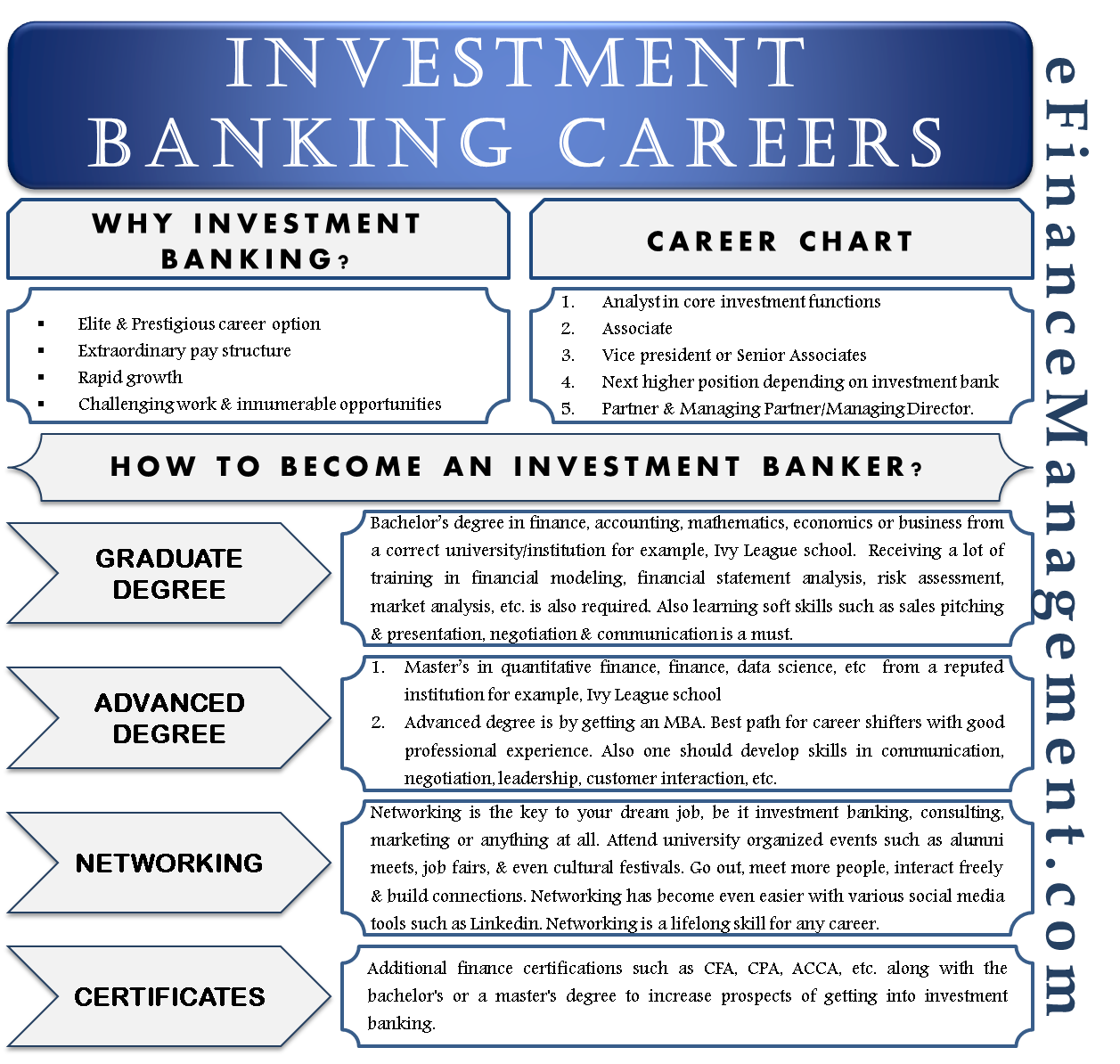

Why Investment Banking?

It is common knowledge that investment banking is an elite career option. Investment bankers hold a position of prestige, and many people aspire to become investment bankers. This is due to multiple reasons; investment banking as a career option offers an extraordinary pay structure, rapid growth, challenging work, and innumerable opportunities to learn. The jobs available in this sector are particularly low, and aspirants are high in number, so the process of making a career in investment banking can be a challenging task. A person has to be naturally good with numbers and analysis. He must also have excellent people skills and motivation to achieve excellence. That, coupled with the right qualifications, can get you an entry into investment banks.

Investment Banking Positions Hierarchy

To understand the career opportunities, first, let’s understand the career chart of an investment banker.

The field of investment banking offers a wide range of positions for professionals to pursue based on their skills, experience, and career aspirations. These positions span various levels of seniority and responsibility within investment banking organizations. Here are the key positions available for investment bankers:

Analyst

The entry-level position in investment banking is typically that of an analyst. A graduate with a bachelor’s degree fresh out of college or university starts as an analyst in core investment functions. Analysts play a crucial role in conducting financial research, building financial models, and assisting in the execution of transactions. They work closely with senior team members, support due diligence processes, and contribute to the preparation of client presentations and pitch materials. This position requires strong analytical skills, attention to detail, and the ability to work in a fast-paced environment.

Associate

From there, he advances to become an associate. The journey from an analyst to an associate typically takes 3-4 years. Associates take on more responsibility in deal execution and client management. They work closely with senior bankers to develop financial models, perform industry and company research, and contribute to the overall transaction process. Associates also play a role in managing client relationships and coordinating with different teams within the investment bank. This position requires a solid understanding of financial analysis, excellent communication skills, and the ability to manage multiple tasks simultaneously.

Also Read: How to Become an Investment Banker?

Vice President

Vice presidents (VPs) in investment banking have a more significant role in managing client relationships, business development, and deal execution. They take on leadership responsibilities, overseeing project teams and guiding analysts and associates in their work. VPs are involved in strategic decision-making, transaction structuring, and client presentations. This position requires strong leadership skills, extensive industry knowledge, and the ability to manage complex financial transactions.

Director

Directors are experienced professionals who provide strategic guidance and oversight in investment banking activities. They play a crucial role in originating new business opportunities, managing client relationships, and mentoring junior team members. Directors also contribute to the development of the investment banking strategy and drive the growth of the business. This position requires a deep understanding of financial markets, strong leadership abilities, and a proven track record in deal execution.

Managing Director/Partner

Managing directors (MDs) or partners hold the highest-level positions in investment banking. They are responsible for leading and growing the investment banking division, driving business development, and managing key client relationships. MDs play a significant role in shaping the overall strategic direction of the organization. They often have extensive industry experience, a vast network of contacts, and a track record of successful transactions. This position requires exceptional leadership skills, business acumen, and the ability to navigate complex financial markets.

It’s important to note that these titles and roles may vary across different investment banking firms. The hierarchy and responsibilities can differ, but the general career progression in investment banking typically follows a similar structure.

Also Read: Investment Banking Courses

Areas in Investment Banking

Investment banking offers a wide range of areas where professionals can carve out a successful and fulfilling career. Whether you are a recent graduate or an experienced finance professional looking to make a transition, it’s essential to explore the various areas within investment banking to find the right fit for your skills and interests. Here are some of the key areas that can contribute to a promising investment banking career:

Mergers and Acquisitions (M&A)

Mergers & acquisitions are a vital aspect of investment banking that involves advising clients on buying, selling, or merging companies. This area requires strong analytical and negotiation skills, as well as the ability to evaluate financial data and assess the strategic value of potential deals. M&A professionals play a pivotal role in guiding clients through complex transactions and helping them achieve their strategic objectives.

Capital Markets

Capital markets professionals specialize in raising capital for clients by issuing various financial instruments, such as stocks, bonds, and derivatives. This area involves underwriting securities, conducting market research, and assisting with the pricing and placement of offerings. Capital markets professionals need a deep understanding of market dynamics, investor sentiment, and regulatory requirements to help clients access the capital they need to fund their operations and growth.

Sales and Trading

Sales and trading professionals facilitate the buying and selling of securities on behalf of clients. They work closely with institutional investors, hedge funds, and other market participants to execute trades and provide liquidity. This area requires strong analytical and interpersonal skills, as well as a keen understanding of market trends, risk management, and investment strategies. Sales and trading professionals thrive in fast-paced environments and excel at building relationships with clients.

Research

Research plays a critical role in investment banking by providing insights and investment recommendations to clients. Investment bankers as research professionals analyze market trends, conduct financial modeling, and evaluate companies and industries to help clients make informed investment decisions. This area requires strong analytical skills, a deep understanding of financial markets, and the ability to communicate complex ideas effectively. Research professionals often specialize in specific industries or sectors, allowing them to develop expertise and become trusted advisors to clients.

Risk Management

Risk management is an essential function in investment banking that focuses on identifying, assessing, and managing financial risks. Investment bankers as risk management professionals analyze market and credit risks, develop risk mitigation strategies, and ensure compliance with regulatory requirements. This area requires a strong understanding of financial products, risk modeling techniques, and the ability to work with quantitative tools and data analysis. Risk management professionals play a crucial role in safeguarding the financial stability of investment banks and their clients.

Corporate Finance

Corporate finance professionals work within organizations to manage their financial operations and strategic decision-making. They assist in capital budgeting, financial planning and analysis, mergers and acquisitions, and treasury management. This area requires a broad understanding of finance, accounting, and business strategy. Corporate finance professionals collaborate with various departments within an organization and provide financial insights to support key decision-making processes.

Conclusion

In conclusion, investment banking offers diverse areas where individuals can build successful career. Each area requires specific skills, knowledge, and expertise. It’s important to explore these areas, consider your strengths and interests, and seek opportunities to gain experience and develop the necessary skills. A successful investment banking career lies in finding the right fit within these areas and continuously honing your skills to adapt to the ever-evolving financial landscape. And, for all these, it is very necessary to have a strong base in investment banking. We recommend reading “How to Become an Investment Banker?“.

very good