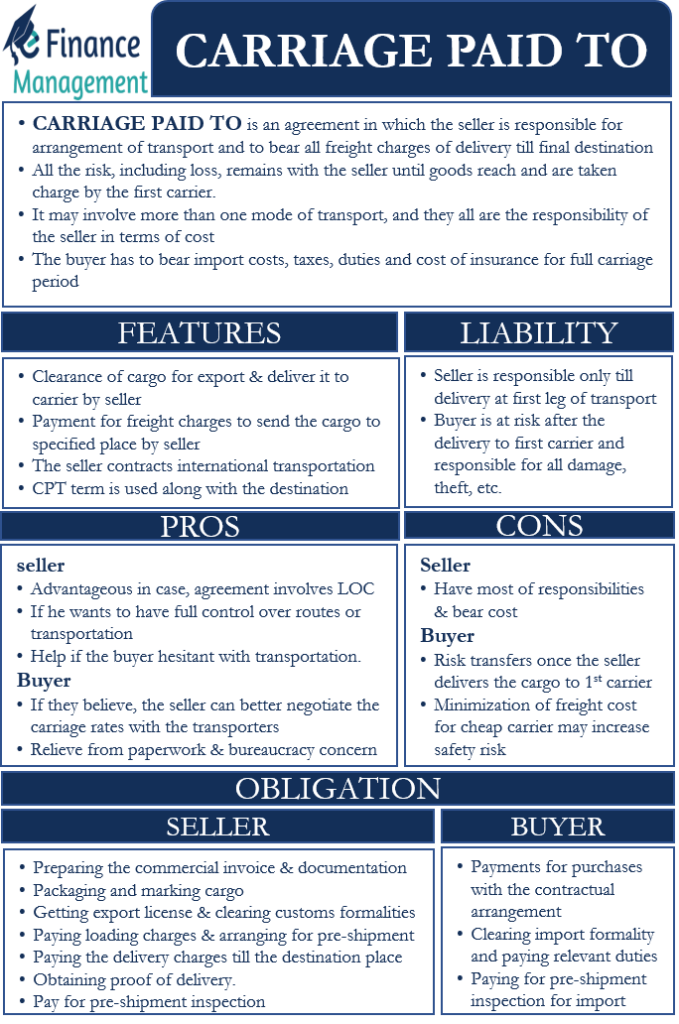

Carriage paid to or CPT is one of the Incoterms, and it helps to make international trade smoother for the buyers and sellers. If an agreement is CPT, it means the seller is responsible for getting export clearance and transporting the goods to the named place. The seller has the responsibility to arrange for the transport as well as to bear all the freight charges to deliver the goods to the named place in the buyer’s country or the final destination.

All the risk, including loss, remains with the seller until the goods reach and are taken charge by the first carrier. However, what makes CPT different from others, such as FCA, is that the seller does not have to pay for the insurance in CPT. One can use CPT for any mode of transport, or even if it involves more than one transport mode.

A point to note is that CPT may involve more than one mode of transport, and they all are the responsibility of the seller in terms of cost. But, the risk passes to the buyer after the first carrier takes charge of the items. In the case of CPT, the buyer has to bear import costs, taxes, duties as well as the cost of insurance for the full carriage period. The seller’s responsibility is only to hand over the goods to the first carrier and pay for freight charges till the final destination.

Carriage Paid To – Features

In a CPT agreement, the seller has to clear the cargo for the export and deliver it to the carrier or any other person (buyer and seller agree on) at the defined place. The seller has to pay for the freight charges to send the cargo to the specified place.

In CPT, it is the seller that contracts international transportation. And usually, the destination where the risk passes to the buyer is on the buyer’s side. In fact, the term CPT is used along with the destination. For instance, if the agreement says CPT Chicago, it implies that the seller has to pay the freight charges up to Chicago.

In the case of CPT, it is important for the buyer to enquire about the THC (Terminal Handling Charges). Usually, the terminal operator pays these charges, but these may or may not have been added by the carrier to their freight price. So, to avoid any confusion, the buyer must clearly enquire about these charges.

Obligations Under Carriage Paid To

Seller’s Obligation

These are the seller’s obligations in a CPT agreement:

- Keeping the goods ready, preparing the commercial invoice, and related documentation.

- Properly packaging and marking the cargo.

- Getting export licenses, as well as clearing customs formalities.

- Arranging for pre-carriage and paying the loading charges.

- Paying the delivery charges till the destination place.

- Obtaining proof of delivery.

- Pay for pre-shipment inspection (if any).

- Obtaining proof of delivery.

Buyer’s Obligation

These are the buyer’s obligations in a CPT agreement:

- Make payments for the items purchased in line with the contractual arrangement.

- Clearing import formalities, as well as paying relevant duties.

- Paying for clearance pre-shipment inspection (if any) for import clearance in his country.

Liability Under Carriage Paid To

As we discussed above, the seller has to pay the freight charges till the named destination. However, the risk in the case of CPT contracts remains with the buyer once the first delivery to the carrier happens at the seller’s end. So the seller’s responsibility is over as soon as the delivery takes place on the first leg of transport. And after that, it is the buyer who is responsible for all such risks of damage, theft, etc.

For example, a shipment involves the use of two modes of transport. First is the seller, delivering the cargo to a truck which then takes it to the nearest airport. Now, if the truck encounters an accident and there is damage to the cargo, the seller is not responsible for the loss. This is because the risk passes to the buyer after the delivery of transport to the first carrier (in this case, truck).

Thus, the buyer is at risk after the delivery to the first carrier. Also, such an arrangement may discourage the seller from selecting the best transportation, or the seller may get the cheapest carrier. However, the buyer can offset this risk by going for a CIP (Carriage and Insurance Paid To) agreement. In this agreement, the seller is also responsible for insuring the cargo during transport.

Pros and Cons of CPT

CPT could prove advantageous for the seller in case the agreement involves LOC (letter of credit). Also, the sellers prefer CPT if they want to have more command over the full route or transportation.

Moreover, a CPT agreement could also help the seller if the buyer is hesitant with the transportation. In such a case, the seller can assure the buyer of transporting goods to him as per his selected location, as well as bear all the expenses for the transport. This would encourage the buyer to make the purchase.

On the other hand, the buyers prefer this type of agreement if they believe that the seller can better negotiate the carriage rates with the transporters. Also, such an arrangement relieves the buyer from paperwork and bureaucracy concerns because the seller will be responsible for contracting the carrier, taxes, customs duties, export clearances, and other formalities.

Final Words

Carriage paid to or CPT puts most of the responsibilities and costs on the seller. And the seller has to ensure the forwarding of the goods. However, the risk transfers to the buyer once the seller delivers the cargo to the first carrier en route. Thus, this is where the buyer is at a disadvantage as the seller may try to minimize the freight cost by going for the cheapest carrier, disregarding the safety as the risk would be with the buyer. But at the same time, the buyer can get a better freight deal, as the seller is regularly transporting goods and may have an excellent arrangement. A similar arrangement may not be feasible for the buyer.

Visit Incoterms to learn more about other terms.

RELATED POSTS

- Cost, Insurance, and Freight – Meaning, Obligations, Advantages, and Disadvantages

- Inland Bill of Lading – Meaning, Importance and More

- Delivered at Terminal – Meaning, Obligations and More

- Free Carrier – Meaning, Obligations, Benefits, Pros and Cons

- Delivered Duty Paid – Meaning, Obligations, Advantages and Disadvantages

- Delivered Ex-Ship – Meaning, Example, and Relevance