The current ratio is a vital liquidity ratio that measures a company’s liquidity position. It is helpful to the internal finance manager and equally useful to creditors, lenders, banks, investors, etc. The current ratio indicates the ability of a company to generate cash from current assets to pay current liabilities, which become due in the short term. It is simple but provides incredibly useful information to financial analysts. The low current ratio is a direct sign of a high risk of bankruptcy, and too high would impact the profits adversely.

The current ratio is also known as the working capital ratio. It is one of the liquidity ratios calculated to manage or control a company’s liquidity position. At the outset, the point of thinking is why we need to manage liquidity positions. Essentially, a company’s liquidity refers to its ability to honor its creditors or other vendors. Now, liquidity position assumes a position similar to a scale with a cost of funds on one end and risk of bankruptcy on the other. If we keep lower than the required funds, the probability of dishonoring our dues is too high. On the contrary, if we keep abundant funds, the cost of funds (in the form of interest cost) would reduce the profits. So, a balanced situation is desirable as far as liquidity is concerned.

Keep reading How to Reduce Current Ratio & Why?

Calculation using Formula

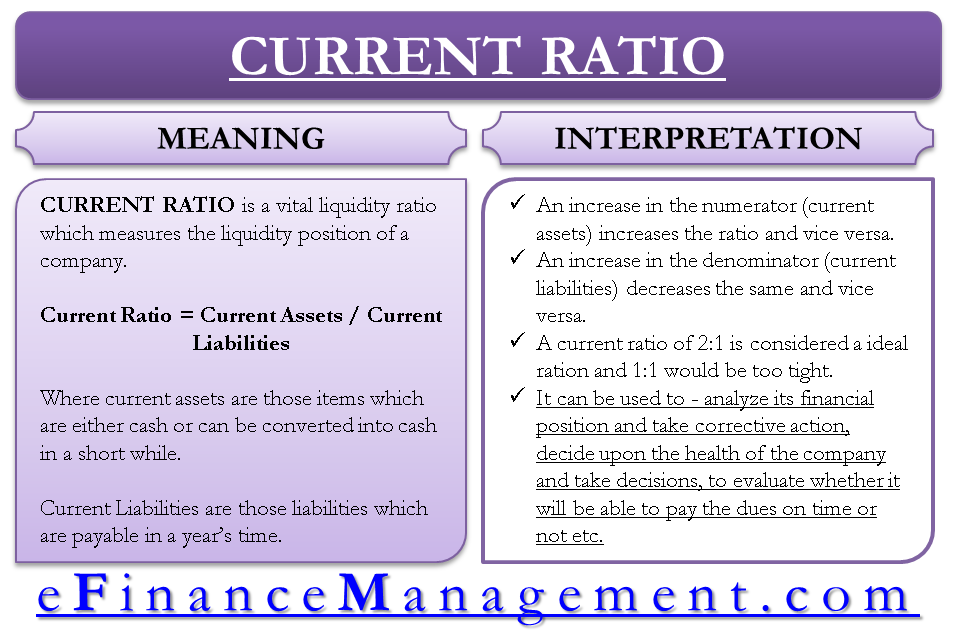

The calculation of the current ratio is very simple. It is just a proportion of the current asset to current liabilities. Sometimes, these figures are readily available. But at times, we need to determine them using the company’s financial statements. Now, we discuss its formula:

Formula

Current Ratio = Current Assets / Current Liabilities

Current Assets

It includes all those items which are either cash or can be converted into cash in a short while. Generally, this period is of one year. Although the following list cannot be comprehensive we have tried to cover most of them. Current Assets include the following items:

Also Read: How to Reduce Current Ratio and Why?

- Inventory / Stock

- Debtors and Bills Receivables

- Cash and cash equivalents

- Short Term Loans & advances

- Marketable Investment / Short-Term Securities

Current Liabilities

The same is the case with current liabilities. Current liabilities are those liabilities that are payable in a year’s time. Current Liabilities include the following items:

- Sundry Creditors

- Outstanding Expenses

- Short-Term Loans and Advances

- Bank Overdraft / Cash Credit

- Provision for Taxation

- Proposed Dividend

- Unclaimed Dividend

Keep reading LIQUIDITY RATIOS for learning about its other types.

Current Ratio Calculator

Interpretation of Current Ratio

An increase in the numerator (current assets) increases the ratio in the current ratio and vice versa. At the same time, an increase in the denominator (current liabilities) decreases the same and vice versa. A current ratio of 2:1 is considered a lenient liquidity position, and 1:1 would be too tight. Whereas a ratio of 1.33:1 forms the base requirement of banks before sanctioning any working capital finance.

- CR < 1: It indicates that current assets are not sufficient to pay the current liabilities of the company. It may give an indication that there are short-term liquidity problems in the company. Indirectly, it has a high risk of bankruptcy.

- CR = 1: It indicates that current assets are just sufficient to pay the current liabilities of the company. It may anytime give rise to liquidity issues, and hence there is a risk of bankruptcy here too.

- CR > 1: It indicates that current assets are sufficient to pay the current liabilities of the company. An ideal current ratio may differ from business to business.

Read more on How to Analyze & Improve the Current Ratio?

Conclusion

The company’s internal managers utilize the current ratio to analyze its financial position and take corrective action if need be. Investors or borrowers like banks or financial institutions use it to decide upon the company’s health and make decisions such as the sanction of loans, their respective amounts, etc. Creditors look at the current ratio of a company to evaluate whether it will be able to pay the dues on time or not.

Effective management of liquidity leads to improvement in profitability and thereby the investors’ wealth. Good bargaining with creditors regarding credit period and control of the credit period of debtors can improve the company’s overall liquidity position and lower the cost of funds to finance working capital.

Refer to the Advantages and Disadvantages of the Current Ratio.

Quiz on Current Ratio

This quiz will help you to take a quick test of what you have read here.

Best for fin.

Very good work

People parrot this nonsense without thinking it through. The current ratio describes the nature of the financing characteristics of working capital – greater than 1 working capital has to be financed from long-term debt and equity, less than one it is being used to finance non-current assets.

Firms with cash sales, fast inventory turnover and in a powerful position with their suppliers generally have current ratios less than one. Such firms do not generally have liquidity problems unless they stop trading or start to shrink.

Example:

Cash Sales of 1 kg – 100

Inventory at cost of 1 kg – 90

Creditors for 2 kg @90 – 180, Consequently C.R. is More than 1.

Here, firm with cash sales does not give C.R. less than 1.

Please extend your thought…… so that I can understand your point of view.

Thanks