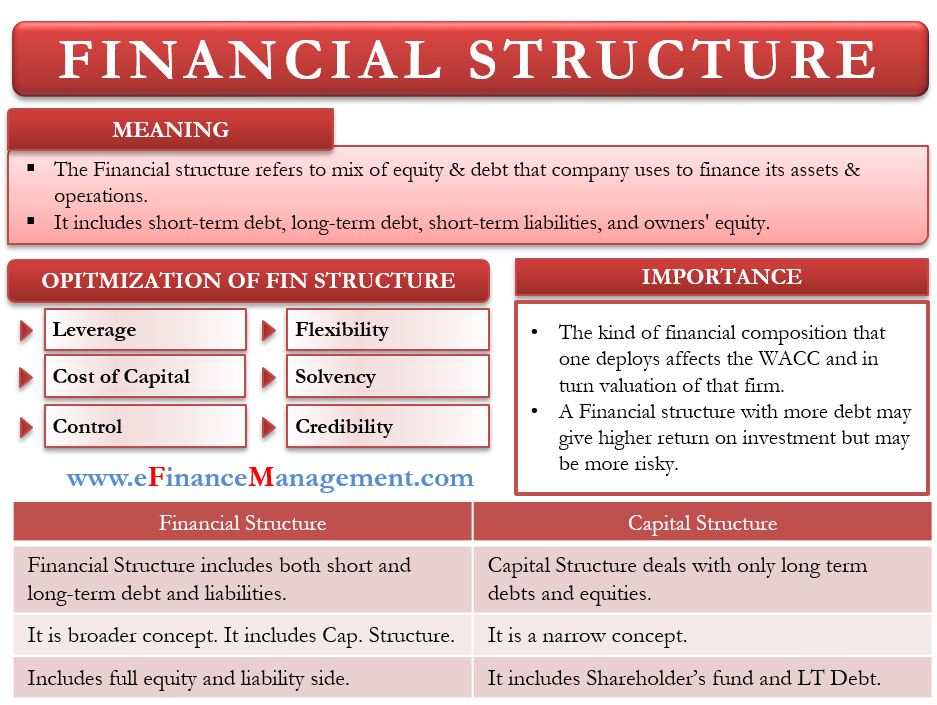

The Financial structure is how a company finances its assets and operations. Or, we can say it is the mix of debt and equities that a company uses to finance its assets and manage its day-to-day operations. The debt and equity that make up the financial structure are short-term debt, long-term debt, short-term liabilities, and owners’ equity.

If you are getting a feeling that the financial structure is the same as the capital structure, then you are wrong. Both are not the same because capital structure includes only long-term debt and equity.

Importance of Financial Structure

Every company, be it public or private, is free to choose the structure. Both public and private companies have access to more or less the same type of sources of funds except for equity. However, a company must not live with just any random mix of debt and equity.

The kind of financial composition that one deploys affects the WACC (Weighted average cost of capital) of that company. It, in turn, has a direct bearing on the valuation of that firm. We can say that a firm should strive for an optimal structure if it wants to maximize its value.

Also Read: Capital Structure Analysis

A company that depends more on debt could have a higher return on investment. However, having a financial structure with more debt could prove risky if a company is unable to honor its obligation. A firm that is either oligopoly or monopoly may easily support a financial structure with more debt because one can easily forecast its sales and cash flows.

On the other hand, a company operating in a highly competitive industry won’t be able to support such a financial mix. It is because the competition could result in volatile earnings and cash flows. And this, in turn, could result in the company missing its debt obligations. The way out for such a company is to move towards a structure with more equity and less debt.

The role of the CFO (Chief Financial Officer) is vital for such a company as they need to decide on the optimum financial structure for the company. A CFO generally uses trend and ratio analysis to evaluate and analyze a company’s financial structure.

How to Optimize?

A manager or CFO should consider the following factors while developing a financial composition:

Leverage

A company can either have a positive or negative debt. Debt can help a company magnify returns and give a tax advantage. But, too much debt may create cash flow issues for the company.

Cost of Capital

The aim of the finance manager should be to reduce the cost of capital (CoC). In comparison to equity, debt and preference shares are cheaper sources of finance.

Control

The finance manager should ensure that the financial structure does not result in too much dilution of control.

Flexibility

A company with stiff financial composition may not be able to survive in adverse conditions. Thus, the financial structure would be such that a company could easily be able to alter it as and when the need arises.

Solvency

When designing or redesigning a financial composition, the manager must ensure that there is no risk of solvency.

Credibility

A company that does not have a good reputation in the market may not have many avenues to get debt. Even the available channels would charge a higher interest rate. Therefore, the company may resort to equity to raise funds.

Read more about Tips for Getting Capital Structure Decisions Right

Financial vs. Capital Structure

Both financial and capital structures share a similar concept, but they are different from each other. We have already discussed the one significant difference between the two above. And, it is that the capital structure deals with only long-term debts and equities. On the other hand, a financial composition includes both short and long-term debt and liabilities.

On this basis, we can say that financial composition has a more significant scope than the capital structure. Or, we can also say that capital structure is a part of the financial structure.

Apart from these, there are a few more minor differences between the two. First, the capital structure includes all items under the head shareholders fund and Non-current liabilities, while the other structure comprises almost the full equities and liabilities side.

Another difference is that the capital structure mainly includes the following items – long-term borrowings, retained earnings, equity, preference capital, and debentures. On the other hand, the financial composition includes capital structure plus account payable and short-term borrowings.

Final Words

The company’s financial structure gives an idea about the leverage and the cost of capital. For a startup, a financial composition may not matter much as for a mature company. A new company focuses more on the funds than the source funds. However, the long-term survival of a company depends a great deal on having an optimal financial composition.

RELATED POSTS

- Capital Structure Decisions – Importance, Factors, Tips and More

- Capital Structure and its Theories

- Functions of Financial Management

- Capital Structure Theory – Net Income Approach

- Capital Structure Theory – Traditional Approach

- What is the Relationship of Financial Management with Other Disciplines?