A monopoly market is a market where there is just one seller of goods and services to the public. Such a market is the opposite of a perfectly competitive market, where a large number of sellers exist. In a pure monopoly market, the company has the power to limit the output, as well as change the prices to enjoy more profits.

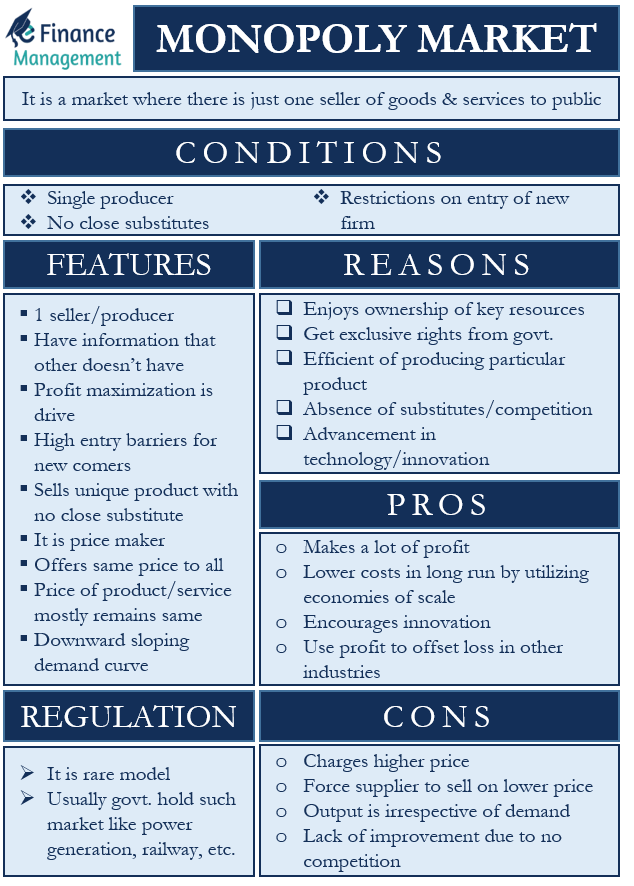

For a market to be tagged as a monopoly market, it needs to meet three essential conditions. Basically, these are the conditions that give a monopoly firm the power to retain its leadership. These conditions are:

- Single Producer – There must be a single seller or producer of a product or service in the market. The seller or producer could be an individual or a company.

- No Close Substitutes – The product that the company sells must not have any close substitutes. The monopoly firm will lose its power if similar products are available in the market.

- Restrictions on the Entry of New Firm – It should be difficult for a new firm to enter the market. If there are no entry barriers, then it will get easier for new firms to enter the market.

Features/ Characteristics of Monopoly Market

Following are the features/characteristics of the monopoly market:

- The market has only one seller or producer.

- The monopoly firm has information that is unavailable to others in the market.

- Profit maximization is also a characteristic of this market. A monopoly firm is guided by its need to maximize profit by raising prices or increasing sales.

- Such a market has high entry barriers for any new firm that makes or sells the same product or service. These barriers could be patents or copyright, etc.

- The product that is offered in the monopoly market is unique, and it doesn’t have close substitutes.

- The monopoly firm is the price maker. It means that the monopoly firm sets the price to maximize its profits.

- Such a firm doesn’t discriminate among customers. It means that the company charges the same prices to all buyers.

- This market minimizes the difference between a firm and industry. It is because the industry in which a monopoly firm operates has one seller, and there are no close substitutes available.

- The cross-elasticity of demand is zero in such a market. It means the price of the product or service largely remains the same.

- Such a market could lead to higher prices as the monopoly firm always strives to maximize profits. However, a monopoly firm can raise or reduce prices to attract customers.

- The demand curve in this market is downward sloping. It means that the firm could raise its revenue by increasing sales. The firm can increase sales by reducing the price of the product.

Reasons for the Existence of Monopoly Market

There are the primary reasons for the existence of such a market, or we can say these are the causes of the emergence of a monopoly market in brief.

- The monopoly company enjoys the ownership of the key resources. Debeers and Diamonds is a good example of this.

- A monopoly firm may get exclusive rights from the government to make a particular product—for example, the right to make a specific drug.

- A firm can also get a monopoly status if it is much more efficient at producing a particular product. American electric power and Columbia Gas are good examples of this.

- The absence of substitutes or competition also gives the firm a monopoly status.

- Sometimes an advancement in technology and innovation could result in monopolistic markets.

Sources of Monopoly Power

A monopolistic market enjoys its position due to the following sources of power:

Legal barriers, Economies of scale, Technological superiority, Control of natural resources, Network externalities, Deliberate actions, Capital requirements, and No close substitute.

Real-Life Examples

- ALCOA had control over the majority of the bauxite supply in the 1930s. Other companies were unable to compete because the cost of developing another track was more than the profits they would get.

- Usually, the government controls the railways in many countries. Govt. doesn’t allow private companies to run the railways to ensure fair transportation for all.

- Luxottica owns the majority of sunglasses brands. Or, we can say it produces over 80% of the eyewear globally.

- We can also call Microsoft a monopolist firm in the tech space because of the dominance of Windows.

- AB InBev owns more than 200 brands of beer, and hence, it enjoys monopoly status in the market.

- Google, because of its search engine technology, has left its competitors (Yahoo and Microsoft) way behind. Thus, it enjoys a monopoly status.

- In the 1980s, AT&T was the only supplier of telephone services in the U.S.

- Facebook, due to its acquisition of WhatsApp, Instagram, and other apps, enjoys monopoly status in the social media space.

Pros and Cons of Monopoly Market

Below are the pros of this type of market:

- A monopoly firm makes a lot of profit. So, it can use this money on research and development to come up with better products. This, in turn, would help the company to boost revenue.

- A monopoly firm can lower costs in the long run by utilizing economies of scale.

- Since monopoly firms have patents, copyrights, as well as the capital, they can invest heavily to come up with innovative products and features. This would benefit society as well. Google, for instance, is always working to improve its search engine, which benefits everyone.

- A firm can use its monopoly profit to offset the losses in other industries.

Following are the cons of this type of market:

- Since a monopoly firm is a sole supplier, it can charge higher prices from the customers. Also, it can raise the prices to increase its profit as there is no competition in this type of market.

- A monopoly firm can force suppliers to lower the prices of their products or services. For example, Walmart follows a similar practice, allowing it to sell products at lower prices to consumers.

- A monopoly firm usually tries to produce the output at which its cost is minimum. Or, we can say its output could be irrespective of the demand.

- Lack of competition may discourage a monopoly firm from improving its products. Thus, it may not take up research and development as well.

Impact of Monopoly Market

A monopolistic market has a significant and wide-reaching economical, political and social impact. These are:

- Consumers get no other alternative, and thus, the monopoly firm may charge a higher price for its product.

- The monopoly firm controls the price and supply of a product or service.

- Neoclassical economists believe a monopolistic market is bad because it could limit production to maximize profits. This, in turn, could reduce the overall real social income.

Regulating Monopolistic Market

In the real world, a monopolistic market model is very rare. Usually, the government grants monopolies in the area of public utility, such as power generation, natural gas supply, and more. Even with such utilities, the government prevents utility companies from charging excessive prices.

Also Read: Causes of Emergence of Monopoly Market

It is also possible that the government puts checks in place to ensure the companies maintain their product or service quality. Or, we can say the government works to ensure the firm adheres to minimum service standard requirements.

There are a few more ways by which a government can regulate a monopolistic market. These are: regulating mergers and acquisitions, antitrust laws, limiting an increase in price, and more.

Final Words

Though monopoly markets are common in the capitalist structure, the government does keep a check on them to ensure the benefit of the buyers. For this, the government Comes up with antitrust laws to prevent the rights of consumers. Along with this, moral policing also discourages monopoly firms from exploiting the buyers to maximize their profits.