Meaning Of Transaction Exposure

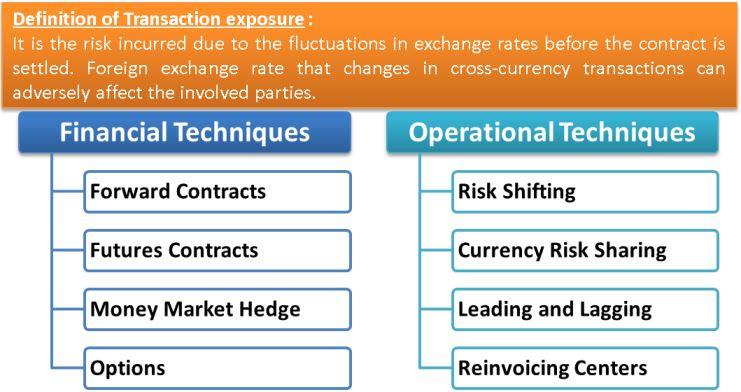

Transaction exposure is a type of foreign exchange (currency) exposure incurred due to the fluctuations in exchange rates before the contract is settled. The foreign exchange rate changes in cross-currency transactions can adversely affect the involved parties. Once a cross-currency contract has been framed and a specific amount of money and quantity of goods is fixed, exchange rate fluctuations can change the value of the contract. However, a company that has agreed to a contract but has not yet settled it faces the transaction exposure risk. The greater the time between agreement and settlement of contracts, the higher the risk involved with exchange rate fluctuations.

Explanation with Example

To simply state, an Indian company bought a machine from a US vendor at USD 10000 in June when the foreign exchange rate was Rs. 60 per USD. The payment terms stated payment in August. The exchange rate changed to Rs. 65 per USD in August.

For the buyer, the value at the time of buying was Rs. 600000, and at the time, payment became Rs. 650000. It became costly by Rs. 50000. For the seller, there is no impact because he dealt and USD and the home currency is also USD.

The buyer’s risk of losing additional Rs. 50000 can be termed as Transaction Exposure.

After understanding the meaning, let us look at the techniques for managing it:

Financial Techniques for Managing Transaction Exposure

The following are the financial techniques for hedging transaction exposure:

Forward Contracts

If a firm is required to pay a specific amount of foreign currency in the future, it can enter into a contract that fixes the price for the foreign currency for a future date. This eliminates the chances of suffering due to currency fluctuations.

Also Read: Transaction vs Economic Exposure

Futures Contracts

Futures contracts are similar to ‘forward contracts.’ However, futures contracts have standardized and limited maturity dates, initial collateral, and contract sizes.

Money Market Hedge

In a money market hedge, the forward price is equal to the current spot price multiplied by the ratio of the currency’s riskless returns. This also creates the finance for the foreign currency transaction.

Options

The options contracts involve an upfront fee and do not oblige the owner to trade currencies at a specified price, time period, and quantity.

After gaining an insight into the financial techniques, we will look at the operation techniques for managing transaction exposure.

Also, refer to Transaction vs. Translation Exposure.

Operational Techniques for Managing Transaction Exposure

The following are the operational techniques for managing it:

Risk Shifting

The firm can completely avoid transaction exposure by not involving itself in foreign exchange at all. All the transactions can be conducted in the home currency. However, this is not possible for all types of businesses.

Currency Risk Sharing

The two parties involved in the deal can have the understanding to share the transaction risk.

Leading and Lagging

Leading and lagging involve manipulating currency cash flows in accordance with the fluctuations. Paying off liabilities when the currency is appreciating is known as leading. While collecting receivables when the currency is at a low value is called lagging.

Reinvoicing Centers

A reinvoicing center is a single third-party subsidiary used to conduct all intra-company trades. The reinvoicing centers carry out transactions in domestic currency, thereby bearing the losses from the transaction exposures.

Conclusion

Transaction exposure risks are suffered due to foreign exchange rate fluctuations. However, these risks can be minimized or entirely eliminated by numerous financial and operational techniques.

Continue reading – Transaction vs. Economic Exposure

Dear Sir,

Thank you for your explanation I just wanted to ask you that the example which you gave of machinery signifies that it is a sort of loan given and then as per fluctuations the prices rise as a part of interest on it?