Meaning of Economic Exposure

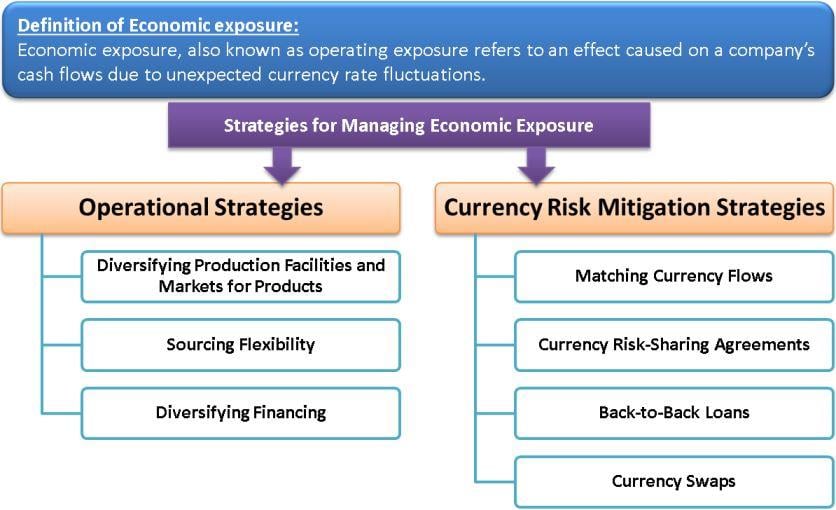

Economic exposure, also known as operating exposure (a type of foreign exchange exposure), refers to an effect caused on a company’s cash flows due to unexpected currency rate fluctuations. These exposures are long-term in nature and have a substantial impact on a company’s market value.

Economic exposure can prove to be difficult to hedge as it deals with unexpected fluctuations in foreign exchange rates. As the foreign exchange volatility rises, this exposure increases and vice versa. Multinational companies having numerous subsidiaries overseas and transactions in foreign currencies face a greater risk of economic exposure.

Determining Economic Exposure

The following are the two factors that help in determining this exposure:

- Economic exposure is higher for firms with both product prices and input costs that are sensitive to currency fluctuations. It is lower when costs and prices are not sensitive to currency fluctuations.

- Economic exposure is higher for firms that do not adjust their markets, product mix, and source of inputs in accordance with currency fluctuations. Flexibility in adapting to currency rate fluctuations indicates lesser economic exposure.

Managing Economic Exposure

The risk of economic exposure can be hedged either by operational strategies or currency risk mitigation strategies.

Operational Strategies

The following are the operational strategies that can be used to alleviate the risk of economic exposure:

Diversifying Production Facilities and Markets for Products

Diversifying the production facilities and sales to a number of markets rather than concentrating on one or two markets would mitigate the risk inherent. However, in such cases, the companies have to forgo the advantage earned by economies of scale.

Sourcing Flexibility

Companies may have alternative sources for acquiring key inputs. The substitute sources can be utilized if the exchange rate fluctuations make the inputs expensive from one region.

Also Read: Transaction vs Economic Exposure

Diversifying Financing

A company can have access to capital markets in a number of major regions. This enables the company to gain flexibility in raising capital in the market with the cheapest cost of funds.

Currency Risk Mitigation Strategies

The following are the currency risk mitigation strategies that can be used to alleviate the risk of economic exposure:

Matching Currency Flows

This is the simplest form of mitigating economic exposure by matching foreign currency inflows and outflows. For example, if a European company has significant inflows in US dollars and is looking to raise debt, it should consider borrowing in US dollars.

Currency Risk-Sharing Agreements

An agreement is framed between the two parties involved in the purchase and sales contract. The agreement states that the parties must share the risk arising from the exchange rate fluctuations. The agreement consists of a price adjustment clause that states that the base price of the transaction will be adjusted in case of currency rate fluctuations.

Back-to-Back Loans

This method, also known as credit swap, involves two companies in different countries entering into an arrangement to borrow each other’s currency for a fixed period. Once the defined period is over, the currencies are repaid.

Currency Swaps

The currency swap method is similar to the back-to-back loans method. However, it does not reflect on the balance sheet. This method involves two firms who borrow currencies in the world market, each benefiting from the best rates, and then swap the proceeds.

Also, read – Transaction vs. Economic Exposure

Conclusion

An awareness of the impact of economic exposure can help firms take steps to mitigate this risk. Investors should identify stocks and companies that have major exposures and make better investment choices during times when exchange rate volatility is at its peak.

The content provided by this website is really helpful. Also, the subject matter is easily understandable