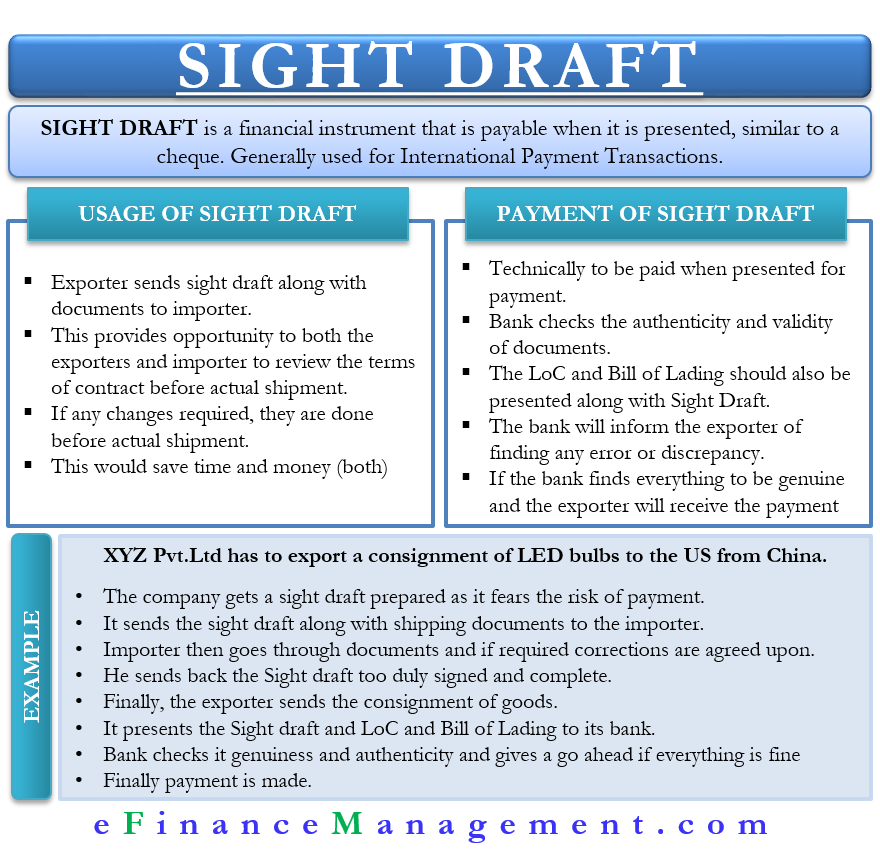

Meaning of Sight Draft

Sight Draft is a financial instrument that is payable when it is presented, similar to a cheque. It is the most preferred form of payment in international trade. The exporter may not know the importer and his credentials in most cases during international trade. Hence, he would not like to bear the credit risk. Sight drafts are very useful in facilitating overseas trade. The exporter would retain full ownership rights and title to the goods until the full realization of the payment.

Usage of Sight Draft

An exporter generally sends a sight draft along with other documents pertaining to the consignment to the importer. The exporter would like to be utterly sure about rates and quantity, shipping instructions, documents for customs clearances, etc. Hence, the exporter prepares all the above documents and sends the sight draft along with those documents to the importer. This would provide an opportunity for both parties to review the terms and conditions of their contract. If there is any difference in any of the above clauses, the importer can immediately raise an objection, and those documents could be modified accordingly. Hence, reconciliations are possible before the actual shipment of goods. If such a situation arises, it can be time and money-saving for both the exporter and the importer. Otherwise, bringing back the products once shipped from another country can be a very tedious and expensive affair.

Payment of Sight Draft

Technically, a sight draft should be paid when presented for payment. But it is usually not the case. The bank with whom the sight draft is presented may take a few working days to check the authenticity and validity of all the documents presented along with the sight draft. The letter of credit and bill of lading have to be presented along with the sight draft. The bank has to ensure that an actual transaction has taken place and the seller has shipped the goods as per the terms and conditions agreed upon. The bank will only check if the exporter has actually shipped the consignment or not. It cannot be held liable for what has been shipped in the consignment, as it has no way of knowing that.

The bank will inform the exporter of finding any error or discrepancy. After the clearance of the issue, payment will be processed. If the bank finds everything genuine, the exporter will receive the payment within 2-3 working days.

Also Read: Time Draft

Example

XYZ Pvt.Ltd has to export a consignment of LED bulbs to the US from China. There is credit risk as it has never traded with the importer earlier. Hence it does not want to give up its title to the goods until it receives full and final payment of the consignment.

The company gets a sight draft prepared. It sends it to the importer along with the contract papers, the actual quantity and rate of the items to be sent, and documents pertaining to shipping and customs formalities. After receiving these, the importer carefully goes through the details of every document. On finding everything as per order and prior discussion, he gives the go-ahead regarding the same. He sends back the Sight draft too duly signed and complete.

The exporter then ships the entire consignment as per the terms agreed on. It presents the Sight draft along with the Letter of credit, and Bill of Lading, and other documents to its bank. The bank ensures that the documents submitted are authentic and genuine. Once the bank finds everything in order, it releases the payment to the exporter. The importer subsequently receives the documents from the bank and then takes delivery of the consignment after it reaches the port.

Summary

Sight drafts act as an assurance of the payment provided to the exporter. Ownership and title to the goods will pass on to the importer after making the payment only. The importer also gets a chance to assess the terms and conditions of the trade deal before making the final payment to the exporter. Hence it is an essential document in international trade and useful to both the parties to the contract.