The cost of the debt calculator determines the cost incurred by the company for raising funds through debt. Debt can be redeemable and irredeemable, and it can be issued at par, premium, or discount. And the interest payment paid/payable by the company along with any discount offered on the issue or any premium to be paid on redemption of such debt is the cost of debt for the company. The cost of debt is denoted by kd.

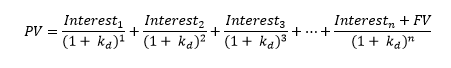

The formula for calculating the cost of debt is as follows:

Where PV = Price at which such debt is issued

Interest = Interest amount payable

n = Number of years for which such debt is issued

and FV = Par value of such debt

Cost of Debt Calculator

How to Calculate using a Calculator?

The user simply has to provide the following data to the calculator.

Period of Interest Payment – Enter the periodicity or interval of offering interest. For example, a company may provide interest monthly or quarterly, or annually.

Price of Debt – Enter the amount at which the company issues debt. It may issue such debt on discount or premium or at par too.

Face Value of Debt – Enter the face value of such debt.

Number of Years to Maturity – The period for which the debt has been issued.

Interest Rate – Enter the rate of interest offered on such debt.