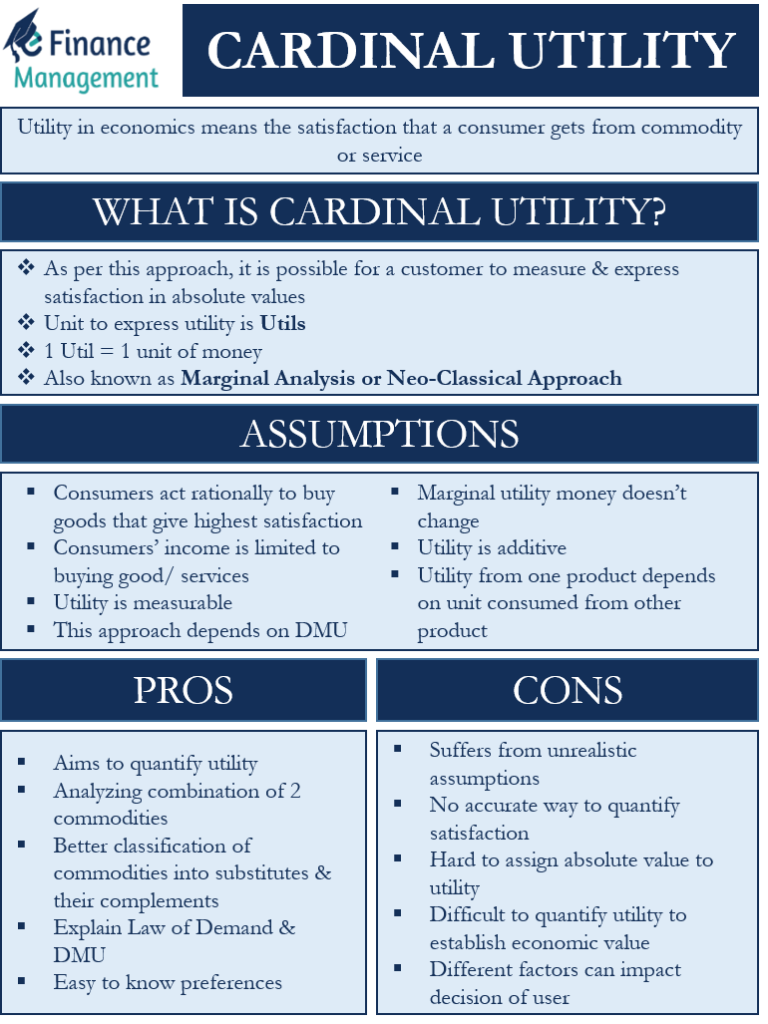

Utility in economics means the satisfaction that a consumer gets from a commodity or service. There are economists who believe that we can’t measure the utility; instead, we can just rank them. We call this approach Ordinal Utility. On the other hand, some economists believe that it is possible to measure utility in absolute terms. And we call this approach Cardinal Utility. In this article, we will be discussing the Cardinal Utility approach.

What is Cardinal Utility?

Neo-classical economists are the proponents of the Cardinal Utility approach. As per this approach, it is possible for a customer to measure and express satisfaction in absolute values. Thus, neo-classical economists have come up with a unit to express utility, and it is “Utils.”

For example, a consumer can say that he got 7 utils from consuming the first unit, 6 utils from the second, and so on.

Usually, one ‘Util’ usually equals one dollar. This is because many economists were of the opinion that the amount of money that a consumer is ready to pay for a good is a good measure of the utility that they get from the good.

Neo-classical economists argue that the utility that a consumer gets from one good is independent of the consumption of other goods. Another name for the Cardinal Utility approach is marginal analysis or neo-classical approach.

Also Read: Ordinal Utility – Meaning and Assumptions

Assumptions of Cardinal Utility Approach

Following are the assumptions of the cardinal utility approach:

- Consumers act rationally to buy the goods that give the maximum and highest satisfaction. It means they will first buy the commodities that give them the highest satisfaction and then the product that gives them the second highest utility, and so on.

- Consumers’ income is limited to buying goods and services. And this is why they first purchase the product that gives them the highest satisfaction.

- The utility is measurable. And one unit of utility equals one unit of money. Or, we can say that 1 Util = 1 unit of money.

- With the increase in consumption, the utility or satisfaction from each additional unit will go down. Or, we can say that the cardinal utility approach depends on the Diminishing Marginal Utility.

- The marginal utility (MU) of the money doesn’t change, irrespective of the change in the income level of the consumer.

- The utility is additive. It means that the utility that a consumer gets after consuming different commodities can be added to get the total utility. For instance, if a user receives 7 utils after consuming the first unit, 6 after the second unit, and 5 after the third, then the total utility (TU) after consuming the three units is 18 utils (7+6+5).

- The utility that a consumer gets from consuming one product is independent of the number of units that a consumer consumes of other products.

Advantages of Cardinal Utility

These are the advantages of the Cardinal Utility approach:

- It aims to quantify utility with the use of cardinal numbers or weights. This, in turn, tells the value a commodity holds for a consumer.

- It helps in analyzing the combination of two commodities.

- This approach assists in better classification of commodities into substitutes and their complements.

- This approach helps to explain the Law of Demand, as well as the Law of Diminishing Marginal Utility.

- It makes it easier to know if a user prefers one product to another.

Disadvantages of Cardinal Utility

These are the disadvantages:

- Like any other concept, this approach also suffers from unrealistic assumptions.

- In reality, there is no accurate way to quantify the satisfaction that a consumer can get.

- It may get hard to assign an absolute value to the utility.

- It may be difficult to quantify the utility to establish its economic value.

- Different factors can impact the decision of a user when assigning a value to the utility.

Final Words

Cardinal Utility is a useful approach to get an idea of the importance that a product holds for a user. Like with most other economic approaches, this approach also depends on many assumptions. And many of these assumptions may not always hold. This approach is widely used in explaining consumer behavior despite the assumptions and drawbacks.

RELATED POSTS

- Law of Equi Marginal Utility – Meaning, Assumptions, and Importance

- Indifference Curve – Meaning, Features, Example, and Graph

- Marginal Utility – Meaning, Importance, Factors, Types, and Graph

- Why Must Marginal Utility be Equal to Price?

- Types of Utility – Form, Time, Place, Possession, and Other Utilities

- Consumer Equilibrium – Meaning, Example, and Graph