Capital Account Balance of Payments: Meaning

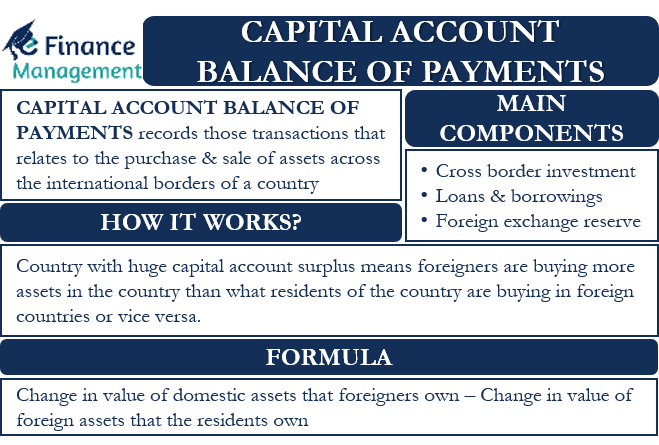

The Balance of Payment account primarily consists of two types of accounts- the capital account and the current account. The capital account part of the Balance of Payments records those transactions relating to the purchase and sale of assets across a country’s international borders. These assets can comprise real estate, stocks, and securities, companies or corporations, other investments like gold, etc. Further, it also records the transactions with regard to cross-border loans and borrowings. Moreover, all transactions in the foreign exchange reserves of the government also find a place in Capital Account. The capital account includes liabilities that the residents of the country create. And these may consist of loans and borrowing from foreign nationals, shares and bank deposits held by foreign nationals in the country, etc.

A purchase of an asset in a foreign country means that capital will flow out of the buyer’s country to make its payment. Similarly, there are many other cross-border investments that lead to an exodus of capital from the country to a foreign country. Therefore, all sorts of outflow for capital transactions are recorded in the Capital Account on the debit side. On the other hand, any action that results in an inflow of capital from abroad is a credit in the capital account. For example, when a resident sells a piece of his land in a foreign country, it results in an inflow of foreign capital in the country. Hence, all such transactions are recorded on the credit side of the Capital Account.

How does a Capital Account Balance of Payments Work?

A capital account is an indicator of the number of assets that a nation has built overseas. Or diluted domestically over the period of time under consideration. We get to know the net assets that a country has from the balance of the capital account. A country with a huge capital account surplus will mean that foreigners are buying more assets in the country than what residents of the country are buying in foreign countries. This will also mean that capital flows into the country to support the purchases of those assets.

Similarly, a capital account deficit means that the residents of the nation are buying or investing more in assets abroad than what the foreign nationals are doing in the country. And this leads to an outward flow of capital from the nation to a foreign country on account of payment for the asset.

A capital account surplus must be balanced by a current account deficit of a similar amount. The reverse is also true. A capital account deficit must be set off by a current account surplus of the same amount. This will result in the sum total of the two accounts being zero. It will balance the BOP account in the end.

Also Read: Balance of Payments Formula

Formula

The formula for calculation of capital account balance is as follows:

Change in value of domestic assets that foreigners own – Change in value of foreign assets that the residents own

A positive answer to the above equation will mean that foreigners are buying more assets in the country or are making more investments. As a result, they are bringing in more foreign exchange into the country than what is going out. This will create a capital account surplus, and the forex reserves of the country will be higher.

On the other hand, a negative answer to the above equation will mean that the residents of the country are buying more foreign assets. More capital flows out of the country to make the payment for these purchases than what is coming into the country in the form of foreign exchange. And this situation will lead to a case of capital account deficit, and the forex reserves of the country will be in a critical condition.

What are the Main Components of Capital Account Balance of Payments?

There are three main components of the Capital account Balance of Payments.

Cross-Border Investments

Cross-border investments in the form of Foreign direct investment (FDI), Foreign portfolio investment (FPI), etc., are one of the major components of the capital account. Nowadays, investments are not restricted to just the borders of a nation. People make investments in other countries to benefit from under-valuations or over-valuations of the assets, securities, and financial instruments. They use the differences in pricing between different countries and profit from it. Some might just invest to hold the asset in a foreign country and benefit from lower rates of the factors of production there.

There is an outflow of capital to a foreign country when a resident purchases an asset in a foreign country. This currency outflow will thus be recorded as a debit in the capital account. Similarly, the purchase of an asset or an investment in the domestic country results in an inflow of foreign currency. Hence, we record such transactions on the credit side of the capital account.

Loans and Borrowings

Residents of a country, including the government, borrow from abroad to fund their needs. Such borrowings or loans mean that foreign exchange is coming into the country. Hence, we record these transactions on the credit side of the capital account (inflow of currency).

Likewise, the residents or the government of the country can provide loans to other nations. This will result in an outflow of capital from the country. We record such outflows on the debit side of the capital account.

Foreign Exchange Reserves

Normally the Central Bank of the countries keeps foreign exchange reserves with them on behalf of the Government. These reserves comprise foreign currency, gold, treasury bills, and securities, etc. The central bank uses this reserve to maintain the Balance of Payment accounts and the foreign exchange rate. The overall aim of these transactions is to stabilize the financial markets.

Transactions from the reserves form a part of the capital account. We will credit the withdrawals to the capital account. Similarly, we debit the deposits in the capital account.