A bank overdraft is a facility extended by a bank to its clients to withdraw funds from their accounts in excess of the balance. The bank provides this facility for interest. This interest is charged for the length of time for which the excess amount is withdrawn. It is important to know the advantages and disadvantages of the bank overdraft facility in order to use it effectively.

An overdraft facility allows the facility holder to withdraw money from the account despite having no balance. There is a limit on the amount that can be overdrawn from the account. The overdraft limit is usually set by the bank on the basis of the amount of working capital, the creditworthiness of the borrower, etc.

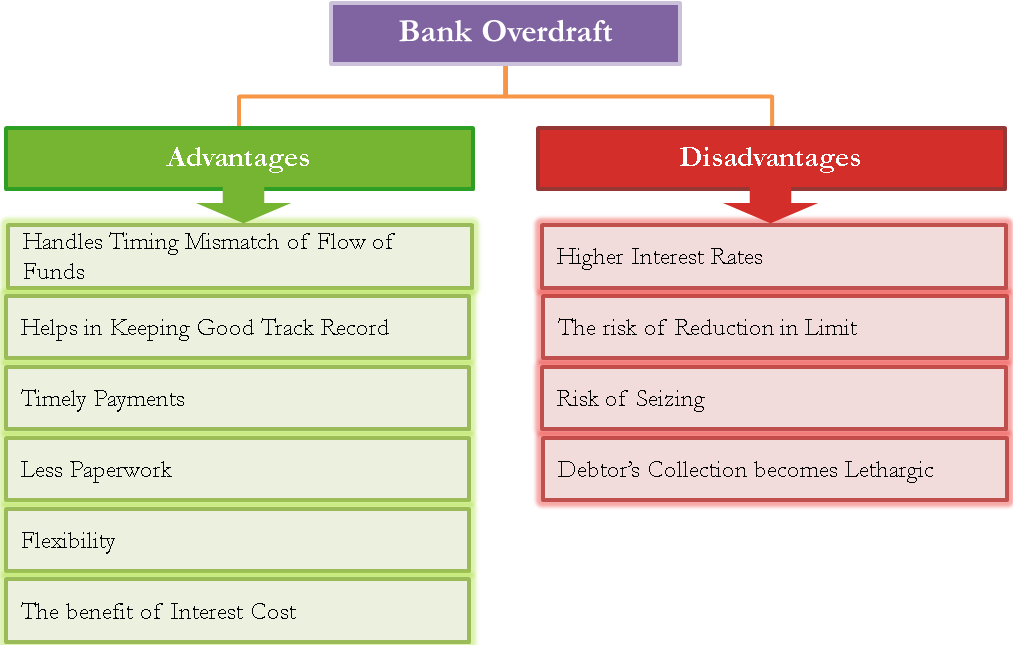

Advantages of Bank Overdraft

The following are the advantages of bank overdraft:

Handles Timing Mismatch of Flow of Funds

A bank overdraft is usually the best for businesses with greater cash flow movement in a given time frame. It can be used to handle timing mismatches of cash flow because they provide a short-term source of funding when an account holder’s balance falls below zero. In other words, if sales proceeds and purchase payments result in a flow of money in and out many times during a week/month, an overdraft facility allows for managing cash flow gaps that might arise due to timing mismatch.

Helps in Keeping a Good Track Record

If a check was made by assuming that some amount will be received in the future, and if it is delayed, the check does not bounce due to the inadequacy of funds. Essentially, an overdraft allows the account holder to borrow money from the bank to cover their expenses until they receive additional funds and, hence allows for better payment history.

Also Read: Overdraft Vs. Loan

Less Paperwork

Unlike other types of financing options, such as loans, overdrafts typically require less paperwork to apply for and access. This is because overdrafts are attached to a borrower’s existing bank account and can be accessed through checks or debit cards, without the need for a separate loan application. This makes overdrafts a more convenient and faster option for borrowers who need access to funds quickly. For more information on the differences between overdrafts and loans, you can check out this article: “Overdraft vs. Loan“

Flexible Repayment

One of the primary advantages of an overdraft facility is that it provides flexibility in repayment. The borrower can repay the overdraft amount as and when they have the funds available, without incurring any prepayment penalty.

Convenience

Overdraft facility has the advantage of convenience as these are attached to the borrower’s bank account and hence one may access it at any time.

Benefits of Less Interest Cost

Another advantage of an overdraft facility over a loan is that in the case of an overdraft, the interest is calculated only on the amount withdrawn and used and not the whole overdraft limit. This allows for greater savings in the interest cost than a normal loan taken for a fixed time period. While in other loans, interest is required to be paid even if the money remains unused. In this case, the charging of interest starts with the amount overdrawn, and it stops instantly when it is paid off.

Also Read: Bank Overdraft Facility

Timely Payments

It also ensures timely payments and avoidance of late payment penalties. Because payments can be made even if there is a lack of sufficient balance in the account.

Disadvantages of Bank Overdraft

The following are the drawbacks of a bank overdraft facility:

Higher Interest Rates

Overdraft facility comes at a cost. Even if the interest is charged on the amount used and not the whole overdraft limit, the interest cost is usually higher than the other sources of borrowing.

Risk of Reduction in Limit

An overdraft facility is a temporary loan and undergoes regular revisits by the bank. Hence, it runs a risk of a decrease in the limit or withdrawal of the limit. Reduction in the withdrawal of limit may usually happen when the company’s financials represent poor performance. Hence, the facility may be withdrawn, especially when the company requires it the most.

Risk of Seizing

Bank overdraft facility may at times be secured against inventory or other collaterals like shares, life insurance policies, etc. The company may run a risk of those assets being seized if it fails to meet payments.

Debtor’s Collection Becomes Lethargic

At times, the availability of an overdraft facility may make the company less strict on collecting debtors’ payments. In other words, a company may not be too much on its feet to collect payments from debtors, as an overdraft facility can manage immediate payment outflows.

Conclusion

Overdraft is a temporary facility the companies obtain to meet their ultra-short-term cash shortage/requirement. One must bear in mind that such a facility comes with a high cost and should be used as stop-gap management of funds or as an emergency activity rather than a routine funding activity. Higher dependence on overdrafts for working capital financing indicates poor working capital management and a liquidity constraint the company faces. Only temporary working capital should be financed by bank overdraft. The permanent working capital should be financed by long-term financing.

Also, read the Difference between overdraft and cash credit for better clarity.

thanks ,this was very useful.iam going to keep on using your blog for my researches.thanks very much

i agree it helped me a lot

so profound… thanks will keep on using your blog

I found this very useful

same

very educative, i like your blog

Thanks .

thx very help

me too

I conceive you have mentioned some very interesting details, appreciate it for the post.

very nice post, i actually like this website, carry on it

Very very useful and easy to understand.

Thanks, I know understand better what an overdraft is

Was really helpful

Great article. Thanks for the detailed information. Your blog is by far the best source I’ve found.

Thanks for sharing this article about Bank Overdraft. This is very useful for me because it gives me more knowledge about Bank Overdraft. I’ll definitely return to this site.

Thanks for sharing this article about bank overdraft