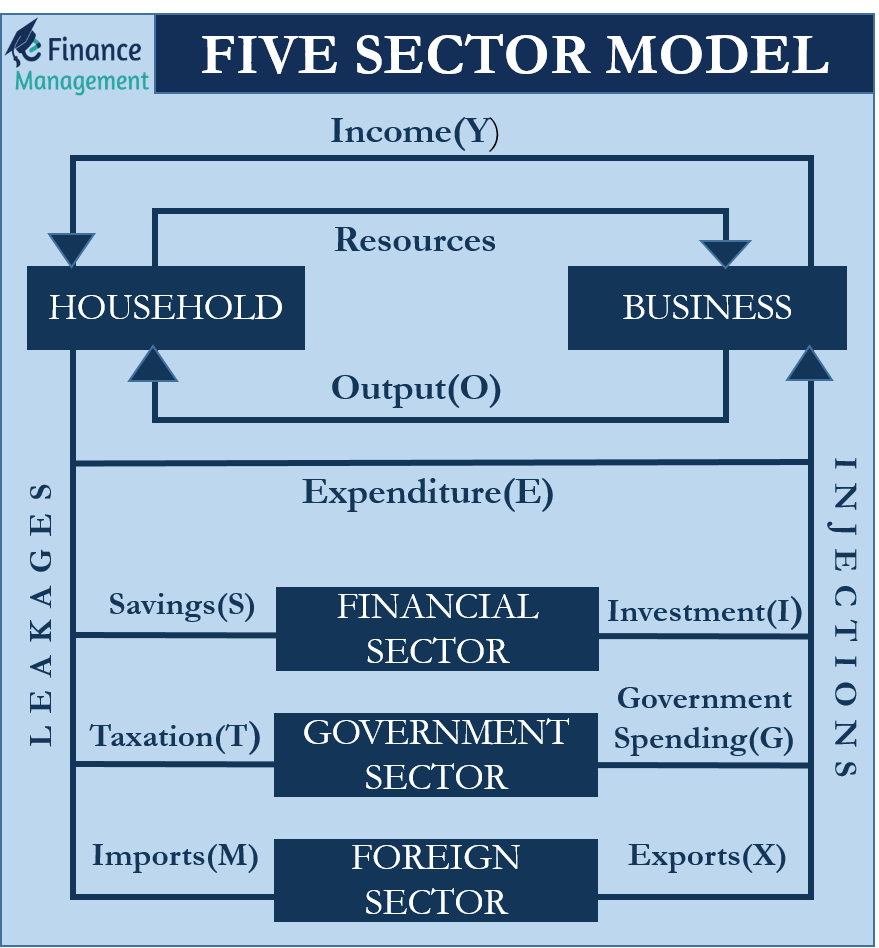

In economics, the circular flow model shows how money, as well as goods and services, flow between different sectors in an economy. This flow of money, goods, and services also helps in determining a nation’s national income or GDP (Gross Domestic Product). There are several models that explain this flow of income and expenditure in an economy. But the most realistic model that explains the flow of income and expenditure in an economy is the five-sector model.

What is Five Sector Model?

The five-sector model has all the sectors that are there in the four-sector model (Households, businesses, government, and foreign sector). In addition to these four, the five-sector model has the fifth sector, and it is the financial sector.

A financial sector is very crucial for the smooth operation of an economy. This sector provides borrowing and lending services to the other sectors in an economy. Extra income from other sectors flows into the financial sector in the form of savings. And the financial sector uses these savings to give loans to other sectors. Moreover, the financial sector allows households, businesses, and government to invest their savings to earn interest and dividend income.

Understanding Five Sector Model

Now, let’s see how other sectors participate in the five-sector model.

Household Sector receives factor income (rent, wages, etc.) from the businesses and transfer payments from the government. Expenditure from households in the form of consumption, taxes, and import goes to businesses, the government, and the foreign sector. Any remaining income with the households will go to the financial sector in the form of savings.

Businesses get income from selling their goods and services to the household sector, foreign sector, and government. Also, the business sector gets government subsidies. Expenditure from businesses is in the form of wages and rent to households, import payments to the foreign sector, and taxes to the government. The savings (or profit) from businesses go into the financial sector.

For the government, the main source of income are taxes from households, businesses, and the financial sector. The government also gets interest and dividend income from investing its savings into the financial sector. The expenditure from the government is in the form of transfer payments, subsidies, grants, import payments, etc.

The foreign sector gets money from businesses, the government, and households in the form of import payments. Expenditure from the foreign sector is in the form of payment for exports from businesses, government, and households.

Relation between Injections and Leakages

Like with other models, there are injections (money coming into the economy) and leakages (money going out of the economy) in the five-sector model as well.

Injections in this model are in the form of Government Spending (G), Exports (X), and Investment (I). And leakages are in the form of Imports (M), Savings (S), and Tax (T).

Let’s look at the relationship between injections and leakages.

In the case of equilibrium or when the economy is stable, the injections in an economy equal the leakages. If the injections are more than the leakages, it would suggest that the economy is growing as more money is coming into the economy than it is going out. It would eventually mean a rise in the GDP (gross domestic product) and a drop in unemployment.

On the other hand, when the leakages are more than the injections, it could mean the economy is slowing down. This is because more money is going out of the economy than coming in. It eventually results in a plunge in GDP and an increase in unemployment.

Let’s take a look at an example to understand the calculation of GDP using the five-sector model. Suppose: G = 25, M= 60, T = 30, I = 20, X =70 and S=35.

Injections = 25 + 70 +20 = 115 and Leakages = 60 + 35 + 30 =125. In this case, leakages are more than injections, indicating the economy is contracting.