Not-for-Profit and Non-profit are the form of businesses often confused to be the same. Thus, people actively use both the terms for businesses that prefer not to share the profit with the owners or the shareholders. In reality, both terms differ in not just the definition but also various other aspects. Moreover, many organizations also use both terms interchangeably to convey the message that making a profit is not their main objective. Thus, layman also confuses the term non-profit with companies that do not earn profit at all. However, it is not true because most of the non-profits and not-for-profit companies may make a profit, but they reinvest those profits in the organization. To better understand these two terms and their usage, we need to see the differences between non-profit vs not-for-profit.

What is Non-Profit and Not-for-Profit?

A non-profit organization is a proper business organization that usually gets tax-exempt status. Even the donations made to these organizations are exempt from tax. We may also call them NPOs. They, however, need to make all their operations and financials public to maintain the trust of the public.

A not-for-profit organization is an organization that does not earn any profit from its members or owners. All the money that such an organization gets (in the form of donations or earnings) is used to achieve its objectives and keep it operational.

Non-Profit vs Not-for-Profit – Similarities

Before discussing the difference between non-profit vs not-for-profit, it is imperative that we understand how both the terms relate to each other:

- Both types of organizations serve the needs of the community.

- As said above, both types of organizations may make a profit. But, they usually invest all their earnings back into the business.

- Both non-profit and not-for-profit organizations define their missions and targets very well and work accordingly. They reveal their products and services to the public.

- Often organizations have limited resources and, therefore, believe in the efficient deployment of the same.

- Like any other organization, these corporations may also have well-defined management, boards, and various levels of staff that help in the better working of the organization.

- Both non-profit and not-for-profit organizations can have a mix of paid and volunteer employees.

- None of these organizations pays a dividend to the stockholders.

Non-Profit vs Not-for-Profit – Differences

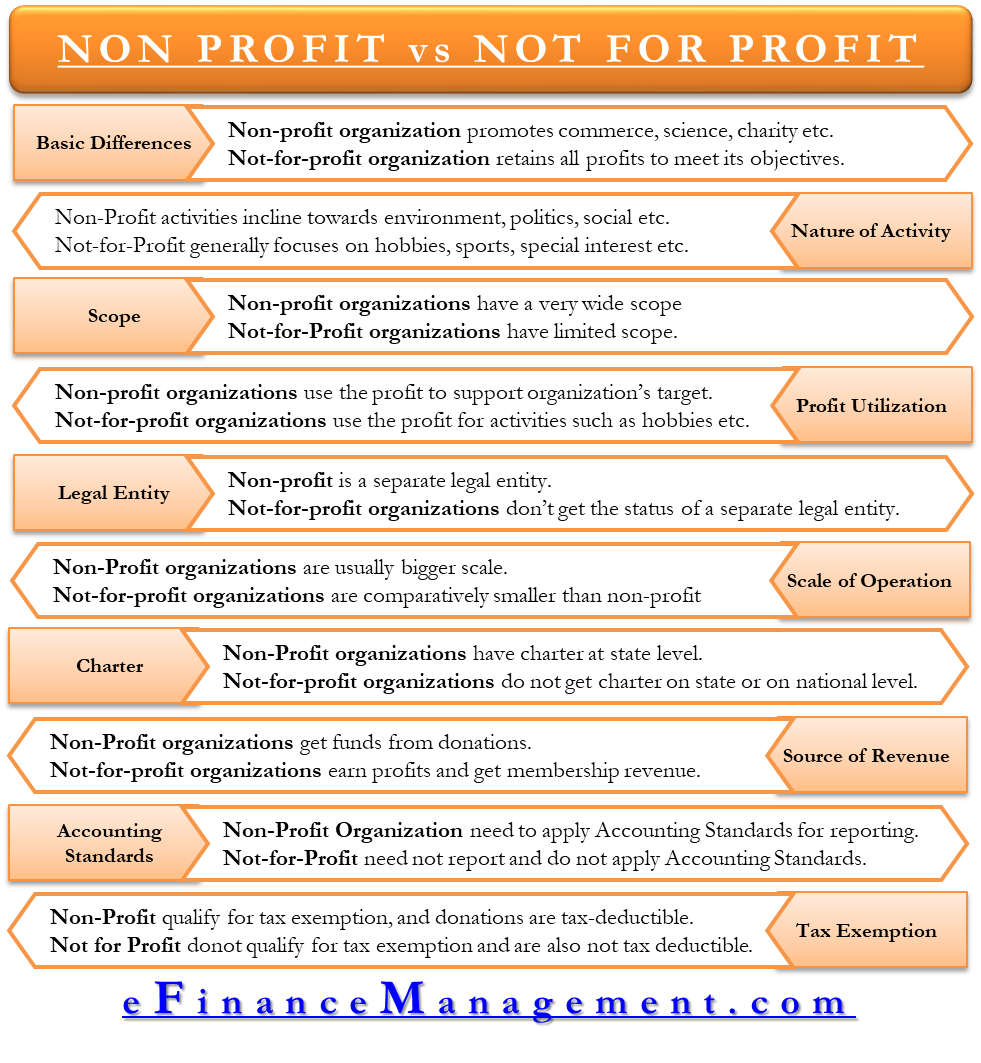

Following are the differences between non-profit vs. not-for-profit:

Basic Difference

“Non-profit” focuses on the absence of profit-generation as the primary goal, while “not-for-profit” emphasizes the intent of not generating profit for the benefit of individuals.

Nature of Activity

Non-profits organizations undertake activities that are more inclined toward environmental, political, social, and economic activities. Some non-profits known globally are UNICEF, American Red Cross, American Heart Association, etc. On the other hand, not-for-profit organizations usually carry out group activities focusing on hobbies, sports, special interests, etc. Some of the examples are sports clubs, leagues, and various associations.

Scope

In comparison to not-for-profit organizations, non-profit organizations have a very wide scope. While non-profit organizations like UNICEF and the American Red Cross are present globally, the not-for-profit organizations are usually local or regional.

Utilization of Profit

Not-for-profit organizations use the profit for various activities such as hobbies or recreation linked to the cause or goals. On the other hand, non-profit organizations use the profit to support the organization to fulfill their target and goals. Further, they also use the funds to pay for the salaries and administrative requirements.

Legal Entity

A non-profit is a separate legal entity. On the other hand, not-for-profit organizations don’t get the status of a separate legal entity.

Scale of Operations

Non-profit organizations are usually large and comparatively much bigger than not-for-profit organizations. They can have operations in many countries. Not-for-profit organizations are comparatively smaller than non-profit ones and are present locally or on a state level.

Charter

Non-profit organizations get their charter at the state level. On the other hand, not-for-profit organizations do not get the charter either on the state level or on the national level. In fact, non-profit organizations get the tax-exempt status only after getting the charter. The charter would include the rules and regulations of the company and other things.

Source of Revenue

Non-profit organizations usually get funds from donations, or they initiate fundraising. Contrary to that, not-for-profit organizations earn profits and get membership revenue. It may or may not get donations.

Accounting Standards

Usually, not-for-profit organizations do not need to report revenues. This means accounting standards do not apply to them stringently. On the other hand, since non-profit organizations raise funds from donations, they have bigger responsibility and obligation toward transparent reporting.

Banking Practice

Non-profit organizations usually prefer banking services that charge them nominal to zero fees. These organizations do not earn revenue from selling a product or service and rely on fundraising mostly. Therefore, they cannot afford to have expensive banking practices. On the other hand, not-for-profit organizations can afford to pay the minimal charges such as banking fees.

Tax Exemption

Since non-profits are proper organizations, one can expect them to earn a profit. This profit helps them fund their operations and support their missions. Thus, non-profits usually do qualify for tax exemptions. On the other hand, most not-for-profits do not qualify as business entities but rather are interest groups. Thus, they don’t qualify for any tax exemption.

Tax Exemptions for Donors

Donations made to the non-profits are usually tax-deductible. On the other hand, donations to not-for-profit are often not tax-deductible.

Final Words

Both organizations are similar in many ways and also different in many ways. One major similarity between the two is that making profits is not their primary aim. On the other hand, the biggest difference between the two is in the nature of the activities they undertake.