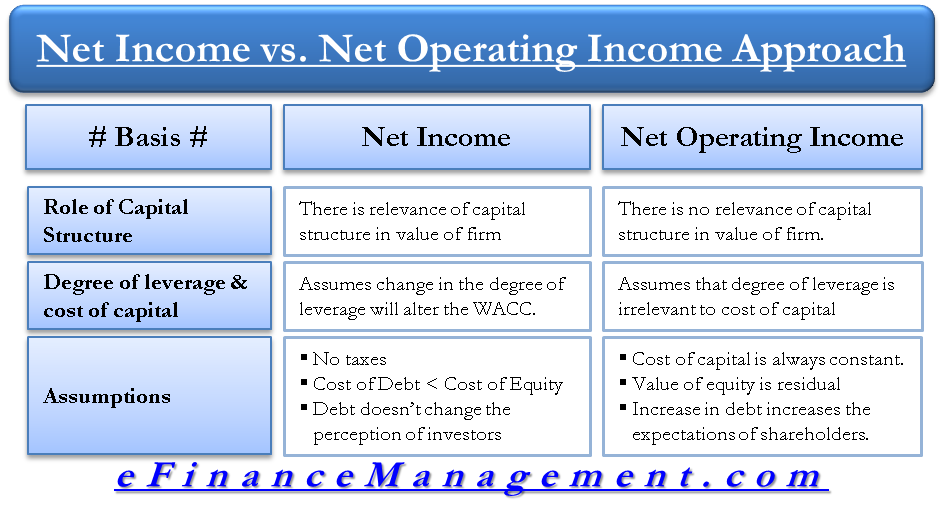

The difference between the net income and operating income approach of capital structure is mainly due to the role of capital structure, the cost of capital, the degree of leverage, and, most importantly, the assumptions it is based on.

Differences between net income (NI) and net operating income (NOI) approach

Role of Capital Structure

Net Income Approach

The net income approach suggested by David Durand brings forth the relevance of capital structure in calculating the value of a firm. The WACC (Weighted Average Cost of Capital), which is the weighted average of debt and equity, will decide the firm’s value. The following formula can represent the net income approach.

WACC = EBIT / (Value of firm)

Value of firm = Value of equity + Value of debt; with a judicious mixture of debt and equity, a firm can arrive at an optimum capital structure in which the firm’s value is the highest and the overall cost of capital is the lowest. Essentially the approach says that since debt is a cheaper source of funds, it can be used effectively to increase the firm’s value by decreasing the overall cost of capital. In essence, change in the degree of leverage will impact the capital structure.

With a judicious mixture of debt and equity, a firm can arrive at an optimum capital structure in which the firm’s value is the highest and the overall cost of capital is the lowest. Essentially the approach says that since debt is a cheaper source of funds, it can be used effectively to increase the firm’s value by decreasing the overall cost of capital. In essence, change in the degree of leverage will impact the capital structure.

Net Operating Income Approach

The net operating income approach suggested by David Durand states the irrelevance of capital structure in calculating the firm’s value. The cost of capital for the firm will always be the same. No matter what the degree of leverage is, the firm’s total value will remain constant. The following formula can represent the net operating income approach.WACC = EBIT / (Value of firm)

WACC = EBIT / (Value of firm)The value of Equity (Residual) = Value of firm – Value of debt

The value of Equity (Residual) = Value of firm – Value of debt

Degree of Leverage and Cost of Capital

The degree of leverage means the proportion of debt. The net income approach assumes that change in the degree of leverage will alter the overall cost of capital (WACC) and hence the firm’s value. Whereas the operating income approach assumes that the degree of leverage of the firm is irrelevant to the cost of capital, i.e., the cost of capital is always constant.

How the cost of capital remains constant irrespective of change in the degree of leverage, especially when debt is the cheaper source of finance? If the debt is increased, the risk of bankruptcy will increase. This increased risk will make equity holders increase their required rate of return. On the one hand, the higher proportion of debt decreases the overall cost of capital. Still, it is compensated by increasing the required rate of return by equity shareholders.

Assumptions

Each of the theories has made assumptions that drive the valuation.

The assumptions for the net income approach are:

- No taxes

- The cost of debt is less than the cost of equity

- Debt doesn’t change perception amongst investors

The assumptions for the net operating income approach are:

- Cost of capital is always constant

- Value of equity is residual (Derived by subtracting the value of debt from the value of the firm)

- If the amount of debt increases, shareholders required return expectations will increase

Excellent ?

Excellent

Excellent way of explaining the methods.