Sources of finance for small businesses can be broadly categorized into equity or debt financing. Equity financing means offering an ownership interest in the company against finance. Debt financing means borrowings – companies owe money and pay interest on those borrowings.

Financing – Investor’s Perspective for Small Businesses

If we look at the investor perspective, research suggests that small businesses fail at a higher rate than big businesses. Thus default risk is also high. This is the reason that small businesses have less access to credit than larger companies because lending to a small business is riskier and more expensive than lending to larger companies. Additionally, evaluating small companies is difficult and not very cost-effective as their data is not as easily accessible as large companies.

Despite all the hurdles, there are many financing options available to small companies. Let’s look at some of the sources of finance for small businesses and deal with the problem of ‘How to Finance a Small Business?’.

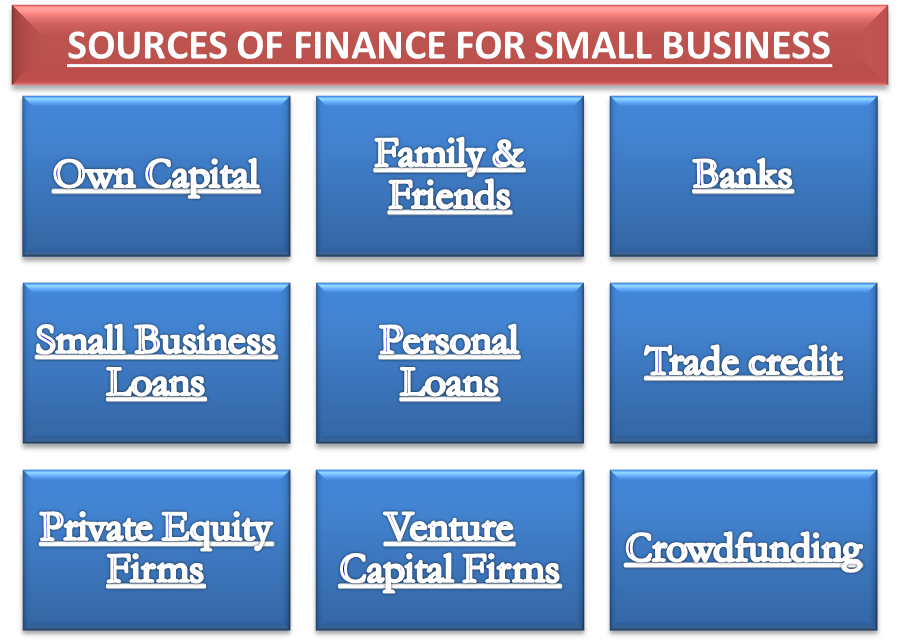

Sources of Finance for Small Businesses

Following are some of the financing methods that small businesses can use:

Own Capital / Savings

Number one & the easiest source of finance for small businesses is one’s own savings. At any stage of business, when a business needs capital, an entrepreneur can tap into his personal assets such as – stocks, mutual funds, real estate, or jewelry – to raise money. He can either sell the assets to raise money or take a loan on any assets. Entrepreneurs can invest such personal capital in their business as equity capital, or they can give loans to their own company.

Family & Friends

Parents, siblings, extended relatives & friends who have excess cash to lend can be a go to option who may be willing to finance your business. They may lend the money to the business in the form of a loan or may be willing to take an equity stake in the company.

Banks

Banks have a special department dedicated to providing loans to small companies. To get a loan from a bank, companies have to qualify for the bank’s minimum criteria. Every bank has its own criteria regarding earning potential, annual turnover, credit scores, etc. Banks offer many types of loans, such as working capital loans, term loans, loans against property, etc. Businesses can choose the type of loans as per their requirement.

Small Business Loans

These are also known as SBA loans. Each country has certain banks or institutions dedicated to providing loans to budding businesses and upcoming entrepreneurs. An example of such an institute in India is SIDBI; in the USA, there is SBA (Small Business Administration). SBA is a United States government agency that has undertaken the task to support the growth of a self-sufficient economy in the United States. The main target of these institutions is to lend money to small businesses that have not been able to obtain financing on reasonable terms through normal lending channels. The SBA plays the role of the guarantor in securing loan amounts up to $150,000 by 85% and by 75% in excess of $150,000. A federal agency is present as a guarantor in this situation. This encourages the banks to participate and extend credit.

The main advantage of SBA loan is that it is designed to accommodate lower down payments and longer repayment terms. While the disadvantage of SBA loan is that the process of obtaining SBA finance is more arduous than conventional finance.

Also Read: Sources of Loan

Personal Loans

If a company is unable to get a business loan, the entrepreneur might consider getting a personal loan & using it in their business. The entrepreneur must have a good credit history for raising a personal loan. One can get a personal loan by mortgaging home, jewelry, etc.

Trade Credit

Some small businesses might have suppliers willing to sell on credit. Such credit may range anywhere from one month to three months. Thus, trade credit is a very good method for small companies to fulfill short-term funding needs. This is an inexpensive method of finance for any small business.

Private Equity Firms

Private equity is a type of equity capital not listed on any stock exchange. These firms raise funds from investors. It then invests these funds to buy capital of promising startups & small businesses. The drawback of such finance is that the private equity firms will acquire a controlling position or substantial minority position in a company and then look to maximize the value of their investment. Thus, the entrepreneur might not have sole control over the business decisions, which may lead to conflict.

Venture Capital Firms

Venture capital firms are a type of private equity firm, but venture capitalists provide funds to only companies in the early stages of their business cycles. These are emerging small companies with high growth potential. Venture capital firms invest in emerging companies in exchange for equity or an ownership stake. Small start-up firms may receive a series of rounds of financing from venture capital firms.

Crowdfunding

Crowdfunding is a relatively new method when we consider sources of finance. It is a method of raising funds by borrowing a small amount of money from a large group of people. A typical example of crowdfunding is proposing people invest US$ 10, and even if 1000 people invest, the company can raise US$ 10,000. Such financing is usually done for a particular project. The benefit of crowdfunding is that small companies can make flexible proposals as per their requirement. They can offer equity against the money or take the money on a loan; they can provide simple interest payments against compound interest like most regular loans.

Crowdfunding gained popularity after the rise of social media because it became easier to reach a number of people by putting minimum effort.

Microloans

This is a type of business loan extended in very small amounts to new businesses or not-for-profit organizations. These businesses particularly operate in third-world countries. Upcoming businesses in smaller economies are not able to provide an attractive credit score, collateral, and fancy future projections. Thus microloans or micro-credit come into the picture where finance is provided by a pool of individuals or community-based lenders rather than banks. The loan is for minuscule amounts not exceeding $50,000. The goal is to cover the flotation and incorporation expenses of budding ventures in underprivileged countries.

- Advantage of Microloans: Micro-lenders often act as mentors and provide valuable technological and intellectual know-how to borrowers. This serves as a boon to business owners who work in challenging environments.

- Disadvantage of Microloan: Microloans entail inflated interest rates. Though the rates are lower than on credit cards, they are still higher than traditional borrowing options. The rationale for this may lie in the fact that since this is an unsecured form of loan, the lenders seek to compensate themselves via an increased interest rate.

Also, read about the Swingline loan. Such loans help in repaying existing loan obligations.

What I don’t understand is actually how you’re not really much more smartly-liked than you may be now. You’re very intelligent. You realize thus considerably in relation to this subject, produced me personally consider it from so many numerous angles. It’s like women and men aren’t fascinated unless it is something to accomplish with Lady gaga! Your personal stuff excellent. All the time deal with it up!

thanks for your lecture mr sanjay

Thank for providing material

please sir, are you voluntary to share information related to source of finance for small business

Thank you for cooperation

(Bahir Dar University MBA regular second year)