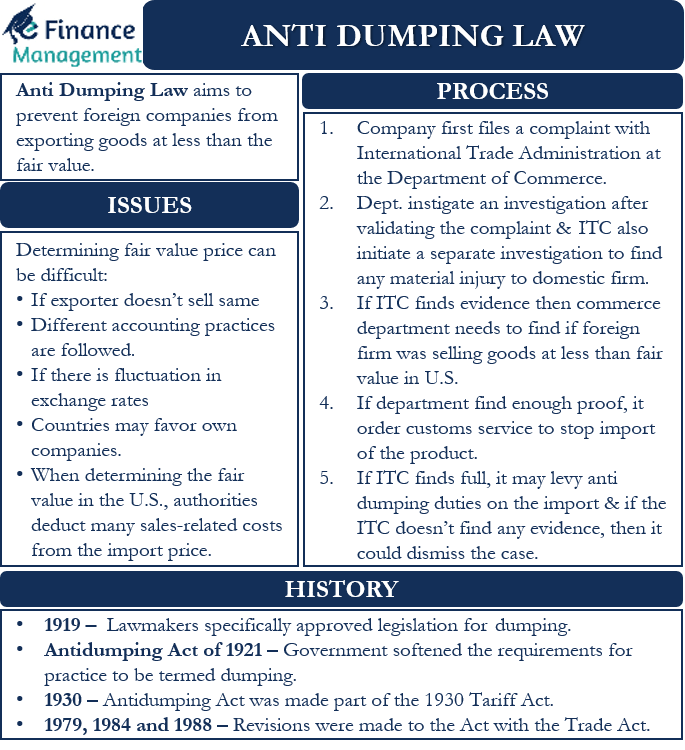

Anti Dumping Law aims to prevent foreign companies from exporting goods at less than their fair value. As per the Department of Commerce, ‘dumping’ occurs when a foreign company exports an item at a price less than what it charges for the same product in its home country or another country. Also, if the foreign firm exports at less than the production cost, it is a dumping case. The Anti Dumping Laws help to prevent such practices.

In the U.S., a local company needs to file a dumping complaint against a foreign company with the Commerce Department. The Commerce Department then investigates the matter primarily by comparing the price that the foreign company charges in its home market, any other country for the same product, and in the U.S. If the Commerce Department finds that the price does not reflect fair market value, then it charges the company for dumping.

When we talk about antidumping laws, it also includes laws for countervailing duties. Basically, the objective of countervailing duties is to offset the impact of subsidies that exporting companies get in their home country.

Anti Dumping Law – History

We can say that the U.S. has had anti-dumping laws since 1897. At the time, only the Countervailing Duty Law of 1897 was in existence. But, in 1919, the lawmakers specifically approved legislation for dumping. As per that law, dumping occurs when a foreign firm exhibits “predatory intent.” Or, they plan to sell the item at less than the production cost with an intention to hurt the local industry or to capture the market in the foreign country. This law came at a time when Congress was also considering other antitrust laws to support U.S. enterprises.

Then with the Antidumping Act of 1921, the government softened the requirements for a practice to be termed dumping. If the price of the foreign product was lower than similar items from the U.S. companies, then the act terms it as dumping. This means the concept of predatory pricing lost importance with this act. A point to note is that this law forms the basis of the current U.S. antidumping law.

In 1930, the Antidumping Act was made part of the 1930 Tariff Act. Later, revisions were made to the Act with the Trade Act in 1979, 1984, and 1988. These amendments made it easy for U.S. firms to file a complaint against foreign firms. Also, it made it easier for the authorities to put restrictions on imports.

Entry of GAAT and Current Status of Anti Dumping Laws

Apart from anti-dumping rules and laws, the countries at various platforms also had many multilateral agreements. And all that ultimately led to the formation of antidumping rules that many countries follow. For instance, between 1963 and 1967, the GATT (General Agreement on Tariffs and Trade) led to the creation of the GATT Antidumping Code. The GATT code lays down the guidelines for the nations to take action on the foreign companies that follow predatory pricing.

A point to note is that GATT does not define what constitutes dumping or how countries can take action against dumping. Instead, it lays down the guidelines that nations can use to frame their own laws against dumping. Some revisions were made to this code between 1973 to 1979 (Tokyo Round of GATT). However, only 25 (of 103 member countries) agree to the revision.

These revisions require member countries to report all their antidumping cases to the GATT. Also, the member countries need to send a semiannual report on antidumping investigations to the GATT.

Similarly, there were multilateral agreements during the Uruguay Round (1986-94). Unlike the Tokyo Round, the Uruguay Round agreements were enforceable on all WTO and GATT members.

Process

As per the U.S. Anti Dumping Law, the following is the process to deal with the dumping cases:

- The first and foremost step is that the company seeking relief needs to approach the International Trade Administration at the Department of Commerce by filing a proper complaint. The complainant company must allege that the foreign firm is dumping goods in America.

- The Commerce Department will instigate the case after due validation of the complaint at the primary level. At the same time, the ITC can also initiate a separate investigation to find if there was any material injury is happening to the domestic firms.

- Suppose the ITC finds evidence of material injury to the domestic firms. In that case, the Commerce Department needs to find if the foreign firm was selling goods at less than the fair value in the U.S. Or at a price less than what it charges in its home country or in any other country.

- If the department finds enough proof of such practices, then it would order the Customs Service to stop the import of the product. It may also ask the U.S. importer to make a deposit. The U.S. government forfeits the deposit if the final investigation finds that the exporter was selling the product at less than the fair value.

- In case the ITC finds full proof of material injury to the U.S. companies, then it may levy “antidumping duties” on the import. The quantum of such duties can be up to the level of dumping margin. And the dumping margin is the difference between the estimated fair value of the product and the current price of the item.

- If the ITC does not find any evidence, then it could dismiss the case.

Issues with Anti Dumping Law

Though the authorities claim that the antidumping laws assist in preventing unfair trade practices by foreign companies and nations, these are not perfect. There are several issues with these laws, such as:

- Determination of the fair value price can sometimes be a bit difficult, particularly if the exporter does not sell the same product in the domestic market or in any other market.

- The provisions and clauses of the anti-dumping agreement leave room for subjectivity in determining dumping. So, this makes it easy for the countries to prove dumping.

- There could be a difference in the sale price in the domestic and foreign markets if the countries follow different accounting practices.

- The fluctuation in the exchange rate may also result in a difference in the sale price in the domestic and foreign markets. A point to note is that the agreement usually considers the exchange rate on the date of sale. However, parties have several options for the sale date, such as the purchase order date, contract date, invoice date, and more. So, depending on the date, the prices may vary.

- Countries may favor their own companies when determining the anti-dumping duty.

- Usually, the anti dumping duties are on a specific item and source. Thus, it is possible for exporters to bypass these by making marginal changes to the customs tariff classification of their products. Or by making minor modifications in the characteristics and features of the products.

- When determining the fair value in the U.S., the authorities deduct many sales-related costs from the import price. These costs could be for packaging, import duties, and more. But, when determining the fair value in the home market of the exporter, the authorities may not eliminate such costs. This difference in the evaluation of fair value may unnecessarily exaggerate the gap.

Final Words

Anti Dumping Laws are very important for countries. They help authorities to save domestic companies from predatory pricing and, in turn, ensure employment and economic growth. At the same time, however, these rules need to be used fairly. Because in the absence of that fairness, a subjective issue, it may go against the basic principles of a free-market economy. Moreover, it would be disadvantageous for the consumers as well. Because they will have fewer purchase options, lower-cost offerings with improved features and technology may not be there. Another critical loss is that over-protectionism would discourage any innovation and cost improvement efforts by domestic companies.