What is the Definition of Earnings Per Share?

Earnings per share are the net earnings of the company earned on one share. It is an important and widely used metric that audited financial reports of the companies also particularly mentioned in most countries. In other words, it expresses the company’s earning capacity if divided by the value of one share. We commonly call it return on equity. The higher the EPS, the better the company’s performance and prospects. The track record of EPS for several years reflects the company’s growth rate, and potential investors look forward to investing in the company if they see an increasing trend.

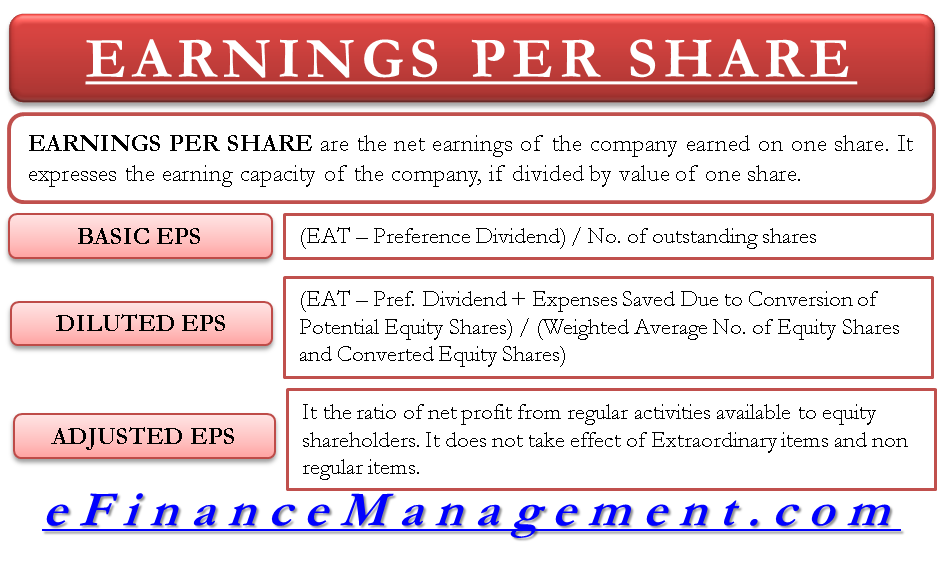

Formula for Calculating Earnings Per Share

The equation or formula used for the earnings per share ratio is as follows.

| Earnings Per Share = (Profits or Earnings after Taxes (EAT) – Preference Share Dividend) / Number of Equity Shares Outstanding |

The steps to calculate profits/earnings after taxes less after deducting preference share dividend (also known as the profit available for equity shareholders whether distributed as a dividend or not) is as follows:

Net Profit

Take the net profit/loss for the year from the profit and loss account of the company. Audited financials are preferred because they ensure compliance with all accounting standards and generally accepted accounting principles. Net profit here means profit arrived after deducting taxes. The tax rate would be different for different countries as per respective laws.

Preference Share Dividend

In regard to preference shares, the dividend for cumulative preference shares will be deducted even if it is not provided, but for non-cumulative preference shares, the dividend shall be deducted only when it is provided.

Also Read: What is a Good EPS?

Number of Equity Shares Outstanding

The number of existing equity shareholders is taken. A weighted average of equity shares is calculated if the number of equity shares changes in the financial period. Weights are given according to the no. of days or months outstanding during the year. Let us understand this with the help of an example.

EPS calculated with the number of existing equity shareholders will present earnings per share for the shareholders existing at the point of the financial year closing. On the other hand, the weighted average of equity shares will give a true picture for analysis of the company. There is a third possibility of changes in equity shares outstanding because of the existence of convertible debentures or preference shares. When the EPS is calculated considering the effect of the conversion of such convertibles into equity shareholders, it is known as Diluted EPS.

Earnings Per Share Calculator

Earnings Per Share Example

Following are the Particulars of A Ltd to calculate EPS.

| Date | Particulars | Increase | Decrease | Balance |

| 01.04.2013 | No. of Shares | 18000 | ||

| 01.09.2013 | Conversion of preference shares to equity shares | 6000 | 24000 | |

| 01.02.2014 | Buyback of shares | 3000 | 21000 |

The profit before tax of the company is Rs. 3, 50,000. Tax Rate @ 30%, Preference share dividend Rs.10,000.

With the above facts, let us calculate EPS for the year.

For the numerator part:

| Profit before Tax | 3,50,000 |

| Less: Tax @ 30% | 1,05,000 |

| PAT | 2,45,000 |

| Less: Preference Share Dividend | 10,000 |

| Net Profit | 2,35,000 |

| (Profit available for Equity Shareholders) |

For the denominator part:

Weighted average no. of shares= (18,000*5/12) + (24,000*5/12) + (21,000*2/12) = 21,000 Shares

Therefore, EPS = 2,35,000/21,000 = 11.19

Diluted Earnings Per Share

After assuming that all convertible securities have already converted into equity, Diluted EPS is the EPS. Convertible securities such as employee stock options, convertible preference shares, convertible debentures, etc. It is the EPS after giving the effect of such securities on both the numerator and denominator of the EPS. The numerator increases by the amount of dividend or interest which is not paid in the event of conversion of such securities. The denominator increases by the no. of equity shares issued due to such conversion.

So, the formula becomes

| Diluted EPS = (EAT – Pref. Dividend + Expenses Saved Due to Conversion of Potential Equity Shares) / (Weighted Average No. of Equity Shares + Weighted Average No. of Converted Equity Shares) |

Read more at Basic vs Dilutes EPS

Adjusted Earnings Per Share

Adjusted Earnings per Share is the ratio of net profit from regular activities available to equity shareholders. It does not take effect on the following:

Also Read: Why is EPS Important to Investors?

- Extra Ordinary Items: Items that occur suddenly without any prior notice, such as windmill gain, or loss from natural calamities, etc

- Non-Regular Activities: Activities that are not part of the day-to-day operations of the company, such as the sale of assets, loss due to fire, etc.

Adjusted EPS especially serves the purpose of Intra Company and Inter-company comparisons.

What is a Good EPS? – read here

Negative Earnings Per Share

Sometimes companies incur losses, i.e., negative earnings, making the EPS negative. Negative EPS reflects how much money the company has lost per share. The shareholders do not have to pay the share of the loss to the company directly, but they suffer indirectly. The net loss decreases the firm’s value, which in turn reduces the value of the shares. Negative EPS is not always a reason to panic. Sometimes it is a good sign as well. For example, when a company develops new products or when it incurs a one-time big expense, then the negative EPS for a certain period is a temporary phenomenon.

Learn why EPS is important for investors

Interpretation / Analysis of Earnings Per Share

There are two ways of looking at the profit that the business generates. First is the total profit that the company generates. And second is how much of that profit makes its way to the shareholders. A business may be making good profits, but it would be meaningful if each shareholder enjoys a good profit both in terms of ROI and absolute terms, i.e., earnings per share. To know the results on a per-share basis, we calculate the EPS.

EPS stands for Earnings Per Share, or the income attributable to each share. It is an extremely important measure for investors and analysts to pick a stock. One can calculate EPS by dividing the net income (Less Dividend on Preference Shares) by the total outstanding shares (average).

A high EPS is a sign of better earnings, a strong financial position, and, therefore, a reliable company to invest in. The EPS for several years indicates the growth pattern of the company. It also helps compare figures of different companies in the same industry. Thus, the EPS number that a company reports can cause significant fluctuations in its stock price.

Read more about RETURN ON EQUITY.