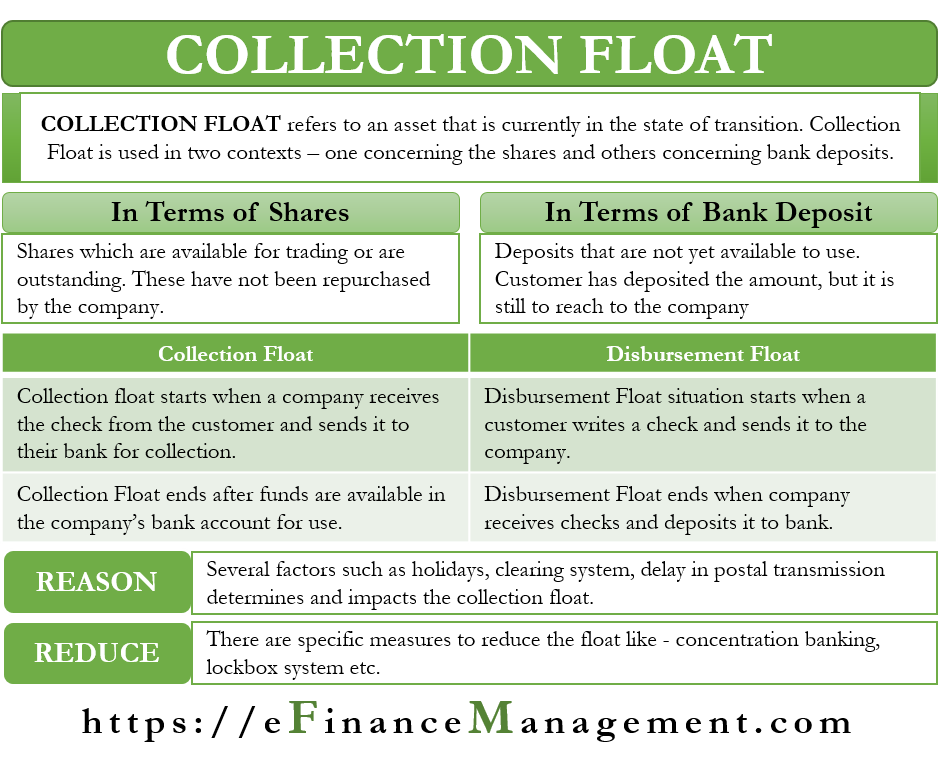

In the financial world, the term Collection Float is used in two contexts – one concerning the shares and others concerning bank deposits. But, in both cases, the term refers to an asset that is currently in a state of transition. Also, in both cases, the term refers to a temporary situation.

Collection Float – Shares

When talking about shares, the term refers to the stocks that are available for trading or are outstanding. Or, we can say these relate to the shares that have not been repurchased by the issuing company. Often we may just call it a float.

Collection Float – Bank Deposits

When it comes to bank deposits, the term refers to the deposit that is not yet available to use. Or the amount that a customer deposit but is still to reach to the company. The collection float is generally about using a check, and we may also call it a bank collection float. It is the amount of all such checks in transition.

It also includes the checks that a company receives but is yet to deposit it. Or, the company has deposited the check but yet to be credited into the company’s account.

Also Read: Floating Charge

For example, Company A deposits a check of $500 into the account of Company B from an out-of-state bank. The fund may show in the bank account of Company B immediately. But, Company B won’t be able to use it until the issuing bank honors the payment and transfer the funds to Company A’s bank. Such a process can take about two to five days.

Collection Float vs Disbursement Float

Collection float starts when a company receives the check from the customer and sends it to their bank for collection. During this time, the company raises the book value of its bank account in its books by the amount of the check.

Disbursement Float, on the other hand, starts when a customer writes a check and sends it to the company. In such a case, though the customer’s bank account balance doesn’t drop, the book value of their bank account goes down. It is because the customer will reduce their bank balance in their books.

In simple words, we can say that the disbursement float represents the amount of all checks issued but not yet cleared. The disbursement float ends after a company receives the check, deposits it in the bank, and the company’s bank request the fund from the customer’s bank. The collection float ends after the funds are available in the company’s account for use.

Also Read: Floating Lien – Meaning, Importance and More

There is also net float. It is the difference between the disbursement and collection float. It helps to reconcile the company’s bank account balance with the book value of that account.

Reasons and How to Reduce it?

Several factors determine the float period, such as any holiday in between, the clearing system, any delay in postal transmission, and others. A company must make efforts to minimize the float period. It would ensure that companies get the funds quicker.

There are specific measures that a company can use to reduce the collection float time. These measures include techniques such as concentration banking, a lockbox banking system, and more.

Under Concentration Banking, a company opens bank accounts in different cities so that customers can deposit the payment directly. In a lockbox system, companies ask customers to deposit their checks in special post office boxes or ‘lockboxes.’ The company’s local bank then collects those checks and credits them to the company’s bank account.