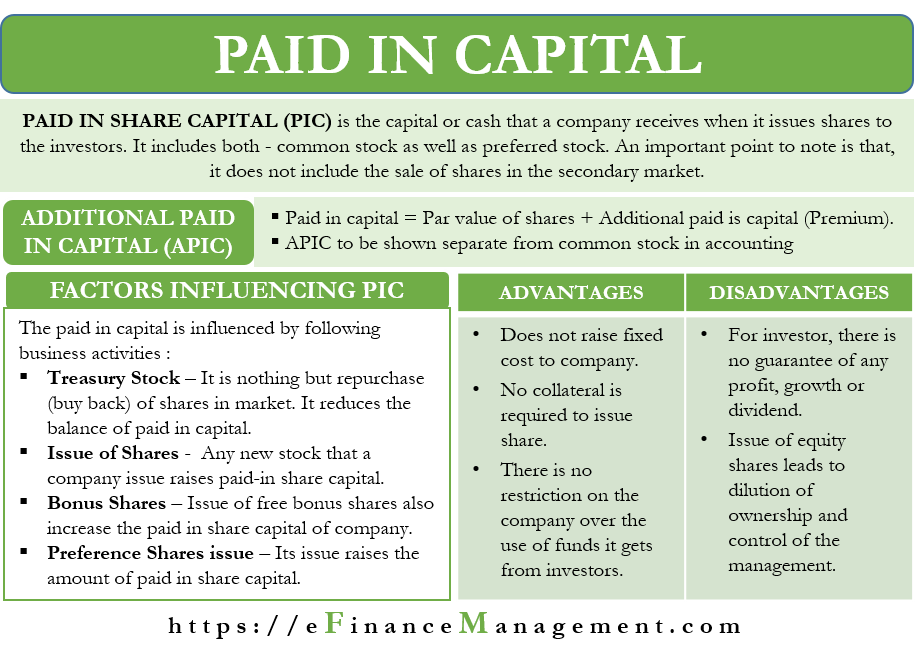

Paid-in capital or Contributed capital is part of the stockholders’ equity. It is the capital or the cash that a company receives when it issues shares to the investors. The paid-in capital includes either common stock or preferred stock and is an essential part of the total equity of a company. Or, we can say it includes the par value of the stock and any amount that a company receives over the par value.

It includes all the money and asset that investors pay – through IPO (initial public offerings), public listings, and direct public offerings – in exchange for common stock.

A point to note is that it includes the funds from the sale of shares to the investors and not the sale of shares on the secondary market. Also, it has no funds or contributions from the ongoing business operations. In the balance sheet, the amount of paid-in capital comes on the liability side, under the stockholders’ equity.

Additional Paid-in Capital (APIC)

Paid-in capital is different from the additional paid-in capital. Or we can say it includes the APIC. The paid-in capital is the sum of both – the par value of shares and the amount that shares get above the par value (or the premium that the investor pays). This amount above the par value is the APIC.

Also Read: How to Calculate Total Paid-in Capital?

Company laws or States rules often require a business to show the par value of the shares separately from the amount that a company receives from selling the shares above the par value. In terms of journal entries, Common stock gets credit to the extent par value of the shares. Similarly, additional pain-in capital gets credit for the amount above the par value.

Let us understand this with the help of an example. The common stock of Company A has a par value of $100 per share. Company A issues one stock at $140. The journal entry for this will be:

| Cash Dr. | $140 | |

| Common stock Cr. | $100 | |

| Additional paid-in capital Cr. | $40 |

Read APIC Accounting and How to Calculate Paid-in Capital for more details.

Business Activities Influencing Paid-in Capital

Following business activities affect the amount of paid-in capital:

Treasury Stock

A company often repurchases its shares from the market. The shares that a company buys back come under the shareholders’ equity section. Companies list these shares as treasury stock, and they reduce the balance of shareholders’ equity.

If a company reissues these shares above their repurchase price, then the profit is credited to a new account – “paid-in capital from treasury stock.” In case the reissue is at a loss. Then it reduces the retained earnings amount. If the reissue is at the repurchase price, then there is no profit or loss. Instead, the transaction just raises the shareholders’ equity to the pre-buyback level.

A company may also decide to retire some treasury stock rather than reissuing them. Once a company retires these shares, it won’t be able to reissue them later. Retiring the shares lowers the paid-in capital balance.

If the repurchase price of these shares was less than the paid-in capital of those shares, then the balance amount is credited to “paid-in capital from the retirement of treasury stock.” If the repurchase price was more than the paid-in capital of those shares, then the loss amount reduces the retained earnings.

Issue of Shares

At any time, a company may decide to issue new shares if it needs funds to buy assets, pursue expansion activities, or any other purpose. Any new stock that a company issue raises the amount of paid-in capital.

Bonus Shares

Issue of bonus shares also adds to the paid-in capital. Bonus shares are the free shares that a company issues to the existing shareholders. A company releases such shares from the securities premium account, capital redemption reserve account, or free reserves. Thus, the issue of bonus shares reduces the balance in these accounts and increases the balance in the paid-in capital account. A point to note is that the bonus shares do not affect the total shareholders’ equity.

Issue of Preference Shares

A company may also decide to issue a different class of shares and not the common stock. Preference shares are issued to prevent dilution in the value of equity or any adverse market reaction. Such shares are preference shares, and their issue raises the amount of paid-in capital.

Advantages and Disadvantages of Share Issuance

Following are its advantages:

- It does not raise the fixed cost for the company. The company doesn’t need to make any payment to the investor. The company can pay a dividend to common stockholders, which is also not compulsory.

- A company does not have to give any collateral in return for the fund it gets from the investor. Also, there is no claim of the investors on the existing assets of the company. A company is free to use its assets any way it wants.

- There is no restriction on the company over the use of funds it gets from investors. It can use the funds in any way it wants. The company can use the fund to pay the existing loan, buy any asset, or for any other purpose.

Following are its disadvantages:

- For the investor, there is no guarantee of any profit, growth, or dividend. We can say that the return of an investor is very uncertain.

- Issue of equity shares leads to dilution of ownership and control of the management. Owners of common stock get several rights in respect of the election of the board of directors and have a say in many business decisions.

Greetings, I wish to found related articles on this topic. ‘The effects of financial market on managerial accounting’

You can check the following post to understand more about it.

Financial Markets

International Financial Markets