One of the economic laws is that market prices result from the product’s demand and supply status. It means that supply and demand forces help to find the equilibrium market price. The equilibrium price is when the supplier is ready to sell and the consumer is prepared to pay. However, in some products, specifically for necessities, the government steps in to ensure the prices do not fall too low or rise too high. Thus, the government sets the Price Floor and Ceiling for that product.

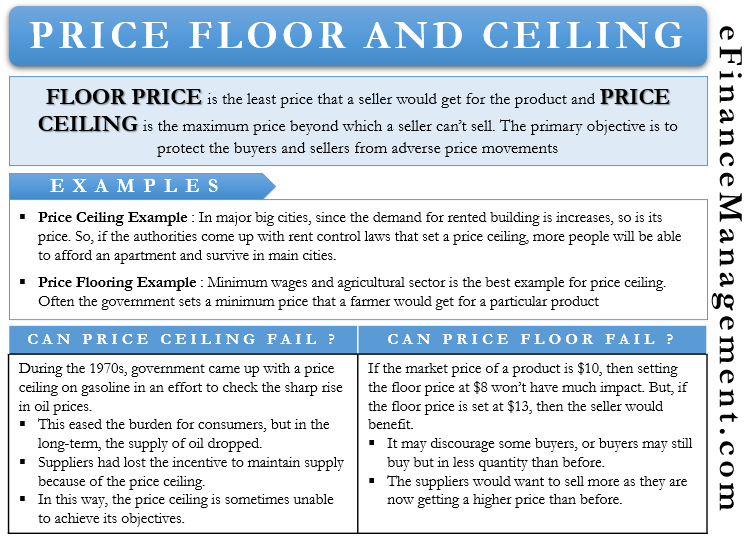

The floor price is the least price that a seller would get for the product. On the other hand, the price ceiling is the maximum price beyond which a seller can’t sell. The primary objective is to protect the buyers and sellers from adverse price movements.

A point to note is that a government may set both price floor and ceiling for a product. Or, it may set either price floor or ceiling.

For example, suppose the farmers produce massive quantities of corn due to good weather conditions. The law of demand says the price drops if there is more supply. To ensure farmers get a reasonable corn price, the government steps in and sets the corn’s floor price.

Price Floor

It is the minimum price that a seller would get for their product or service. Such pricing helps to protect suppliers from losses. The price floor is usually more than the equilibrium price.

However, there may be rare situations where the floor price or the bottom price fixed for the product could be lesser than the equilibrium price. This usually happens when there are high expectations that the price could drop in the future due to the large supply. In the case of a price floor, it is possible that the supply exceeds the demand, leading to surplus availability.

If the demand for an item is inelastic, then the floor value would benefit the supplier because inelasticity will not affect the levels of demand. And therefore, virtually, demand for the product will not drop, or the drop could be negligible. Thus, the price floor would boost the supplier’s profit. If the demand is elastic, a rise in price in the form of a floor price will lead to a drop in the demand. This, in turn, would reduce the supplier’s profit. So, the government must consider the product’s price elasticity when setting the floor price.

Price Ceiling

It is the highest price that is fixed or decided by the Government or Association, etc. A seller can not sell his product or service above this fixed price. Unlike floor price, the price ceiling helps to protect the buyers from overpaying. In case there is an equilibrium price, then the price ceiling is set below it. Like a price floor, a price ceiling can be set above the equilibrium price in some exceptional situations. This happens when there are expectations that the price may rise going ahead.

In the case of a price ceiling, the demand for a good or service is more than the supply, and thus, results in a shortage. If the demand for the product is inelastic, the price ceiling will lower the seller’s profit. This is because a lower price won’t much push the demand up. If the demand for the item is elastic, then the price ceiling could dramatically drive the demand. It would certainly increase revenue for the seller.

Price Floor and Ceiling – Example

One good example of a price ceiling is the rising rent of apartments in main cities. Since the demand is higher than what is available, the rent in these cities continues to rise. Such a rise in rent is also a key factor driving workers out of the city. So, if the authorities come up with rent control laws that set a price ceiling, more people will be able to afford an apartment and survive in the main cities.

The best examples for price floor are the minimum wage and the agricultural sector. Often the government sets a minimum price that a farmer would get for a particular product. This helps to stabilize the farmers’ income so that they are not discouraged from producing more.

Can Price Ceilings Fail?

With price controls, there is always a risk that it works in the opposite way. Also, it is possible that the price ceiling may help control prices in the short run, but it may fail to achieve the objectives in the long run. Because ultimately, market forces tend to influence prices.

For example, during the 1970s, the government came up with a price ceiling on gasoline in an effort to check the sharp rise in oil prices. This eased the burden on consumers, but the supply of oil dropped in the long term. After the analyses, it was found that the suppliers lost the incentive to maintain the supply because of the price ceiling.

Some of the unforeseen consequences in this case were:

- The drop in prices resulted in a shortage of supply. The authorities then had to come up with rationing schemes to boost the supply.

- Long queues were seen outside gasoline stations, resulting in loss of work and wages.

- This eventually was negative for the economy because there was lower employee productivity.

- For gas stations, it was a loss in revenue. To make up for the loss, the gas stations started charging for previously free services, such as windshield cleaning.

In this way, the price ceiling is sometimes unable to achieve its objectives.

Can Price Floor Fail?

To achieve the objective with the price floor, it is crucial that the price is set above the equilibrium price. For example, if the market price of a product is $10, then setting the floor price at $8 won’t have much impact. But, if the floor price is set at $13, then the seller would benefit.

There are, however, some side effects of a price floor:

- Since the floor price is more than the equilibrium price, it may discourage some buyers, or buyers may still buy but in less quantity than before.

- On the other hand, the suppliers would want to sell more as they are now getting a higher price than before.

This may lead to oversupply or surplus. In case of a surplus, the government has the following options:

- The government can buy the surplus using taxpayers’ money and store it for adverse times. If it doesn’t, it leads to a deadweight loss to society.

- The government can also control the production of that product so that there is no surplus. It can do so by encouraging farmers to produce another product.

- They can also encourage buyers to buy more by subsidizing their purchases or giving tax benefits.

- Or, the government leaves the seller to decide what they have to do with the surplus. The sellers who are able to sell all their stock gain, while those unable to sell incur a loss.

Final Words

In theory, both the price floor and ceiling look to be very efficient. However, if they do not get the government’s support, they may fail to give the best results in the long run. When price floor and ceiling lead to losses, we call it a deadweight loss. Such a loss occurs if the market is inefficient or the demand and supply are not at equilibrium. Or, we can say every time a price control measure moves the market away from the equilibrium, it may do long-term harm to the society and economy.