Three Sector Model of Circular Flow of Income: Understanding the Term

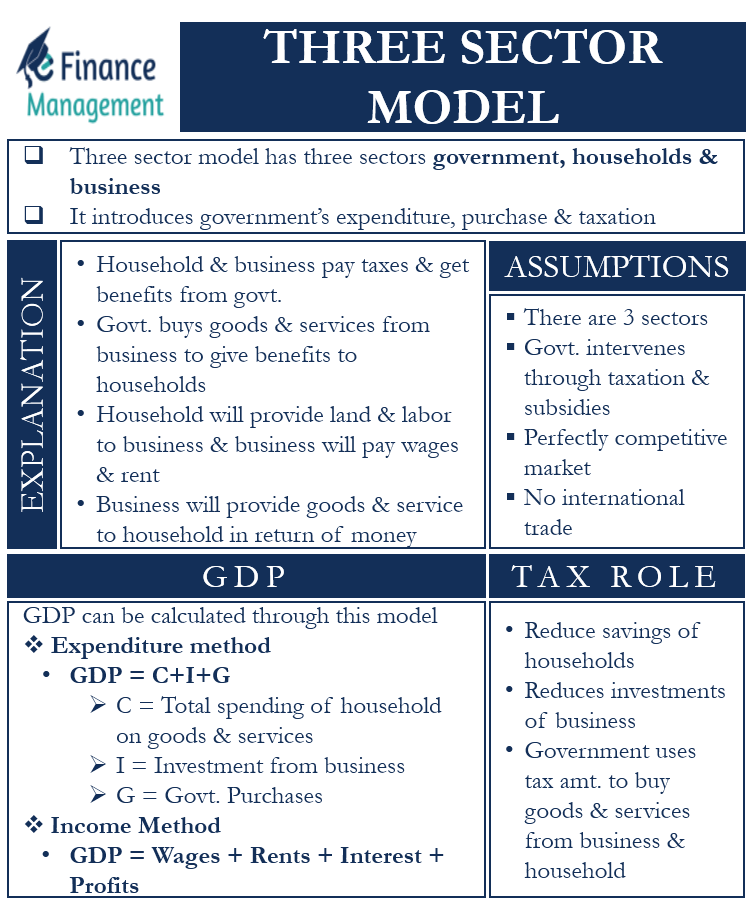

A three-sector model is one of the best ways to explain the flow of income and expenditure in an economy. In a two-sector model, there are only two sectors (households and businesses). But in the three-sector model, we include the government as well. However, it is still all within the national boundaries. And this model still is a closed economy where there are no foreign transactions taken into account or assumed. Hence, another name for this model is the closed economy model.

So, this model introduces government purchases or expenditures and taxation to our two-sector model theory of income determination. The purchases, expenditures, and subsidies from the government inject more money into the economy, while taxation takes out money from circulation.

Assumptions

The threes sector model makes the following assumptions:

- This model assumes the existence of three sectors in the economy. And those are households, businesses, and the government.

- The intervention from the government remains in the form of taxation and subsidies.

- The market is perfectly competitive.

- There is no international trade or any type of foreign transaction -grants, loans, and other support.

Understanding Three Sector Model

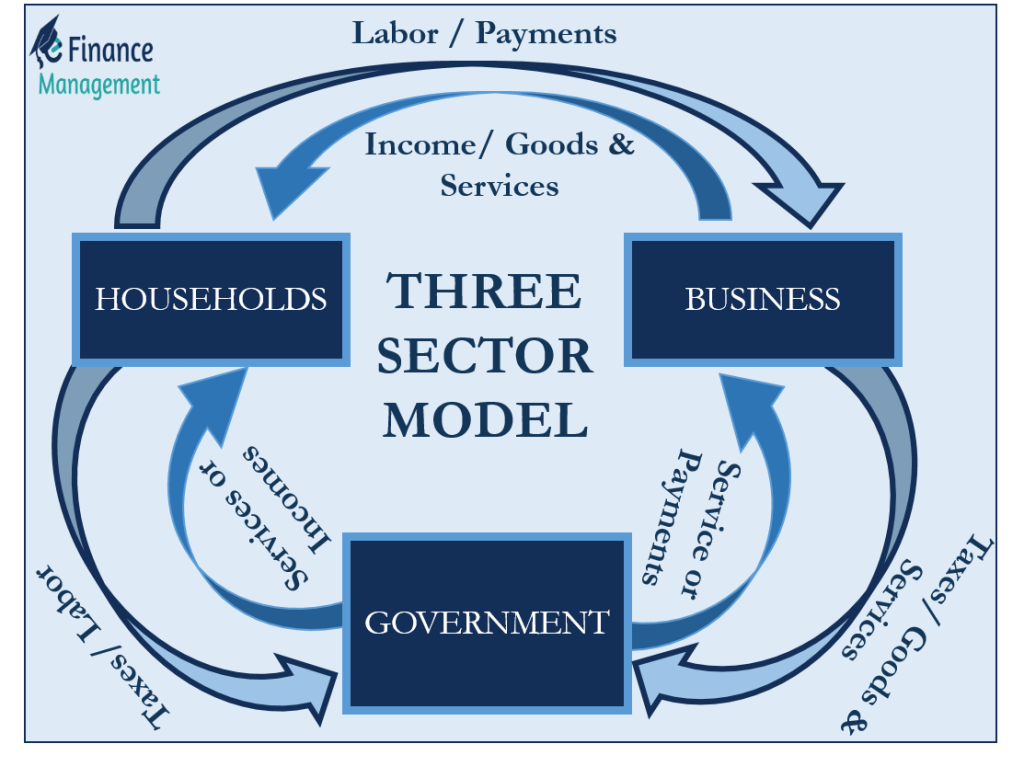

To understand the flow of income and expenditure in this model, we need to understand the flow of income and expenditure between each of these three sectors.

Let us first understand the structure and money flow between the household sector and the government. The households earn income from businesses and pay income tax on their earnings as well as pay other taxes on consumption and other purchases to the government. In turn, the government uses this money from households and other sources to offer several benefits and subsidies to the households. These benefits include pension funds, education, health, sanitation, and more.

Similar way, let us now try to understand the to and fro flow between businesses and the government. The flow between businesses and government is similar to what we discussed between households and the government. Businesses also need to pay income tax to the government on their earnings and other taxes on their expenditure and transactions, exactly like a household. And in return, the government provides many benefits to businesses, such as transfer payments, subsidies, and more. Also, the government buys goods and services from businesses for its welfare activities. These are then used for the benefit of the households.

In the two-sector model, we have already discussed the structure and the flow of income between households and businesses. Households offer labor and land to businesses, as well as buy their goods and services. In return, households get wages and rent, while spending from households becomes the income of the businesses.

Role of Taxes

Now, let us understand the role of taxes in the three-sector model. The tax payment that travels to the government treasuries from the households and businesses is a direct reduction/leakages in the circular flow of income and the total output. Such leakages or diversions reduce the consumption and savings of the households, as well as the investments and production for the businesses.

However, the government uses those leakages to buy goods and services from businesses and provide various welfare services to households. This expenditure equals the amount of taxes the government collects—such a flow of income and expenditure results in equilibrium in the economy.

We must note an important point at this stage. When the government purchases more than what it collects by way of taxes, it would lead to a budget deficit on the government’s end. This deficit will equal the difference between public expenditure and taxes. And, if the situation is reversed, i.e., where the purchases are less than the tax collections, it would result in a budget surplus.

Using Three Sector Model to Calculate GDP

We can also use the three-sector model to come up with the nation’s gross domestic product (GDP).

There are mainly two methods to calculate a nation’s GDP: the expenditure approach and the income approach. A point to note is that both approaches must give the same result due to the circular flow relation between production, income, and expenditure.

In the expenditure approach, we use the following formula to calculate the GDP:

GDP = C+I+G

“C” is the total spending of households on goods and services; “I” means investment from businesses, and “G” is the government purchases.

Under Income approach, GDP = wages + rents + interest + profits.

“Wages” means the payment to households from the government and businesses; households also get the “rent” for providing land to businesses and the government; households also get “interest” for the capital they invest in businesses; and “profit” means the earnings of the corporations.

Final Words

The Three-Sector Model is a good way to explain the flow of income and expenditure in an economy and is better than the two-sector model. However, it is still not a realistic one. Because it still ignores foreign trade. In the current world order, no nation can survive practically by closing its economy. Foreign trade has become an integral part of today’s commercial world. So we need to look for an improved model where foreign trade is also one part of the model.