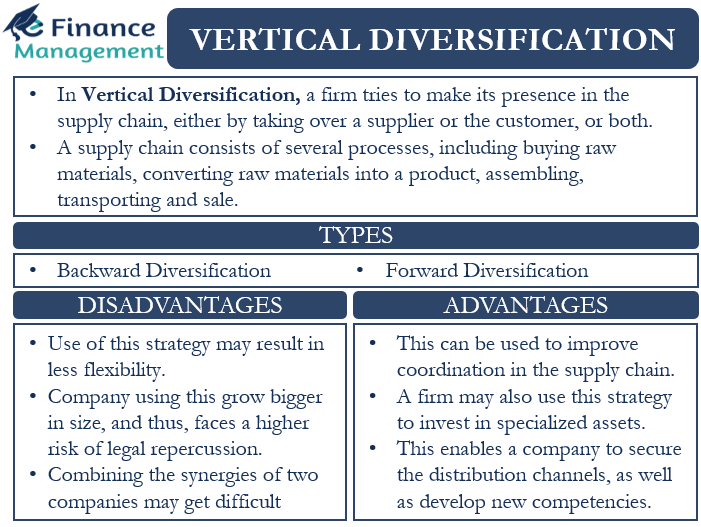

Vertical Diversification is one of the crucial diversification and expansion strategy. In this, a firm expands either in the forward or backward direction. Basically, under this diversification, a firm tries to make its presence in the supply chain, either by taking over a supplier or the customer, or both. Another name for this type of diversification is vertical integration.

A supply chain consists of several processes, including buying raw materials, converting raw materials into a product, assembling, transporting, and sale. Usually, one firm performs one process in a supply chain, but if a firm takes on more roles in the supply chain, then it is said to be using vertical diversification.

For example, a soda maker can vertically diversify by acquiring aluminum makes or a firm that installs and maintains vending machines. The primary objective of using this strategy is to lower dependence on the supplier, boost revenue, cut costs and raise profit.

Before going for vertical integration, a company must consider two factors:

Costs – a firm should not go for this diversification if the cost of making the product in-house is more than the cost of buying it from a third party.

Scope – a firm must go for this diversification if it does not dilute its current competencies.

Types of Vertical Diversification

There are mainly two types of vertical diversification, and these are:

Backward Diversification

As the word suggests, in this, a company integrates backward. This means the company would start making raw materials for the products that it currently makes. It allows a firm to lower its dependence on outside suppliers. Another name for this strategy is downstream integration.

Along with reducing uncertainty, this strategy also helps to lower costs because the firm here makes its own inputs rather than buying them from outside. For example, a sugar mill acquires sugarcane farms.

Forward Diversification

As the word suggests, a firm using this strategy moves up in the supply chain into finishing, distributing, or selling its products. A company may come up with its own distribution outlets to establish direct contact with the customers. Another for this integration is upstream integration.

Such a strategy allows companies to exercise greater control over distribution. Apple Inc. is a good example of this. And now, Apple sells its products in its own stores as well as through third parties.

Apart from these two, there is one more type of vertical diversification, and it is balanced integration. This diversification is a combination of both backward and forward diversification. Thus, this strategy involves a company taking on the role of the supplier and the customer.

For example, a car maker makes all the parts needed to make a car and has retail outlets to sell its cars.

Balanced integration is not as popular as the other two and is very rare in the real world, maybe because implementing such a strategy requires massive investment.

Advantages and Disadvantages of Vertical Diversification

Following are the advantages of this type of diversification:

- This strategy helps companies to reduce the cost of production.

- It also allows companies to better the quality of supplies and acquire crucial resources.

- By using this strategy, a company can improve coordination in the supply chain.

- This strategy enables a company to secure the distribution channels and develop new competencies.

- Eventually, this strategy may lead to higher revenues and more market share.

- A firm may also use such a strategy to invest in specialized assets.

Following are the disadvantages of this type of diversification:

- Such a strategy may result in higher costs if a company is unable to efficiently manage and integrate the activities.

- Generally, this strategy helps companies to reduce competition. So, the lack of competition may make a company complacent and result in inferior quality products.

- The use of this strategy may result in less flexibility.

- A company using this strategy grows bigger in size and thus, faces a higher risk of legal repercussions.

- Combining the synergies of the two companies may get difficult for the management.

Real-World Examples

Amazon is a very good example of vertical integration. Along with serving as a platform for buyers and sellers, the company also sells its own products. Also, the company operates its own distribution channel. So, Amazon sources products, market them, sells them, and then distributes them.

Ikea sells wooden furniture and other fixtures and fittings to the end-user. In 2015, this company bought a Romanian forest, as well as forestland in Alabama in 2018. Such acquisitions allow the company to develop a sustainable supply chain. So, Ikea controls the supply of main ingredients, production, and distribution.

Netflix offers its streaming services directly to consumers. Initially, the platform was dependent on third parties for the content, such as movies, TV series, and more. Later, the company decided to enter the production business. So, the company now not just delivers content but makes them as well.

Zara, a premium clothing and accessory brand, have its own retail stores. Along with selling and distributing its products, the company sources most of its products in-house. This helps the company to lower its dependence on independent designers and manufacturers, as well as quickly adapt to new trends.

Final Words

Vertical Diversification is a key diversification strategy. Successful implementation of this strategy can result in several benefits, including more revenues, more profit, and better control over the supply chain and market share. However, such a strategy may not always be successful. It is crucial for the management to consider costs and other factors before adopting this strategy.

Frequently Asked Questions (FAQs)

In Vertical Diversification, a firm expands either in the forward or backward direction. That is, it tries to make its presence in the supply chain, either by taking over a supplier or the customer, or both.

In horizontal diversification, a firm adds new products. While, in vertical diversification, a firm adds the elements of the supply chain, that is, the supplier, transporter, etc.