Meaning of Translation Exposure

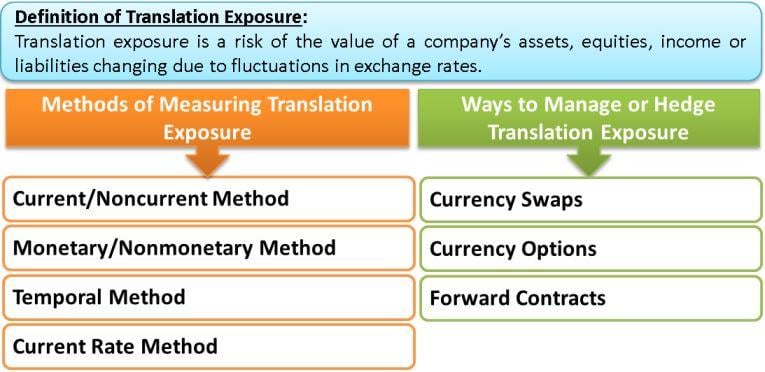

Translation exposure is a type of foreign exchange (currency) risk of change in the value of a company’s assets, equities, income, or liabilities due to fluctuations in exchange rates. Firms that denominate a portion of their assets, liabilities, and equities in a foreign currency face this risk.

Generally, multinational companies face translation exposure due to the base of their operations and assets in foreign currencies. Firms that produce goods or services sold in foreign markets are also affected by this risk.

On knowing the meaning of translation exposure, let us look at how to measure the same.

Measuring Translation Exposure

The following are the methods of measuring translation exposure:

Current/Noncurrent Method

Current assets and liabilities having a one-year or lesser maturity are translated at the current exchange rate. Noncurrent assets and liabilities are converted at the past exchange rate that prevailed when the asset or liability was recorded in the books. Under this method, a foreign subsidiary owning current assets in excess of the current liabilities will incur a translation gain if the local currency appreciates. The income items are usually calculated at the prevailing exchange rate. While the depreciating items falling under non-current items are calculated at the historical exchange rate.

Monetary/Nonmonetary Method

In this method, all monetary balance sheet accounts such as cash, notes payable, accounts payable and marketable securities of a foreign subsidiary are converted at the current exchange rate. The remaining nonmonetary balance sheet accounts and shareholder’s equity are converted at the past exchange rate when the account was recorded. This method works on the philosophy that monetary accounts are similar as their value is equivalent to an amount of money, the value of which changes with fluctuations in exchange rates. The monetary/nonmonetary method categorizes accounts on the basis of similarities of attributes rather than maturities.

Also Read: Transaction vs Translation Exposure

Temporal Method

In the temporal method, monetary accounts, both current and noncurrent, such as receivables, payables, and cash, are converted at the current exchange rate. The other balance sheet accounts, if carried out on the books at current value, are converted at the current rate. However, if they are carried out in the past, they are converted into the historical rate of exchange that prevailed during that time. Cost of goods sold and depreciation are converted at the historic rates if the balance sheet accounts associated with it were carried out at historical costs.

Current Rate Method

Under this method, all balance sheet accounts except for the stockholder’s equity are converted at the prevailing current exchange rate. The income statement items are converted at the existing exchange rate on the dates the items are recognized.

After gaining insight on measuring translation exposure, we will now have a look at how to manage the same.

Continue reading – Transaction vs. Translation Exposure

Translation Exposure Management

The following are the ways to manage or hedge translation exposure:

Currency Swaps

These are a settlement between two entities to exchange cash flows denominated for a particular currency for a fixed time frame. Currency amounts are swapped for a predetermined period, and interest is paid during that time span.

Currency Options

The Currency option gives the right to the party to exchange the amount of a particular currency at an agreed exchange rate. However, the party is not obligated to do so. Nevertheless, the transactions must be conducted on or before a set date in the future.

Forward Contracts

Under the forward contracts, two entities fix a specific exchange rate to interchange two currencies for a future date. The settlement for the agreed amount of currencies is conducted on a particular future date which is pre-decided.

Conclusion

Translation exposure is bound to occur in entities with foreign operations or dealing with foreign currencies. Nevertheless, there are ways that can be adopted to mitigate the exposure risk involved.