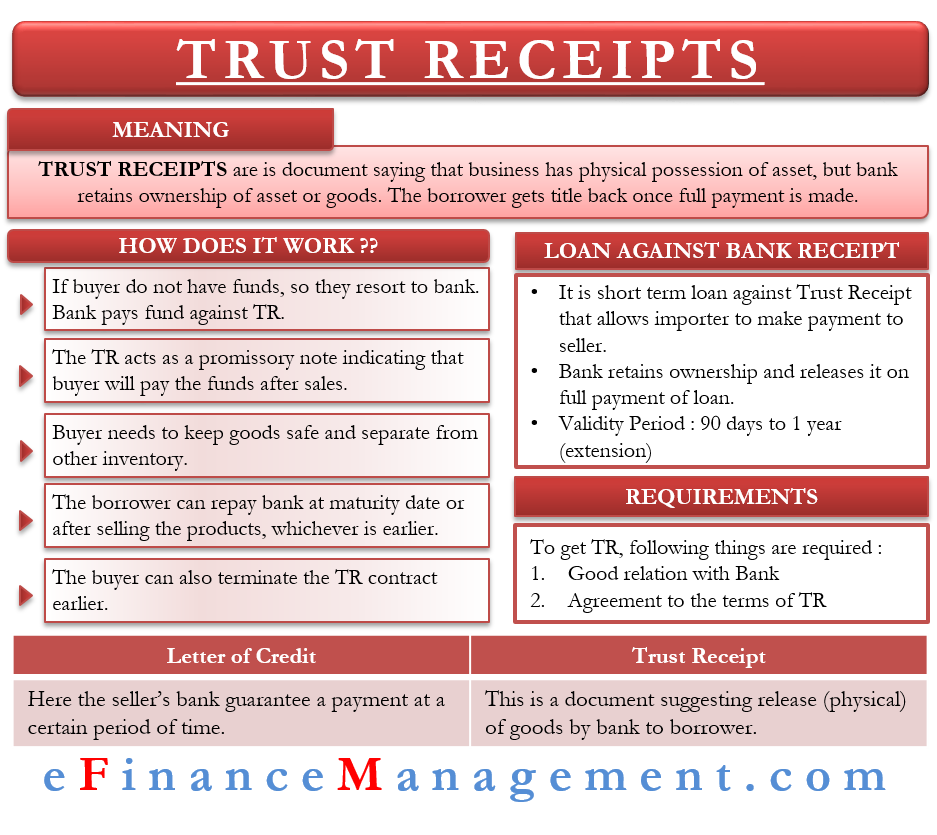

Trust Receipt or TR is a document that comes into play when a buyer has a loan or any other arrangement, such as a Letter of Credit (LC), from a bank to buy an asset or goods. Basically, it is a document saying the business has physical possession of the goods or an asset, but the bank retains the ownership of the asset or goods.

The borrower gets the title back once they make the payment to the bank. The bank has the right to sell the asset if the buyer fails to pay back the funds under the earlier arrangement.

Primarily, distributors and dealers, who sell expensive goods, go for such a funding route. They use the TR to get the items from the seller. The buyer may use the proceeds from the sale of the item to pay back the lender.

Loan Against Trust Receipt

A loan against trust receipts or LATR is a facility that a bank gives to its client, usually an importer of the goods or assets. It is basically a short-term loan against Trust Receipt that allows the importer to make the payment to the seller. The bank retains the ownership of the goods. A buyer can get back the ownership after repaying the loan amount. Though the LATR facility is short-term, usually for 90 days, it may extend to a year under special circumstances.

Also Read: Trust Deed – All You Need to Know

Trust Receipt – How it Works?

Buyers resort to TR when they don’t have sufficient cash to pay the seller. In such a scenario, the buyer gets the funds from the bank via TR and then pays the seller.

Trust Receipt basically acts as a promissory note for the bank, indicating that the buyer will pay them after the sale of goods. The bank, in this case, gives the fund to the borrower or issues a letter of credit to the seller or seller’s bank guaranteeing the payment.

In the case of TR, the buyer needs to keep the goods safe and separate from other inventory. In fact, the buyer acts as a trustee for the bank for storing and selling the goods. Even though the title or possession of the good stays with the bank, the buyer has possession. The buyer can do anything with the goods or assets as long as he (or she) does not breach the terms of the contract with the bank.

The buyer or the borrower can repay the bank at the maturity date or after selling the products, whichever is earlier. The maturity date in TR is short, usually between 30 to 180 days. At the maturity date, the borrower must repay the loan amount in full and with interest. If the borrower fails to make the payment at the maturity date, then the bank can sell the assets or goods.

The buyer can also terminate the TR contract earlier. To end or terminate the contract and get ownership of the goods, the buyer must repay the bank in full.

Requirements

To get a TR, a buyer needs the following things:

- The buyer must have a good relation with the bank.

- Bank and borrower must also agree to the terms of the TR, including the loan amount, interest rate, maturity date, and more.

Who Bears the Risk?

In a typical TR arrangement, the buyer or borrower makes little or no investment at all to get the assets. Thus, it is the bank that bears the majority of the credit risk in the contract.

On the other hand, Buyer keeps the profit from the sale of the products, but they also have to bear the business risk. This risk represents what if the buyer is unable to sell the goods or there is no demand for that product. Further, the buyer also has to bear the risk of goods getting damaged, lost, or deteriorate in value. Moreover, the buyer is also responsible for any additional costs they incur in relation to the good, such as freight, custom, storage, and more.

Letter of Credit vs. Trust Receipt

Banks issue a Letter of Credit or LC to the seller or seller’s bank to guarantee a payment or a specific amount at a certain period of time.

On the other hand, Trust Receipt is a document suggesting the release (physical) of goods by the bank to the borrower. LC may come both before and after the TR. TR comes into play if the buyer needs to make an immediate payment.

Quiz on Trust Receipt

Pls give your post on Financial terms