What is Short Term Finance?

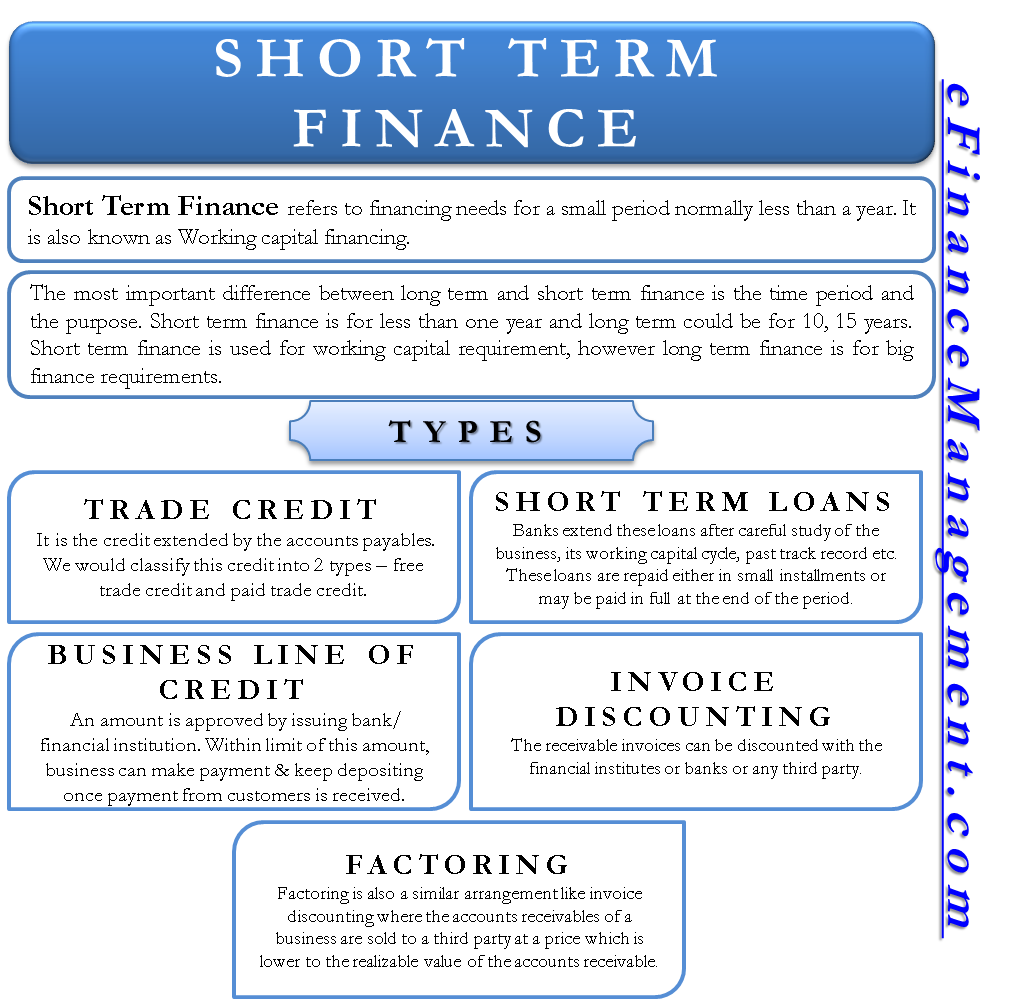

Short-term finance refers to sources of finance for a small period, normally less than a year. In businesses, it is also known as working capital financing. This type of financing is usually needed because of the uneven cash flow into the business, the seasonal pattern of business, etc. In most cases, it is used to finance all types of inventory, accounts receivables, etc. At times, only specific one-time orders of business are financed.

Types / Sources of Short-Term Financing

As we understand why we need short-term financing, there are various sources of short-term financing for a business. Each type of short-term finance has different characteristics and can be used in different situations. Some of those are explained below:

Trade Credit

Ooh yes, you have understood it right. It is the credit extended by the accounts payables. We would classify this credit into 2 types – free trade credit and paid trade credit. After a particular no. of days as per payment terms, the supplier charges interest on the delay of payment. So, the period before this is free trade credit, and after that is paid trade credit.

It’s pretty obvious that the free trade credit should be as much as possible because it is free of cost. How much is free trade credit extended to a customer? It depends upon the buyer’s creditworthiness, discipline maintained in payment commitments, the bulk of the business, etc. The higher you rate on these factors, the higher would be the free trade credit available to your business.

Also Read: Types of Term Loans

Paid trade credit is definitely a type of short-term financing, but it would be quite below on the priority list. In short, it should be selected only when another financing is not available. The reason for not opting for it is its high-interest cost.

Short-term / Working Capital Loans

Short-term loans can be availed from banks and other financial institutions. Banks extend these loans after careful study of the business, its working capital cycle, past track record, etc. Once availed, these loans are repaid either in small installments or may be paid in full at the end of the period. This depends on the terms of the loan. It is advisable to use these loans for financing permanent working capital needs. There are other alternatives to fund the temporary working capital needs. For more, refer to Working Capital Loans.

Business Line of Credit

A business line of credit, a type of short-term financing, is most appropriate for temporary working capital needs. In this type of financing, an amount is approved by the issuing bank or financial institution. Within the limit of this amount, the business can make payment and keep depositing once payment from customers is received. It works like revolving credit, and the best part of this is that interest is charged only on the utilized amount and not on the approved amount. The business has the flexibility to deposit unused amounts to save on interest costs. This way, it becomes a very cost-effective financing option.

Invoice Discounting

Invoice discounting is another source of short-term finance where the receivable invoices can be discounted with the financial institutes, banks, or any third party. Discounting invoices means the bank will pay you the money at the time of discounting and collects the money from your customer when the bill becomes due.

Also Read: Working Capital Loan and Finance

Detailed post: Invoice Discounting

Factoring

Factoring is also a similar arrangement to invoice discounting, where a business’s accounts receivables are sold to a third party at a price that is lower than the realizable value of the accounts receivable. This purchasing party is commonly known as a factor. Both banks and other financial institutions provide these factoring services. There are many types of factoring, like with recourse or without recourse, etc.

Short-Term vs Long-Term Financing

The most important difference between the two types of financing is the time period, the purpose, and the cost of financing. The time period is simple to understand. Short-term financing is normally for less than a year, and long-term financing could even be for 10, 15, or even 20 years. The purposes are totally different for both types of financing. Short-term financing is normally used to support the working capital gap of a business, whereas the long term is required to finance big projects, PPE, etc. The third thing is the cost of financing, which is higher in case of short term and comparatively lower in case of long-term, barring abnormal economic conditions.

Quiz on Short-term Finance

Definition Are good

I also think that factoring is a good financing solution for business. I think that it will definitely help for business owners to get instant working capital. This is definitely a great article. Thanks for sharing this article.

Sir give me short term financial assistance

I think that factoring is a good financing solution for business.I already tried it for my business and it definitely help me to achieve a good cashflow. Thanks for sharing this article.

Thanks for sharing this article. I already tried factoring and it’s really useful and helpful for financing my business. It’s really good for business. I recommend this to other’s as well.

Thanks for sharing these sources of finance. I’ll try these in order to finance my business. This is a very helpful post especially for those who are seeking ways on how to finance business.