Cost, Insurance, and Freight, or just CIF, is a common shipping agreement in the world of international trade. Traders have been using CIF contracts since the early days of international shipping. And the terms of the contracts have been more or less the same since then. CIF is one of the Incoterms that lays down the responsibilities of the parties, both in terms of cost and risk, in international trade.

Who Bears the Costs?

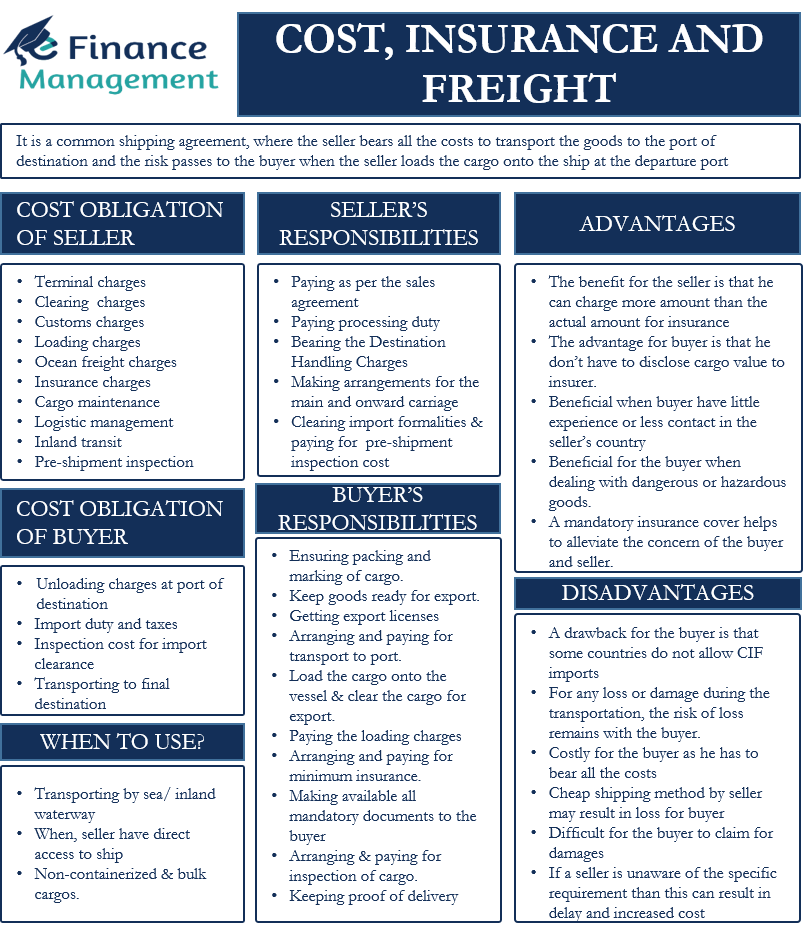

In a CIF agreement, the seller bears all the costs of transporting the goods to the port of destination. This means the seller bears the freight and other supporting costs to transport the goods to the destination port. However, the risk under CIF passes to the buyer when the seller loads the cargo onto the ship at the departure port. So, similar to CFR, the risk transfer point and the cost transfer point is different in CIF as well.

In a CIF agreement, the seller also has to take a minimum insurance cover. Because in CIF, the insurance of the consignment till it reaches the destination port is also the responsibility of the seller. And therefore, he needs to take insurance for the goods and pay for it, at least for the invoice value (minimum). If the buyer wishes for extra cover, they need to convey and get approval from the seller. Or make their own arrangements.

Minor Change in CIF from 2010 to 2020

Incoterms 2020 made some changes to the CIF terms for the insurance. It increased the scope of insurance for the sellers. The 2020 update requires sellers to take more comprehensive insurance than they were required to take under Incoterms 2010.

Cost, Insurance and Freight – Costs Obligations

In a CIF agreement, the seller usually bears the following costs: terminal charges, clearing charges, customs charges, loading charges, ocean freight charges, insurance charges, paying for the maintenance of cargo, paying the agent for managing the logistics, inland transit, pre-shipment inspection, if any, and more.

On the other hand, the buyer generally bears the following costs: unloading charges at the port of destination, import duty and taxes, inspection cost for import clearance, transporting the cargo at the final destination, and other similar costs.

When to Use CIF?

The CIF agreement is usable only when transporting goods by sea or inland waterway. Usually, the seller goes for this agreement if they have direct access to the ship. This makes it comparatively easier for the seller to load the cargo onto the vessel.

Moreover, CIF is usable for non-containerized and bulk cargo. If the parties are dealing with containerized cargo, then the parties need to use the CIP agreement (Carriage and Insurance Paid).

In the case of containerized cargo, the seller would have to leave the goods at the terminal (and not ship). And from there, the port authorities would load it onto the vessel. So, there is no way of knowing if there is any damage to the cargo at that time because the containerized cargo remains un-open until they reach their destination.

Cost, Insurance and Freight – Buyer and Seller Responsibilities

Following are the responsibilities of a seller in a Cost, Insurance, and Freight agreement:

- Ensuring adequate packing and marking of the cargo.

- Keep goods ready for export.

- Get the export licenses and other clearances for the product.

- Arranging and paying for transport to the named port.

- Load the cargo onto the vessel within the set time and clear the cargo for export.

- Paying the loading charges and handling charges at the loading port.

- Arranging and paying for minimum insurance.

- Making available all mandatory documents to the buyer (Bill of lading, Invoice, Insurance papers, Export license, and more).

- Arranging and paying for the inspection of cargo.

- Keeping the proof of delivery and other documents safe.

Following are the responsibilities of a buyer in a Cost, Insurance, and Freight agreement:

- Paying for the goods as per the sales agreement between the parties.

- Paying processing duty after the cargo reaches the destination port.

- Bearing the Destination Handling Charges (DTHC). This cost includes unloading and transferring the cargo within the destination port.

- Make arrangements for the main carriage and the loading and onward carriage from the port to the final destination.

- Clearing import formalities, as well as paying relevant duties and pre-shipment inspection.

Advantages and Disadvantages of CIF

Advantages

Following are the advantages of the Cost, Insurance and Freight agreement:

- The benefit for the seller is that they can take cheap insurance. But add a bigger amount for that when giving a CIF quote.

- For the buyer, the advantage is that they do not have to worry about disclosing the cargo value to their own insurer.

- A CIF contract is beneficial to the buyer if they have little experience with the seller’s country. Or lack relevant contacts to properly handle the cargo in the seller’s country with regard to carriage and insurance agents.

- A CIF contract also proves beneficial for the buyer when dealing with dangerous or hazardous goods. This is because different countries may have different rules for such goods. So, it is best to allow the seller to deal with it.

- A mandatory insurance cover helps to alleviate the concern of the buyer and seller.

Disadvantages

Following are the disadvantages of the Cost, Insurance and Freight agreement:

- A drawback for the buyer is that some countries do not allow CIF imports. In such a case, the buyer needs to get the insurance from an insurer within the destination/importing country.

- For any loss or damage during the transportation in the CIF arrangement, the risk of loss remains with the buyer.

- CIF contract could prove costly for the buyer as they eventually have to pay for the insurance and freight. This is because the seller does include these costs in the CIF price. So, in a way, the buyer has to bear all the costs.

- Sellers usually advertise CIF as “free shipping.” So, if a buyer is unaware of CIF literal terms, then they may believe that the seller would deliver to the buyer’s place for free. But, in CIF, the seller is only responsible for delivering the cargo to the port of destination. So, the buyer may be left stranded.

- Sellers may go for a cheap shipping method that could take more than normal time. This may result in losses for the buyer.

- If there is any damage to the goods, then the buyer may face difficulties in claiming them. Any damage will usually come to notice only once the buyer gets the goods and open them. It is possible that by that time, the buyer would have made the payment to the seller. Moreover, since the seller takes insurance under CIF, so any claim money goes to the seller first. In such a case, the buyer may have a hard time in collecting the claim money from a seller.

- Suppose a seller is unaware of specific import requirements in the destination country. Then it could lead to delays and an increase in cost.

Incoterms Similar to Cost, Insurance and Freight

There are many other Incoterms that are similar to CIF with slight differences. For instance, a CFR agreement is the same as CIF. The only difference between the two is that the seller does not have to arrange and pay for the insurance of the goods.

CIP is also similar to CIF. But the parties can use the former for all modes of transport, including air. Also, in a CIP agreement, the risk passes to the buyer at a set location in the country of origin/country of export. But, in CIF, the risk passes to the buyer after the seller loads the goods onto the ship.

Another similar Incoterm is FOB. But in this arrangement, the seller is only responsible for loading the cargo onto the ship. And not for arranging and paying for the freight and insurance charges.

Final Words

Cost, Insurance, and Freight (CIF) is a very popular arrangement in international trade. In terms of cost, CIF puts more burden on the seller, but in terms of risk, the buyer bears more burden. So, it is important that buyers and sellers are clear with all CIF terms and conditions before signing the contract.

RELATED POSTS

- Free Alongside Ship – Meaning, Obligations, Advantages and Disadvantages

- Carriage Paid To – Meaning, Features, Benefits, and More

- Inland Bill of Lading – Meaning, Importance and More

- Incoterms – Meaning, History, Benefits and More

- What are the Differences Between Incoterms 2010 and 2020?

- Delivered at Terminal – Meaning, Obligations and More