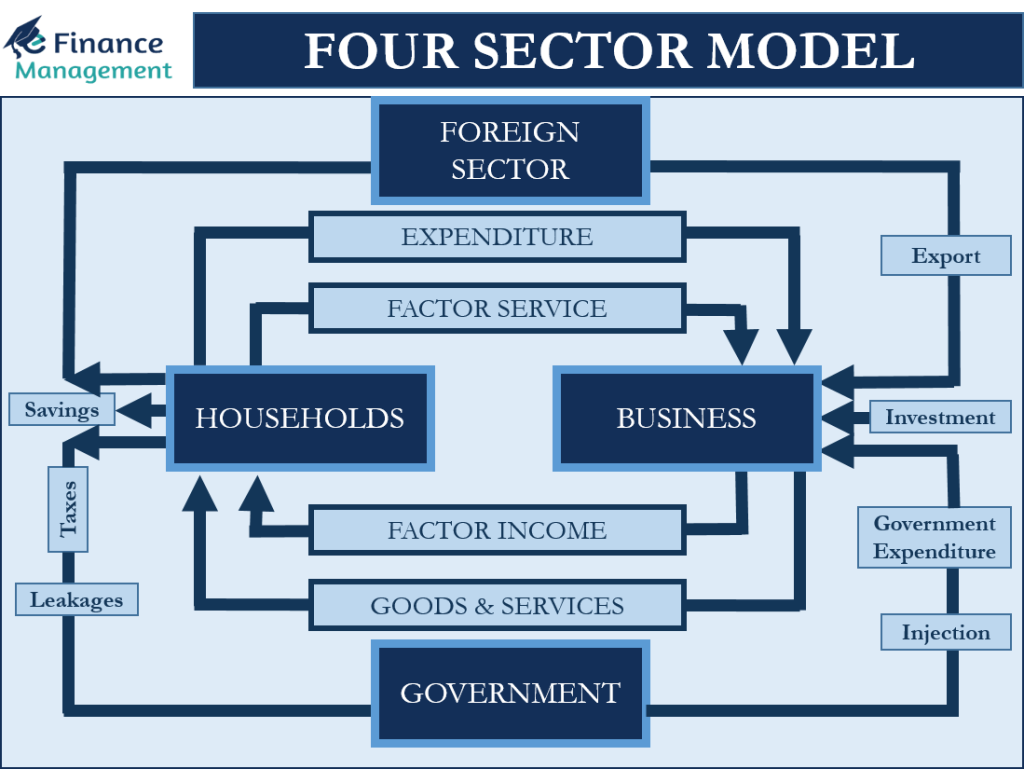

The Four Sector Circular Flow Income Model is the most realistic one under the current world conditions. In our earlier discussions, we have seen the other Models also – Two Sector and Three Sector. However, the Three Sector Model represented a closed economy which is no more relevant in current times. The Four Sector Model does away with this shortcoming. And foreign transactions are also included and integrated into this Model. In a circular flow of income, every sector plays a dual role. Each sector not only gets a payment from other sectors but pays them as well in one form or another. Thus, understanding the circular flow of income and expenditure in an economy is very important, and one of the best models that explain it is the four-sector model.

This model is realistic and practical as it consists of four primary sectors. These sectors are households, businesses, the government, and the foreign sector (or the rest of the world). The foreign sector primarily means the export and import of goods and services. Therefore, this Four Sector Model is also called an Open Economy Model. In the Four Sector Model, imports are treated as expenditure and become a leakage. Whereas exports boost the national income.

Assumptions of the Four Sector Model

This model drops the unrealistic assumptions of the two- and three-sector models. Following are the assumptions of a four-sector model:

- The entry and recognition of the Foreign Sector in this model leads to no restrictions on the import and export in general. Specific restrictions like the trading country, product, etc may be there.

- The Government intervention is minimal.

- Both domestic and foreign markets feature perfect competition.

- Household exports labor and capital, while businesses export goods and services.

Understanding Four Sector Model

Let us understand each sector’s role (income and expenditure) in detail to better understand the four-sector model.

Household Sector

The Household Segment plays a critical role in the Economic Development of any Country. This sector acts as:

- A producer: Small businesses – self-employed and family businesses does make some products and sell the same. And gets money from other sectors by selling these goods and services.

- Works as a factor of production: They provide resources to the businesses as well as the public in the form of labor, professionals-Doctors, Engineers, Lawyers, Consultants, etc. They earn income in the form of rent on owned properties, fees, and remuneration for the work and services provided to other sectors as well as to the household segment.

- Transfer payments: This segment also gets various transfer payments from the government in the form of subsidies, welfare activities, and so on.

- Acts as a consumer: households consume various goods and services produced and sold by the businesses. The major outgo of the household segment is in the form of consumption only. They also pay for the imports of goods and services.

- Pays taxes to the Government: Besides the businesses, the households form a large chunk, rather than the biggest chunk of taxpayers to the government. They pay direct taxes in the form of income tax, wealth tax, gift tax, etc. They also pay indirect taxes in the form of VAT, Sales Tax, Service Tax, GST, etc.

- Act as Saver: Households are the biggest block of savers and investors in an economy. Every other segment-businesses and the government try to woe their savings. The money left over from their income, after fulfilling all their consumption needs, is saved. These savings get deposited with banks and financial institutions. Part of it also goes for investment in the stock market, real estate, bullion, and so on.

Business Sector

Businesses get revenue from selling goods and services to households, as well as through exports. They also get subsidies from the government.

On the other hand, payments from businesses to other sectors include factor payments, taxes, import payments, and more.

Government Sector

The segment includes two types of activities. The First one is the governance, welfare activities, services, and so on. The second segment is where the government owns and operates certain businesses.

The primary income source for the government is tax collections from households and businesses. Also, the government gets interests and dividends from investing in businesses, as well as international grants and loans.

On the other hand, payment from the government includes transfer payments, subsidies, grants, and more. The transfer payments involve sending money to households through pension funds, scholarships, and more. Also, the government buys goods and services from businesses.

Foreign Sector

This sector gets income from businesses, governments, and households who import goods and services from other countries. On the other hand, the foreign sector makes payments to businesses and governments when they export goods and services to other countries. It also makes factors payment to households.

In the case of exports being more than imports, there is a surplus balance of payment. And, when the imports exceed exports, there is a deficit balance of payment in the economy. The government uses different policies to maintain a balance between imports and exports.

Determination of Equilibrium Output/Income

We can use the four-sector model to determine the equilibrium income/output in an economy. Using the aggregate expenditure method, we can get the equilibrium income/output by adding the expenditure from all four sectors.

So, equilibrium income/output = C + I + G + (X – M)

Here ”C” is the household expenditure, ”I” is a business expenditure, ”G” is government purchase, while ”X – M” is the net foreign demand or ”Exports less Imports.”

If other things remain the same, the income and output in an economy will go up with a rise in exports and a drop in imports. And, the income and output level in an economy will drop if there is a jump in imports and a drop in exports.

Final Words

The four-sector model is closer to reality than the two-sector and three-sector because of the introduction of the foreign sector. The Addition of the foreign sector transforms the model from a closed to an open economy.

good day, i love your write up on four sector economic model. i have a question, and kindly reply.

Using four sector economic model, what is the possible solutions on how the household, firms, and government sector can grow the economy to a balance of payment surplus where export will exceed import

Hey, Welcome to eFinanceManagement.

The following is the answer to the question you raised. To achieve a surplus in balance of payments:

1) Household: Save more, buy local.

2) Firms: Boost productivity, explore new markets.

3) Government: Support exports, develop infrastructure.

4) Rest of the World: Attract investments, expand tourism and services.

Hope you find the answer.

Thank You