This article explains the difference between Equity research Vs Credit research. They are two divisions of financial analysis. The main difference between them lies in the securities being valued. Equity research deals with analyzing publicly listed stocks on the stock exchange. On the other hand, credit research refers to evaluating the debt portion of a firm. The main objective of both types of research is to value a company and find out the best price an investor could pay. However, the perspective of evaluation varies in both cases.

Difference between Equity Research Vs. Credit Research

Definition of Equity & Credit Research

To understand the differences between equity and credit research, let us first understand both concepts.

On a broader view, equity research is a branch of financial analysis that involves analyzing a company’s financial statements and determining the right value of a company. The main objective behind this process is to make an investment decision on whether to buy or sell a stock.

Refer to Equity Research for more.

Credit research is the study of a company’s financial position. It also involves analyzing the company’s financial statements, but the focus is on its capital structure and its ability to manage its finances. The objective of conducting credit research is to determine if the company will sustain itself long with its current equity and debt structure and whether it will be able to make payments to the debt it has taken.

Equity analysts and credit analysts work for their clients (i.e., investors), and all their research work is targeted to satisfy their needs and requirements. Equity investors are people who invest in stocks. In other words, equity investors are owners of the company. Whereas debt (or credit) investors are people who lend money to the companies in the form of debt in order to receive some interest rate. In other words, debt investors are lenders for the company.

Also Read: Equity Research

Perspectives

To understand how different the perspectives of equity and debt investors are, let us examine a situation.

Imagine a person X has bought a mango orchid. He waters the plants every day and would like to see them grow. He is more interested in watching the plants grow instead of just the fruits they bore in every season. X is an equity investor. Conversely, imagine another person has taken a mango orchid on a lease for one year. He is particularly interested in the fruits bore by the plants because his aim is only to make money by selling the fruits. He is a debt investor.

If a person invests in a stock, he gets some ownership of it. Hence, his perspective is always long-term, and his interest is to see the company grow. He would always want the company to generate sustainable profits so that the value of the stock increases.

The sight of a debt investor is only until the maturity of his debt (bond). Hence, his investment perspective is short-term or until his debt matures. He is only concerned if the company generates enough earnings to repay his debt.

Since their perspectives are different, the focus area of research is also obviously different.

Focus Area

The main objective of equity research is to analyze the growth potential of a stock. Analyst’s work focuses on evaluating how the company is trying to maximize its shareholder returns and EPS.

Also Read: Equity Research Firms

Credit research focuses on the downside risk. Analysts are only bothered about the company’s financial position. They look if the company has sustainable cash flow and can repay their interest and the bond principal after maturity.

Parameters Used for Evaluation

An equity analyst focuses more on how efficiently and sustainably a company is earning profits and if it is generating any cash. Hence, they focus mainly on the income statement and cash flow statement.

A credit analyst focuses on balance sheet and cash flow statements. He is more concerned if the company has a good liquidity position and generates enough cash to repay its debt.

Risks Associated with the Securities

In the case of default and liquidation of assets, an equity investor will get his share only after all the debt holders are paid.

Companies are legally obliged to repay the debt holders of their principal amount. Hence, they get preference over equity investors (according to the seniority of the debt) for the payment in case of liquidation.

Equity Research Vs. Credit Research – Table

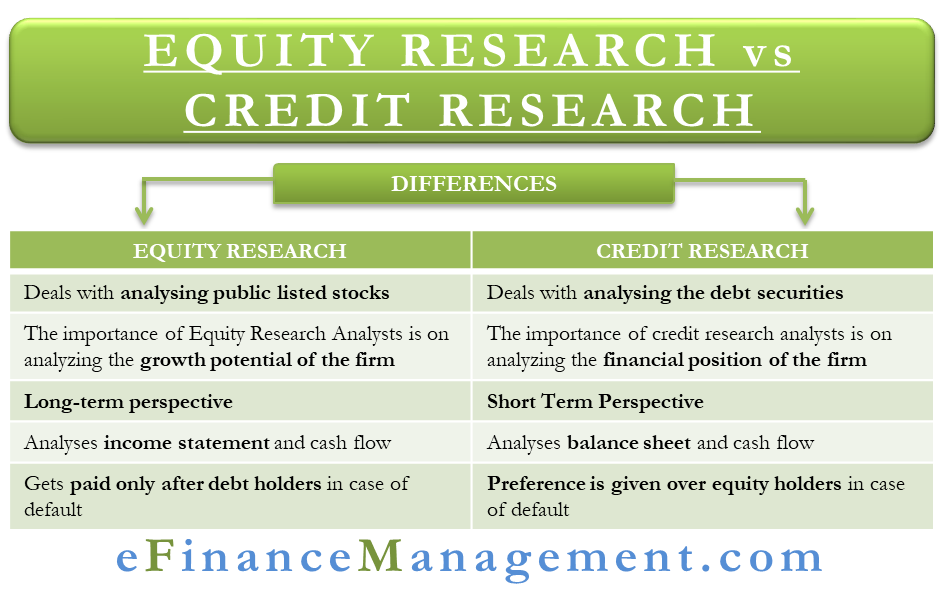

| Equity Research | Credit Research |

| The importance is on analyzing the growth potential of the firm | The importance is on analyzing the financial position of the firm |

| Long-term perspective | Short-term perspective (or until the bond matures) |

| Analyze income statement and cash flow | Analyzes balance sheet and cash flow |

| It gets paid only after debt holders in case of default | Preference is given over equity holders in case of default |