International Financial Management

What is International Financial Management?

International financial management is a well-known term in today’s world, and it is also known as international finance. It means financial management in an international business environment. It is different because of the different currencies of different countries, dissimilar political situations, imperfect markets, diversified opportunity sets, etc.

International financial management came into being when the countries of the world started opening their doors to each other. This phenomenon is well known by the name of “liberalization.” Due to the open environment and freedom to conduct business in any corner of the world, entrepreneurs started looking for opportunities even outside their country boundaries. The spark of liberalization was further aired by swift progression in telecommunications and transportation technologies that too with increased accessibility and daily dropping prices. Apart from everything else, we cannot forget the contribution of financial innovations such as currency derivatives, cross-border stock listings, multi-currency bonds, international mutual funds, and other international market instruments.

The result of liberalization and technology advancement in today’s dynamic international business environment. Financial management for a domestic business and an international business is as dramatically different as the opportunities in the two. The meaning and objective of financial management do not change in international financial management, but the dimensions and dynamics change drastically.

Difference between Domestic & International Financial Management

Four major facets which differentiate international financial management from domestic financial management are an introduction of foreign currency, political risk, market imperfections, and enhanced opportunity set.

Foreign Exchange

It’s an additional risk that a finance manager is required to cater to under an international financial management setting. Foreign exchange risk refers to the risk of fluctuating prices of currency that has the potential to convert a profitable deal into a loss-making one.

Political Risks

The political risk may include any change in the economic environment of the country, viz. Taxation Rules, Contract Act, etc. It is pertaining to the government of a country, which can anytime change the rules of the game in an unexpected manner.

Market Imperfection

Having done a lot of integration in the world economy, it has got a lot of differences across the countries in terms of transportation costs, different tax rates, etc. Imperfect markets force a finance manager to strive for the best opportunities across the countries.

Enhanced Opportunity Set

By doing business in other than native countries, a business expands its chances of reaping the fruits of different tastes. Not only does it enhance the opportunity for the business, but it also diversifies the overall risk of a business.

Goal of International Financial Management

Just like domestic financial management, the goal of International Finance is also to maximize the shareholder’s wealth. The goal is not only limited to the ‘Shareholders’ but extends to all ‘Stakeholders’ viz. employees, suppliers, customers, etc. No goal can be achieved without achieving the welfare of shareholders. In other words, maximizing shareholders’ wealth would mean maximizing the price of the share. Here again, comes a question of whether in which currency should the value of the share be maximized? This is an important decision to be taken by the management of the organization.

International Business

International level initiatives like General Agreement on Trade and Tariffs (GATT), The North American Free Trade Agreement (NAFTA), World Trade Organization (WTO), etc., have promoted international trade and given it a shape. All because of liberalization and those international agreements, we have a buzzword called “MNC,” i.e., Multinational Corporation. MNCs enjoy an edge over other normal companies because of their international setting and best opportunities.

Such initiatives help a business to operate globally with ease. It also helps in the smooth exchange of goods and services internationally.

International Markets

International finance has become an important wing for all big MNCs. Without the expertise in international financial management, it can be difficult to sustain in the market because international financial markets have a totally different shape and analytics compared to the domestic financial markets. Sound management of international finances can help an organization achieve the same efficiency and effectiveness in all markets.

International Banking

It is nothing different but a general banking service that facilitates transactions within a company or among different companies internationally. Since different countries have different currencies with different exchange rates. International banking service facilitates this exchange at different rates.

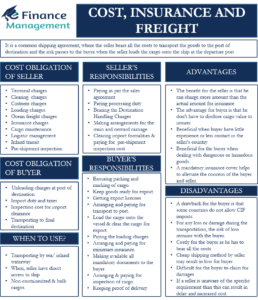

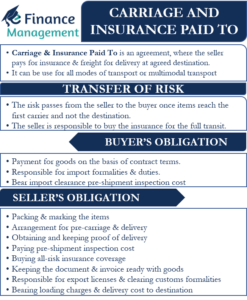

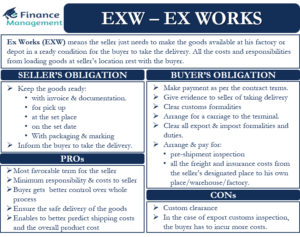

Incoterms

Incoterm or International Commercial Terms are the terms one uses in international business. These terms explain the obligations and rights of the parties importing and exporting the goods regarding the pickup and delivery points. These terms require acceptance and cooperation from both parties as these are not mandatory rules.

International Trade

International trade is basically international business at the country level. Hence, it is a broader concept in comparison with international business as there is a vast difference between both of them. It directly has a link with the economic environment of a country. It determines how international business contributes to the growth of a country’s economy.