What is Dividend Coverage Ratio?

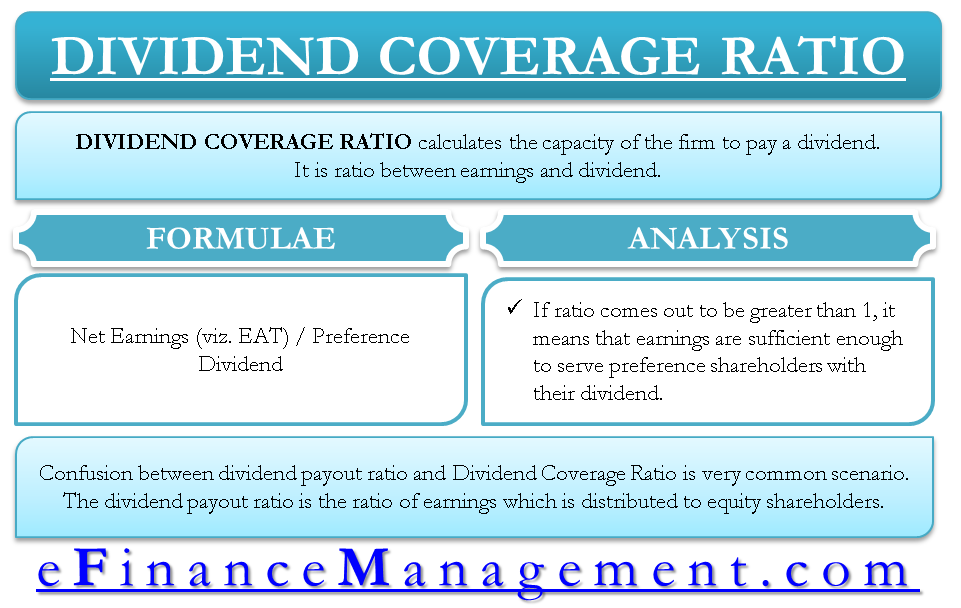

The dividend coverage ratio (DCR) essentially calculates the capacity of the firm to pay a dividend. Generally, the calculation of this ratio is specifically for preference equity shareholders. Preference shareholders have the right to receive dividends. The dividends of preference shares may be postponed, but payment is compulsory, and therefore they are considered a fixed liability.

The DCR is a relation between earnings and dividends, where earnings are the numerator, and the dividend amount is the denominator. The ratio is relevant for capital providers but especially important for preference shareholders. These shareholders have a preferred right to receive dividends over equity shareholders. The dividend payout to equity shareholders is at the discretion of the management, but in the case of preference shareholders, the dividend payout is compulsory.

How to Calculate Dividend Coverage Ratio (DCR)?

The computation of DCR is very simple. We need two elements to compute the ratio, net earnings, and dividends.

The formula used to calculate the DCR is as follows:

| Dividend Coverage Ratio (DCR) = Net Earnings / Dividend |

Net Earnings

Net earnings mean the earnings left after all the expenses, including taxes. But, why does the calculation of the dividend coverage ratio use net earnings? The dividend is paid out of profits left out to the shareholders. Though a preference dividend is a fixed liability, it is not charged to the firm’s profits and is considered the appropriation of profits. There is no point in taking profit before taxes because there is no tax shield available for this fixed liability. Out of the different types of shareholders, the preference shareholders get the preference over others, and therefore they receive dividends before any other equity holder.

Dividend

The dividend here refers to the amount of dividend that preference shareholders receive. The dividend are of two types:

- Equity shareholder’s dividend

- Preference shareholder’s dividend

You can also use our Dividend Coverage Ratio Calculator.

Example

Let us take an example for a better understanding.

Assume a company has $500,000 of 7% preference share capital and $ 500,000 of equity share capital. The rate of dividend for equity shareholders is 10%. The net income of the company is $434,000.

Also Read: Dividend Coverage Ratio Calculator

Dividend for preference capital = $35,000 (i.e., 500,000*7%)

And, dividend for equity capital = $50,000 (i.e., 500,000*10%)

Therefore, the dividend coverage ratio for:

Preference Capital = 434,000 / 35,000 = 12.4

Equity Capital = (434,000 – 35,000) / 50,000 = 7.98

Interpretation of Dividend Coverage Ratio

The formula of DCR provides an absolute value rather than a percentage. Ideally, if the ratio comes out to be greater than 1, it means that the earnings are sufficient enough to serve preference shareholders with their dividends. The ratio should be as higher as possible to evaluate the business or firm’s ability to serve. Keeping a cushion for uncertainties, the ratio above 2 is good.

From the viewpoint of preference shareholders, the ratio of 1 may be sufficient on the lower side. Still, with a ratio of just 1, equity shareholders have no chance to receive any dividend. So for equity shareholders to expect a dividend, the ratio has to be much higher than 1.

In the above example, the dividend coverage ratio for preferred stock is 12.4, which means the company has enough earnings that it can pay the dividend to preference shareholders 12.4 times. And same goes for equity dividends. This ratio should always be > 4 or 5 under normal circumstances because a growing company would not like to distribute all its earnings through dividends. Instead, a major portion will be retained for further investments and growth.

Difference between Dividend Coverage Ratio and Dividend Payout Ratio (DCR vs DPR)

Let us not confuse the dividend payout ratio and dividend coverage ratio. The dividend payout ratio is the ratio of earnings distributed to equity shareholders. It is simply a ratio between total dividends that management declares divided by total available earnings for the equity shareholders. But, the dividend coverage ratio calculates the number of times a company can pay dividends from the available earnings.

Read about other Coverage Ratios and their Types.