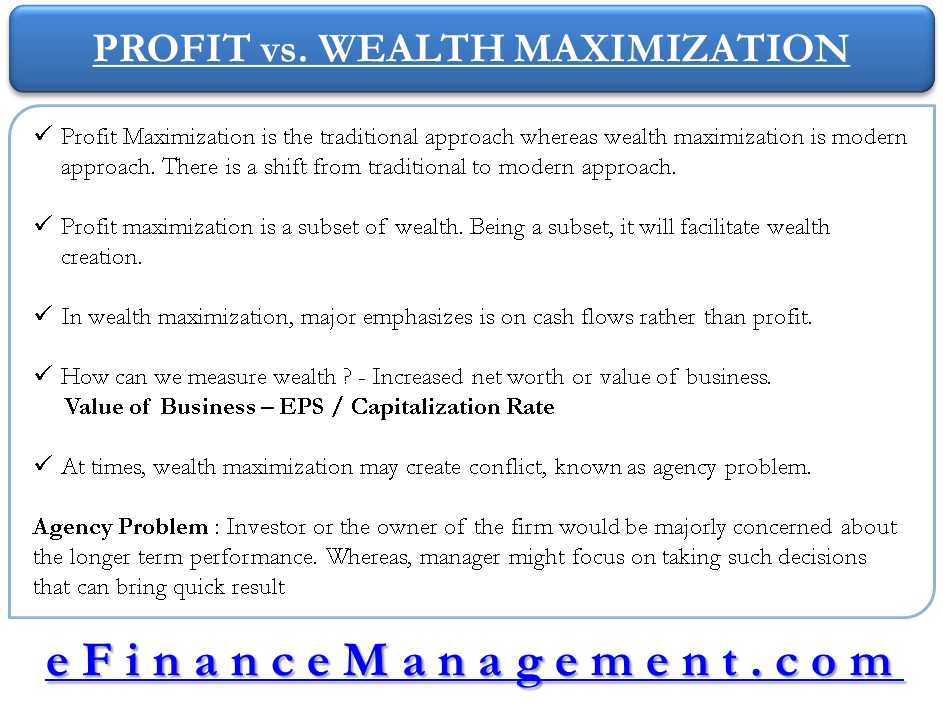

Profit maximization vs. Wealth maximization is a prevalent but very crucial dilemma. Financial management has come a long way by shifting its focus from a traditional approach to a modern approach. The modern approach focuses on the maximization of wealth rather than profit. This gives a longer-term horizon for assessment, making way for sustainable performance by businesses. Let us see more about Profit vs. Wealth Maximization.

A myopic person or business is mainly concerned about short-term benefits. A short-term horizon can fulfill the objective of earning profit but may not help create wealth. It is because wealth creation needs a longer-term horizon. Therefore, financial management emphasizes wealth maximization rather than profit maximization. For a business, it is not necessary that profit should be the sole objective; it may concentrate on various other aspects like increasing sales, capturing more market share, etc., which will take care of profitability. So, we can say that profit maximization is a subset of wealth. Being a subset, it will facilitate wealth creation.

Approach

Managers are now giving priority to value creation. They have now shifted from the traditional to the modern approach of financial management that focuses on wealth maximization.

This leads to a better and proper evaluation of the business. E.g., under wealth maximization, cash flows are more important than profitability. As we know, profit is a relative term, and it can be a figure in some currency, a percentage, etc. E.g., we cannot judge a profit of say $10,000 as good or bad for a business till we compare it with investment, sales, etc. Similarly, the profit’s duration is also essential, i.e., whether it is earned in the short term or long term.

Also Read: Wealth Maximization

The primary emphasis is on cash flows rather than profit in wealth maximization. So, to evaluate various alternatives for decision-making, cash flows are considered. E.g., to measure the worth of a project, criteria like “present value of its cash inflow – the present value of cash outflows” (net present value) are into consideration. This approach considers cash flows rather than profits into consideration. It also uses discounting technique to find out the worth of a project. Thus, the maximization of wealth approach believes that money has a time value.

An obvious question that arises at this point is how we can measure wealth. Well, a basic principle is that ultimately wealth maximization should be discovered in increased net worth or value of the business. So, to measure the same, the value of a business is a function of two factors. These are earnings per share and capitalization rate. And it can be measured by adopting the following relation:

Value of Business = Earning Per Share (EPS) / Capitalization rate

Agency Problem

At times, wealth maximization may create conflict, known as the agency problem. This describes the conflict between the owners and managers of the firm. Owners appoint managers as their agents to act on their behalf of them. A strategic investor or the owner of the firm would be majorly concerned about the longer-term performance of the business; which can lead to the maximization of shareholder’s wealth. At the same time, a manager might focus on making such decisions that can bring a quick result so that they can get credit for good performance. However, in fulfilling the same, a manager might opt for risky decisions that can put the owner’s objectives at stake.

Hence, a manager should align their objective to the broad aim of the organization and achieve a trade-off between risk and return while making a decision, keeping in mind the ultimate goal of financial management, i.e., to maximize the wealth of its current shareholders.

Read Agency Theory In Corporate Governance to learn more.

The answer is satisfactosy and will go a long way helping future researchers

Thank You, the answer has explained better to my satisfaction.

This is really interesting.

I like this….simple and well elaborated

thanks..

much to my satisfaction.

really usefull…

Its vry usefull

Thanks for reading and reviewing us.

This broaden mmy knowledknowledge…

So refreshed after reading…

Thanks.

Comment Text*thanks for this write up sir, I guess I can satisfy my finance lecturer with these.

what a shoft explaine!!!!!!!!!!!!!!!!!!!!!!!!!

Interesting! I almost forgot financial management subject as I teach HRM. The explanation has renewed what I studied years back. Thanks.

I really like forgathering useful information, this post has got me even more info!

next level explanation!