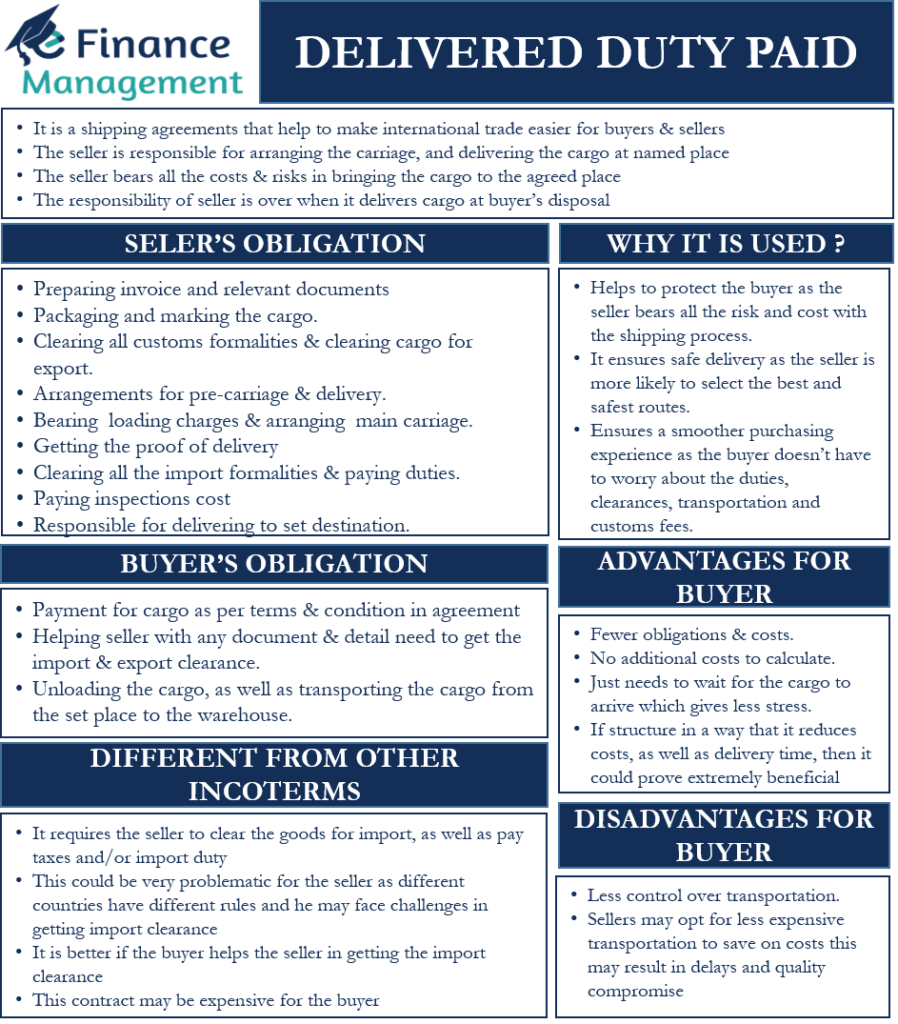

Delivered duty paid or DDP is one of the most popular shipping agreements and one of the standard Incoterms. Such a clause or use of this term helps to make international trade easier for the buyers and sellers. In DDP, the seller is responsible for arranging the carriage and delivering the cargo at the named place. The seller also needs to clear the cargo for import and pay the applicable taxes and duties.

The seller’s responsibility is over when it delivers the cargo at the buyer’s disposal and is ready for unloading at the set place (usually the buyer’s place of business). The seller bears all the costs and risks in bringing the cargo to the agreed place. Moreover, it is the seller’s obligation to not only clear the cargo for export but for import as well.

Also, the seller needs to complete all customs formalities, as well as pay applicable export and import duties. A point to note is that the seller is not responsible for unloading the cargo at the final destination (at the buyer’s place).

In DDP, the risk moves to the buyer when the seller makes available the cargo that is all set for unloading from the arriving means of transport. A point to note is that the seller is not responsible for getting the insurance for the cargo, both with pre-carriage or main carriage.

In terms of usage, the term DDP comes along with the delivery location, like ‘DDU: Port of Spain.’

How it’s Different from Other Incoterms?

Like any other Incoterms, DDP also lays more obligations on the seller. But, what makes it different from others is that DDP requires the seller to clear the goods not only for the export in his country but for import in the buyer’s country. The seller also has to pay all the taxes and/or import duties. This could be very problematic for the seller as different countries have different rules, and thus, the seller may face challenges in getting the import clearance (in the buyer’s country).

Thus, it is better if the buyer helps the seller get the import clearance. Since the seller assumes most of the risks and costs, they generally include all the costs and risks in the agreement price. So, a DDP contract may prove expensive for the buyer.

Delivered Duty Paid – Obligations of Buyers and Sellers

As we discussed, most of the activities are the responsibility of the seller, and these are:

- Preparing the cargo, invoice, and relevant documents, as well as proper packaging and marking the cargo.

- Clearing all customs formalities and clearing the cargo for export, including pre-shipment inspection, if applicable.

- Making arrangements for pre-carriage and delivery.

- Bearing the loading charges and arranging the main carriage.

- Getting the proof of delivery and producing it when needed.

- Clearing all the import formalities, as well as paying relevant duties.

- Paying for the cost of inspections and unloading at the port in the buyer’s country.

- Making arrangements and payment for onward carriage to the designated place in the buyer’s country after import clearance.

These are the buyer’s obligations under DDP:

- Making payment for the goods as per the terms and conditions of the sales agreement.

- Helping sellers with any documents and details they may need to get the import and export clearance.

- Unloading the cargo and transporting the cargo from the set place to the warehouse.

Delivered Duty Paid – Example

To better understand the responsibilities and obligations of both the parties in a DDP contract, let us discuss this with a simple example. Suppose a buyer from New York enters into a DDP agreement with the seller from London. In this, the seller needs to pay all transportation costs for carrying the cargo from their storage up to the port in New York.

Since the seller is responsible for the delivery of the goods, hence safe carriage of goods is also his responsibility. Therefore, any damage during the transit will be to the seller’s account. Once the cargo reaches the New York port, the buyer is responsible for unloading the cargo. But, the seller will be responsible for customs duty, import tariffs, and any other relevant local taxes.

In case the agreement lists the terminal destination as New York port, the seller then is not responsible for additional freight to the final destination of the buyer. But, if the terminal destination is the buyer’s warehouse, then the seller needs to make an additional freight payment and arrangement. In this case, even unloading will be the seller’s responsibility.

Why Delivered Duty Paid?

The following points help to explain why DDP agreements are popular in international trade:

- It helps to protect the buyer as the seller bears all the risks and costs with the shipping process. Since the seller bears all costs and risks, it discourages scammers as well.

- It ensures safe delivery as the seller is more likely to select the best and safest routes and carriers.

- DDP, overall, ensures a smoother purchasing experience as the buyer does not have to worry about the duties, clearances, transportation, customs fees, transit delays, etc.

DDP vs DDU

In DDU (delivery duty unpaid), the buyer or the end-user has to pay the duties after the package reaches the destination country. Here, once the cargo reaches the importing country port, usually, the customs office will contact the buyer. The buyer may have to go personally to collect the cargo after paying applicable fees.

Both DDP and DDU are popular shipping contracts. But, of the two, DDP is better in terms of customer experience. It is because, in DDP, the seller considers all the fees and documentation, leaving the end-user or buyer with a tension-free purchase experience when the goods are delivered to his doorstep.

Advantages and Disadvantages for Buyer

Following are the advantages of DDP for the buyer:

- The buyer has fewer obligations and costs to worry about.

- There are no additional costs as well that a buyer needs to calculate.

- After the seller ships the product, the buyer just needs to wait for the cargo to arrive. This takes away a lot of stress.

- If a buyer is able to structure a DDP agreement in a way that it reduces costs, as well as delivery time, then DDP could prove extremely beneficial to the buyer.

Following are the disadvantages of DDP for the buyer:

- Buyer has less control over transportation. Thus, the buyer may or may not have information on the transportation. Also, the buyer has no way of knowing if the local agents that the seller selects will be able to handle the consignment or not.

- Sellers may opt for less expensive transportation to save on costs. This may compromise the quality and result in delays for the buyer.

Final Words

DDP is a common shipping agreement in international trade. The parties generally use it when the supply of cargo is stable and predictable. But, it is more beneficial to the buyer than the seller. The main challenge for a seller in DDP is obtaining import clearance. This could result in more risk and cost for the seller and may result in delays as well. Thus, a seller should only agree to a DDP agreement if they are confident in getting the import clearance easily.

RELATED POSTS

- Delivered at Terminal – Meaning, Obligations and More

- Inland Bill of Lading – Meaning, Importance and More

- Free Carrier – Meaning, Obligations, Benefits, Pros and Cons

- Carriage and Insurance Paid To – Meaning, Obligations, and More

- Carriage Paid To – Meaning, Features, Benefits, and More

- Free On Board – Meaning, Qualifiers, Obligations, and Benefits