What do you mean by Zombie Banks?

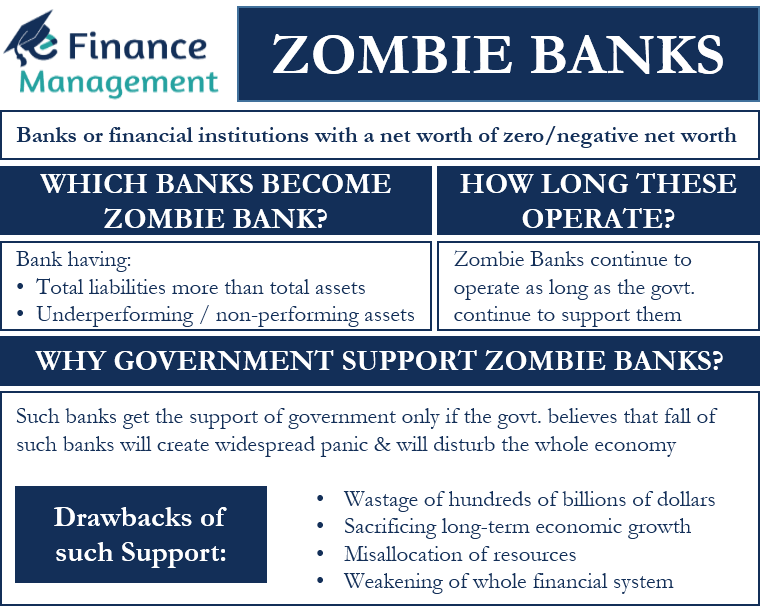

Zombie Banks are the banks or financial institutions with a net worth of less than zero or negative net worth. In other words, we can call such banks and firms as a Living Dead. Technically, such banks are already insolvent/have their current net worth in the negative. Or though they look ok currently but they are sure to become insolvent in the future. And thus, they will not be able to operate or survive without support from the government. The support from the government is mainly in the form of bailouts or guarantees, or credit support. Such support allows these banks to pay back their debts.

Origin of Zombie Banks

The first person to coin this term in 1987 ‘Zombie Bank’ was Edward Kane. He came up with this term in his article Dangers of Capital Forbearance: The Case of the F.S.L.I.C. and ‘Zombie’ S.&L.’s. Kane used the term about the U.S. savings and loan crisis (S&L) in the late ’80s/early ’90s. Later, the term was also used when talking about the Japanese banking crisis in the ’90s and the 2009 financial crisis.

How does a Bank becomes Zombie Bank?

A bank that has many underperforming or non-performing assets. So, when the banks’ total assets (revalued) are subtracted from their total liabilities, their net worth comes to be negative. Generally, such banks do not perform normal banking functions as they lack the resources to do so and thus, become Zombie banks over the years.

Zombie Banks appears to be okay and healthy from the outside. But their true financial health comes out once we revalue their asset. Since these banks are technically dead and feed on the money from the government, we use the term zombie for them.

Also Read: Lender of Last Resort

How Zombie Banks Operate?

Zombie Banks continue to operate as long as the lenders have confidence that the government will continue to support them. But once the government pulls out, these banks die.

Zombie Company

Similar to a zombie bank, there can also be a zombie company. Such a company is technically insolvent. It can only pay back its debt and is unable to expand. If creditors offer strict terms or government ends support to it, such companies cease to exist or die.

Why do Government Support Zombie Banks?

Government usually supports these banks because they are considered to be too big to fall. Or if the government believes that the fall of such banks will create widespread panic and it will not be good for the economy.

Drawback of Supporting a Zombie Bank

Though government wants to avoid widespread panic by preventing such banks from dying, supporting these banks also has its drawbacks. The biggest drawbacks include wasting hundreds of billions of dollars and sacrificing long-term economic growth.

Also Read: Advantages and Disadvantages of Bank Loans

By supporting such banks, the capital that could have been used for productive purposes gets stuck. So, the money which would have been diverted for social development and financial strengthening gets tied with the zombie banks. This is another fallacy we call in the financial world, where good money is used for bad money.

Moreover, these banks may also continue to accumulate risk by lending to businesses that are themselves not performing well. We call such type of lending from zombie banks forbearance lending. All these conditions, further injection of funds, continuous operations and lending to non-viable businesses, and so on ultimately lead to the weakening of the entire ecosystem and misallocation of resources.

Real Example: Japan’s Zombie Banks

In 1990, following the collapse of Japan’s real estate prices and the stock market, several of the country’s major banks went insolvent. However, the Japanese government continued to support these banks through guarantees and bailouts.

These banks were just eating money without making any noticeable contribution to the economy. This means they were taking deposits but were not giving anything back to the economy.

This resulted in a weak economic performance for about a decade. Economists refer to this period as the ‘lost decade’ for Japan. Even after 30 years, many of Japan’s zombie banks still have a significant amount of non-performing assets on their balance sheet.

Europe made such a similar mistake on the lines of Japan in the 2008 financial crisis. They should have taken the learnings from Japan, but they continue to make similar mistakes that lead to the global financial crisis.

Final Words

Zombie Banks are still a reality. The last we witnessed such banks were at the time of the 2008 financial crisis. At the time, many banks got financial support from their respective government (the U.S. and Europe). Even though the government supports these banks to prevent widespread panic and manage financial weakening, there is evidence that such an action is not good for long-term economic growth.