What is the Invisible Hand Theory?

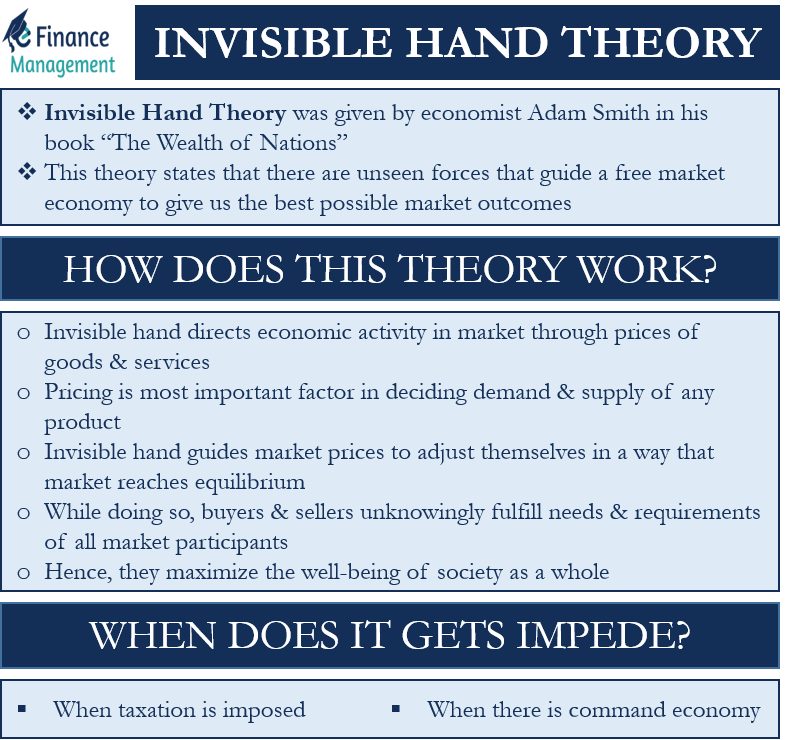

The “Invisible Hand Theory” was given by the 18th-century Scottish economist Adam Smith. He is also known as the Father of modern economics. He wrote the famous book “The Wealth of Nations” in the year 1776, in which he gave us this theory. The invisible hand theory states that there are unseen forces that guide a free market economy to give us the best possible market outcomes. According to Smith, self-interest guides each and every economic activity. No individual will make or provide a good or service out of love and affection for mankind. He will trade with another person only if he gets in return something which is valuable to him, something which he wants.

The unseen forces or the invisible hand come into action when individuals work towards fulfilling their self-interests. The theory states that in the process of promoting their own interest, individuals promote the public interest without intending to do so. This is because of the power of the invisible hand.

How does the “Invisible Hand Theory” Work?

The invisible hand directs the economic activity in a market through the prices of goods and services. Pricing is the most important factor in deciding the demand and supply of any product. It influences a buyer’s decision the most while deciding whether to buy a product or not. If the price of a product goes up in comparison to other available options of the product in the market, its demand will probably fall. The reverse is also true. If the price of a product goes down vis-à-vis its substitutes in the market, its demand will go up. This is the law of demand.

Now let us see the law of supply. The supply of a product increases with the increase in the prices of a product. Also, it falls with a fall in the price of that product. Therefore, market prices show the value of a good or service to any market or society. It reflects how much money society is willing to pay for a particular product. Similarly, the market prices show the cost of making the goods for society.

According to Adam Smith, the invisible hand guides the market prices to adjust themselves in a way that the market reaches equilibrium. It reaches the point where demand is equal to the supply at a given price point. The self-interest of all the market participants- the buyers, sellers, distributors, etc. is met. While doing so, the buyers and sellers unknowingly fulfill the needs and requirements of all the market participants. Hence, they maximize the well-being of society as a whole too.

When does the Invisible Hand get Impeded?

Let us now look at situations when we impede or restrict the power of the invisible hand. Governments sometimes restrict the free movement of prices in the market. The pricing no more depends upon the demand and supply of goods and services but is decided by the government.

Such a situation prevents the invisible hand from properly coordinating the market outcomes. The decisions of households on the demand side and firms on the supply side often fail to reach an equilibrium point.

Taxation

Taxation of any sort has an adverse effect on the allocation of resources from the supply side. When the government imposes high taxes on any product, the producers shift their resources to producing lower-taxed goods. Also, suppliers divert resources from regions that are highly taxed to those regions which have lesser taxes or provide tax breaks.

The invisible hand fails to coordinate the market outcomes in such a situation. Markets are not able to achieve the demand and supply equilibrium. Hence we cannot achieve efficiency in the markets.

Command Economy

A command economy is another example of a situation where governments impede the power of the invisible hand. The government dictates the prices in the markets in communist countries or command economies. However, the planners who are responsible for fixing the prices of goods and services do not have adequate knowledge about the tastes of the consumers on the demand side and the cost of the producers on the supply side.

The forces of demand and supply are never allowed to operate freely. The producers do not compete to provide the best quality products since they are assured of their supply price. The buyers also cannot maximize their self-interest. Hence, the invisible hand fails to use the price mechanism to bring the markets to equilibrium. Again, the markets fail to attain efficiency.

Summary

The “Invisible Hand Theory” supports capitalism and a free market economy. It does not support markets where the government or any other authority controls the pricing of goods and services. Instead, pricing should be left free to arrive itself at a point of equilibrium where the demand is equal to the supply. This results in a market where producers compete fiercely to provide the best quality goods so that they can sell more and maximize their self-interest. Buyers also compete in the market to get the products they want at the least possible cost to maximize their self-interest.

This will lead to an economy with higher productivity and efficiency and better quality goods and services. There will be no long-term shortages or over-supply. Hence, this will result in the overall welfare and well-being of society.

RELATED POSTS

- Theory of Demand – Meaning, Demand Curve, Exception, and Graph

- International Trade Theory – All You Need to Know

- Greater Fool Theory – Meaning, Examples, and More

- Free Market Economy – Meaning, Features, Advantages, and Limitations

- Agency Theory in Corporate Governance

- Principle 5: Trade can make everyone better off