Borrowing and lending have become common in businesses in recent years, and bank loans are an essential part of this system. Various types of bank loans are available to meet individual and business financial needs. As with any other product, there are advantages and disadvantages of bank loans. Let’s have a closer look:

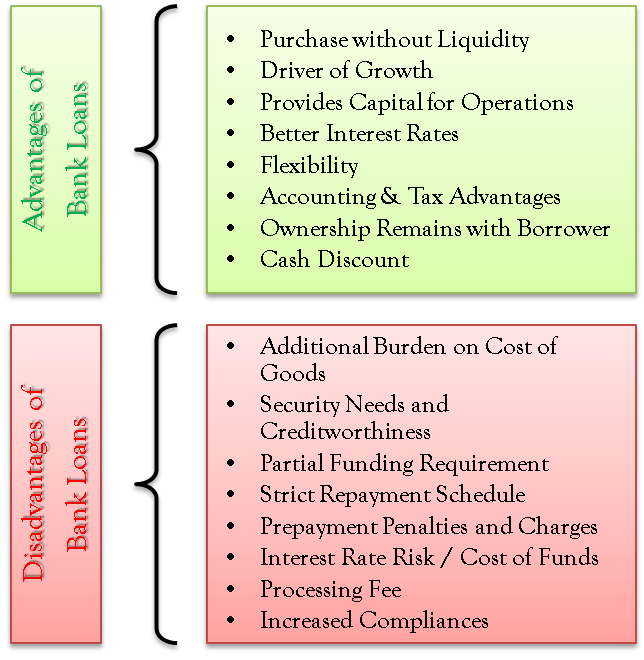

Advantages of Bank Loans

Following are some advantages of banks loans.

Purchase without Liquidity

A major goal of a bank loan is to lend to people who do not have ready cash. A bank loan can help an individual or a business buy something as simple as a car or a home for which he doesn’t have a corpus, or it can help businesses buy machinery or set up big units for which it doesn’t have money. The scope of a bank loan is vast, and the borrower can borrow as per their capacity depending on their creditworthiness.

Driver of Growth

Bank loans are major drivers of growth, especially for public and private sector companies. Very few companies may have enough cash flow to finance huge expansion. However, in today’s fast-track economy, expansion is the only way to have sustainable profitability. This is where bank loans come into the picture. Suppose Company A wants to expand its production, for which it needs to invest in machinery. If the cost of machinery is 5 times the company’s yearly net income, Company A does not have to wait for 5 years to expand. It can borrow a term loan from the bank to fund its expansion plans and repay it over the next 5 years, thereby accelerating growth.

Provides Capital for Daily Operations

The banks have special loans that can help a company fund its day-to-day operational capital and cash cycle. The working capital bank loans and cash credit loans are major bank loans that are used for the purpose. This allows companies to be flexible about their debtor and creditor agreement. Suppose Company X has purchased goods worth USD 1000.00, the payment of which has to be made in 10 days, whereas it sells these goods in USD 1200.00, which it will receive in 30 days. In such a situation, Company X can borrow USD 1000.00 from the bank for 20 days and repay the USD 1000.00 to the bank after receiving the payment of USD 1200.00 from the debtor. A major advantage of such a loan is that the company has to pay interest only for the amount and the number of days for which it has borrowed.

Also Read: Advantages and Disadvantages of Banks

Better Interest Rates

Before a century, the borrower would borrow money from unorganized money lenders. The money lenders would usually exploit the borrowers by asking for exorbitant interest rates and abnormal collateral demands. With the rise of organized banking from the beginning of the 1900s, these troubles have vanished. Organized and systematic bank loans are provided to borrowers with minimal interest rates. Furthermore, bank loans are cheaper than other loans from other financial institutions such as NBFCs.

Flexibility

Bank loans provide an element of flexibility to the borrower, which can be very beneficial in the long term. The borrower can choose the duration of the loan and the amount of EMI, whereas the amount of loan and interest rates are negotiable. For example, if an individual takes a home loan from the bank, he can decide if he wants to repay the loan in 5, 10, or 20 years.

Accounting & Tax Advantages

The interest on bank loans is deductible from taxable income. This is an advantage to the borrower in the form of tax savings. In addition, the borrower gets the advantage of budgeting and planning for monthly loan expenses. This is especially true for fixed-rate loans, although a simple model can be prepared for changes in floating-rate loans.

Ownership Remains with Borrower

With an ownership perspective, bank loans can be a great funding source for companies. If a company decides to raise funds, it has many alternatives such as issuing equity shares, raising private equity, including venture capital, etc. However, in all these methods, the company may have to lose some part of the ownership share. Whereas in a bank loan, the company can raise funds and keep the ownership.

Also Read: Sources of Debt Financing

Cash Discount

Since most creditors allow cash discounts, the benefit of which can only be derived when you have funds available to pay. A bank limit can support a business for such opportunities. Before making a cash payment and availing of the cash discount, business people must analyze the pros and cons. The benefit derived from the cash discount should be more than the cost involved in terms of interest on the funds. Only then the cash payment would be beneficial.

Disadvantages of Bank Loans

There are certain disadvantages of bank loans as follows:

Additional Burden on Cost of Goods

One of the biggest disadvantages of bank loans is that the borrower pays way more than the product’s purchase price when he uses a loan to buy a product. Suppose an individual wants to buy a smartphone for USD 800.00; he decides to use his own USD 300.00 and borrow the rest of USD 500.00 by bank loan at 10% interest per annum. After one year, he repays his loan, whereby he has to pay the principal amount of USD 500.00 + interest payment of USD 50.00 (10% of USD 500.00). Thus in total, he paid USD 850.00 for a product priced at USD 800.00. This seems a minor amount but imagine the principle going in hundreds of thousands of dollars; then it can be quite expensive.

Security Needs and Creditworthiness

It is very difficult to obtain a bank loan unless an individual or a corporate has a sound credit score or valuable collateral. Banks are careful to lend money, and they only give loans to borrowers who have the ability and willingness to repay the loan. Small companies who are new to the business and have not taken any bank loans in the past find it even more difficult to obtain a bank loan.

Partial Funding Requirement

In the case of term loans, every bank has its own set of criteria as to partial payment requirements from the borrower. The partial payment may range from 10% up to 40% in some cases. For example, if a company wants to borrow USD 10,000.00 to buy a new office, then the bank may require that the company invests USD 1000.00 of its own. If the borrower doesn’t have sufficient funds for partial payment, the bank may reject the loan application.

Strict Repayment Schedule

Bank prescribes a very strict repayment schedule to the borrower, which must be adhered to. Failure to do so may reduce borrowers’ credit scores and future credibility. The stringency to stick to the repayment schedule sometimes creates a burden on the borrower.

Prepayment Penalties and Charges

Most banks charge borrowers for early repayment, which is a lose-lose situation for the borrower. Some financial institutions apply heavy prepayment penalties and charges. It is quite ideal for a prospective borrower first to check if the agreement of loan contains any prepayment penalties. If yes, the borrower should double-check his need for a loan and the tenure for which he needs it.

Interest Rate Risk / Cost of Funds

Big businesses plan their ventures for long terms, say 10 years, 20 years, etc. For such big and long-term projects, the interest rates offered are normally floating rates. The viability of these projects is checked before they are started, and there is a very important assumption of the cost of their funds throughout their project tenure. With floating rates, this assumption becomes floating. In economic situations where the interest rates rise, the cost of funds would also rise, making these projects unviable.

Processing Charges

For sanctioning a loan, most banks charge a processing fee which adds to the cost of your loan. This is normally charged in terms of percentage. The higher the loan amount, the bigger becomes the processing fee.

Increased Compliances

When a business acquires loans from banks, they have a schedule of regular renewal, and at the time of renewal, the banks recheck many credit points of the business. For example, if the loan is extended against inventory and receivables, the bank will assess the inventory statements and levels of receivables again before the renewal is approved. These things add to additional compliances for the business apart from their daily administrative headaches.

Despite all the drawbacks, bank loans remain the most basic source of funding for individuals and corporates alike.

After all, what a great site and informative posts.

Regards, Reader.

So educative!

I am interested to get a bank loan for my business fund. This article is very helpful for me. This definitely gives me a lot of ideas. Thanks for sharing this very helpful and informative article.

Thank You so much for the factual information about bank loans as I plan for my business venture.