Overdraft Limit – Meaning

Overdraft is a credit extension from a bank to its checking account holders. The credit is extended in case the checking account balance becomes zero. The credit is extended up to a certain limit; this limit is known as the overdraft limit or overdraft protection.

In general terms, your check will not bounce in case of no balance in your checking account if you have an overdraft on your checking account, but only up to the overdraft limit. Let’s understand this better. Suppose a company has a checking account balance of USD 10,000.00 and an overdraft limit of USD 5,000.00. So it can make payments of up to USD 15,000.00 without any difficulty. After its usage of the overdraft limit of USD 15,000.00, it cannot withdraw any additional money, and a request for any additional withdrawal will bounce.

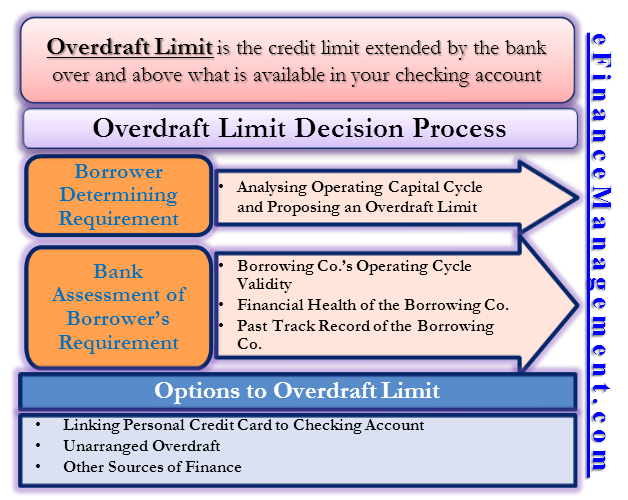

Overdraft Limit Decision Process

Companies usually avail of overdraft protection to fund their operating cycles. The operating cycle is described as a time gap between investment and realization of funds used in a company’s regular operations. The overdraft limit decision process is a two-step process as follows:

Borrower Determining Overdraft Limit Requirement

First and foremost, the borrowing company needs to decide how much overdraft limit it requires. To determine its overdraft limit requirement, the borrower must do an in-depth analysis of its operating cycle. Once the limit requirement is determined, the borrower should propose this amount to the bank as a request for an overdraft limit. Let’s understand with an example –

Also Read: How does an Overdraft Facility Work?

Following is the projected transaction statement of Max International for the year 2018–

| Date (DD/MM/YYYY) | Transaction | Income & Expenses (In USD) | Balance in Checking Account (In USD) |

| Opening Cash Balance | 10,000.00 | ||

| 01/01/2018 | Placing an order for raw material of USD 10,000.00 and paying 50% advance | (5,000.00) | 5,000.00 |

| 01/02/2018 | Wages, Electricity, Miscellaneous monthly expenses for January 2018 | (1,000.00) | 4,000.00 |

| 01/03/2018 | Wages, Electricity, Miscellaneous monthly expenses for February 2018 | (1,000.00) | 3,000.00 |

| 01/04/2018 | Receiving raw materials and paying the remaining 50% | (5,000.00) | -2000.00 |

| 01/04/2018 | Wages, Electricity, Miscellaneous monthly expenses for March 2018 | (1,000.00) | -3000.00 |

| 20/04/2018 | Completion of Production Process | 0 | |

| 30/04/2018 | Packing, transportation, and delivery of goods to the customer’s warehouse | (500.00) | -3500.00 |

| 01/05/2018 | Wages, Electricity, Miscellaneous monthly expenses for April 2018 | (1,000.00) | -4500.00 |

| 01/06/2018 | Receiving payment from the customer | 15000.00 | 10,500.00 |

Following are the observations from Max International’s transaction statement –

- The complete operating cycle of Max International is from 1st January 2018 to 1st June 2018, i.e., 150 days.

- Max International needs additional cash over and above what is available in its checking account during its operating cycle.

- Max International’s checking account is overdrawn from 1st April 2018 to 1st June 2018, and the maximum additional cash requirement is USD 4500.00.

In conclusion, we can say that it would be feasible for Max International to apply for an overdraft limit of USD 4500.00 to its bank.

Bank Assessment of Borrower’s Overdraft Limit Requirement

In the next step, the bank will assess the borrower’s proposal to determine whether the overdraft facility should be granted and, if so, what shall be the overdraft limit. To determine the overdraft limit, the following factors are considered by the bank –

Borrowing Company’s Operating Cycle Validity

The banks are in the business of lending, and they want to make sure that the money they lend is returned with interest. So when considering an overdraft limit, the bank will look into the validity of operating cycle projections that the borrower has shown for the proposed overdraft limit. This way, the bank can determine if the money will flow as per the borrower’s projection and if he can repay the borrowed overdraft.

Financial Health of the Borrowing Company

The banks assess the financial health of the borrowing company to determine an overdraft limit. It considers ratios that help to know the company’s efficiency, such as the average number of days receivables outstanding, the average number of days payables outstanding, inventory turnover ratio, etc. It also considers the current and quick ratios to determine the borrowing company’s short-term solvency. This helps the bank understand whether the borrowing company is capable of repaying the overdraft limit that it is asking for. Sometimes there are companies that are extremely profitable, but their working capital cycles are inefficient and overstretched. In such cases, banks might reconsider the proposed overdraft limit.

Also Read: Overdraft Vs. Loan

Past Track Record of the Borrowing Company

The banks also look into the borrowing company’s past track record. This includes its credit scores and past transaction history with the bank. A borrower who has a checking account with its bank for the past 10 years and is efficient and timely in all its transactions with the bank has a high chance of getting the overdraft limit it has asked for. On the other hand, a borrower who has missed multiple payments to the bank in the past and has a low credit score might not get an overdraft limit at all.

This brings us to the conclusion that overdraft limits are tailor-made for each applicant.

Options to Overdraft Limit

If the borrowing company is unable to get the desired overdraft limit, then it has the following options –

Linking Personal Credit Card to Checking Account

Sometimes the borrower who doesn’t get the desired overdraft limit on his checking account will link his personal credit card to the checking account. In this case, his credit card limit will become his overdraft limit. This means that a credit card limit of USD 2000.00 becomes an overdraft limit of USD 2000.00. He must manage all his personal and business transactions within this limit.

Unarranged Overdraft

There are two types of overdrafts – arranged and unarranged. The one we referred to until now is an arranged overdraft. An unarranged overdraft occurs when the checking account holder withdraws more money than the available balance without a prior overdraft arrangement. Most banks provide this facility. An unarranged overdraft is more expensive than an arranged overdraft.

Still, it must be noted that an arranged overdraft in itself is expensive as it carries various types of fees and interest. Before applying for any arranged overdraft limit, a proper cost-benefit analysis should be done.

For example, ABC Ltd. finds out from its projections that it will be overdrawn up to USD 500.00 for 2 days in the year 2018. Following are its bank charges –

| Types of transactions | Unarranged Overdraft | Cost of unarranged overdraft to ABC Ltd. | Arranged Overdraft | Cost of arranged overdraft to ABC Ltd. |

| Fees to set up the facility | NIL | – | USD 50.00 | USD 50.00 |

| Per day usage fees | USD 8.00 | 8.00 X 2 = USD 16.00 | NIL | – |

| Interest | 15% | USD 500.00 X 0.15/365 = USD 0.20 | 12% | USD 500.00 X 0.12/365 = USD 0.16 |

| TOTAL USAGE CHARGE FOR THE YEAR 2018 | 16.00 + 0.20 = USD 16.20 | 50.00 + 0.16 = USD 50.16 |

Here we can observe that ABC Ltd. is spending less on unarranged overdraft even though unarranged overdraft carries a higher interest rate and a per-day usage fee that arranged overdraft doesn’t charge. This is because the cost of setting up a facility is not giving any benefit to the company. In such a scenario, ABC Ltd. is better off without an overdraft limit and should use the unarranged overdraft facility.

Other Sources of Finance

Suppose, despite not getting access to an overdraft facility, the company needs to fund its operating cycle. In that case, it can always look into other sources of finance such as advances from customers, extended credit periods from vendors, short-term borrowings from friends, etc.

I regularly read your articles on financial management. And it is really very interesting to read them and i get a lot of knowledge about new terms etc.

How to measure the overdraft facility used for the intended purpose?