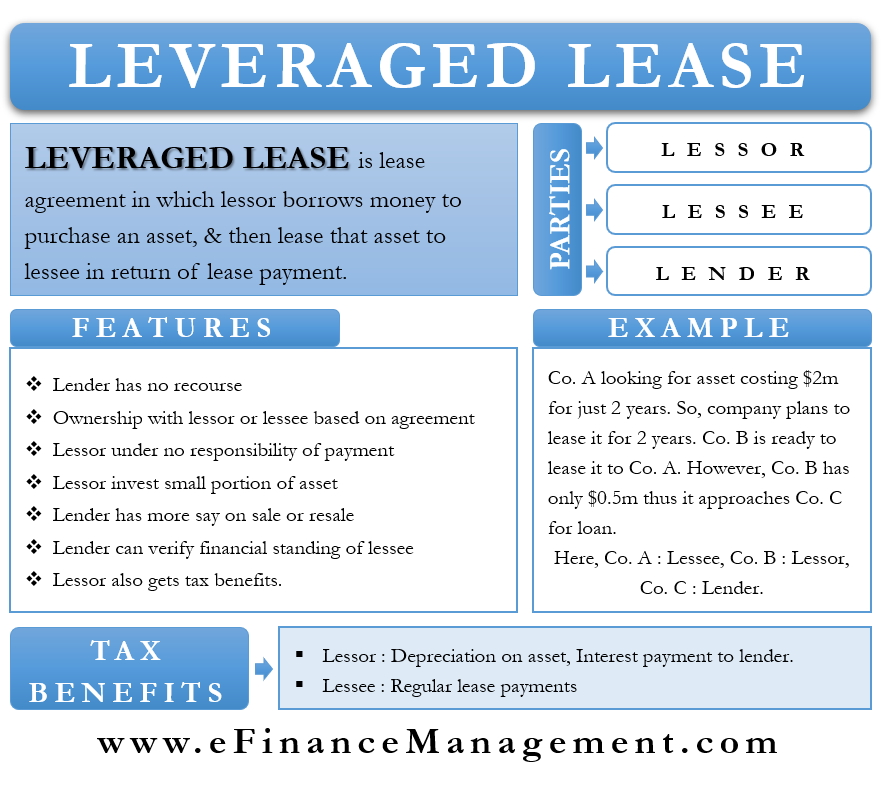

A Leveraged Lease is a lease arrangement that brings tax benefits to the lessor and lessee both. In this, the lessor borrows (full or partial) money to purchase an asset and then lease that asset to the lessee. Depending upon the lease arrangement type, the asset’s ownership still remains with the lessor or the lease provider. And in return for providing the assets on the lease, the lender receives the lease payment from the lessee. From the payment received from the lessee, the lessor keeps his share, and the balance is paid to the lender. In the event lessee makes a default in payment of regular lease premium/rentals, the lender has the right and privilege to take back or repossess the asset leased.

Parties to the Lease

This type of lease involves three parties – the lessor, the lessee, and the lender. The name leveraged lease is inspired by the fact that the lessor borrows funds to buy the asset that is further leased to the lessee. In this lease, the lessor may borrow all or the majority of the money to buy the asset.

Such an agreement is common when purchasing high-value assets. Also, these transactions are common when the lessee wants an asset for short-term use. Assets that are generally used in the leveraged lease are construction vehicles, trucks, cars, and more.

The Lender’s interest is well protected or secured in a leveraged lease. This is because the lessee is required to make the payment to the lender. In fact, this lease agreement is assigned to the lender.

Tax Benefits to the Parties in the Lease Arrangement

Talking of how such an arrangement provides tax benefits, the lessor can use depreciation on the asset to lower their taxable income. Also, even though the lessor takes the loan to buy the asset, the payment goes to the lender. This interest payment to the lender is deductible from the income of the lessor, being the interest payout on a loan. Thereby it reduces the gross and net taxable income of the lessor. The lessee, on the other hand, can reduce the taxable income by deducting regular lease payments.

Usually, in this type of lease, the lessor puts about 20% to 40% of the money from his pocket and borrows the rest from a third party. Such a feature makes this lease special.

Another aspect that makes this lease different is that the lessee makes the payment directly to the lender. Thus, in the case of a lessee default, the lessor has no obligation as the lender can repossess the asset.

Example of Leveraged Lease

Company A is looking for equipment costing $2 million for a project that will continue for two years. Since the equipment is costly and Company A would use it for just two years, they are planning to lease it.

Also Read: Advantages and Disadvantages of Leasing

Company B also wants to buy this equipment and is ready to lease it to Company A for two years. However, Company B has only $500,000; thus, it approaches Company C for a loan to buy the equipment.

This is a transaction of a leveraged lease. Here Company C is the lender, Company B is the lessor, and Company A is the lessee.

Features of Leveraged Lease

Following are the salient features of leveraged leasing:

- The lender has no recourse to the lessor.

- Depending on the terms of the agreement, the title/ownership of the asset can remain either with the Lender or Lessor.

- The lessor doesn’t have the responsibility to make payment to the lender. This is because the lessee makes the payment directly to the lender.

- Lessor usually invests only a small portion (or nothing at all) of the asset price. They borrow the remaining funds from the lender.

- The lender has more say than the lessor in the situation of sale or resale of the asset.

- The lender can verify the financial standing of the lessee. If the lender finds that the lessee won’t be able to make the lease payment, then they may go for recourse loan payment. In such a case, the lessor would have to make the payment.

- Lessor also gets tax benefits.

- The debt to the lessor is usually of non-recourse nature. It means that in case of default, the lessor is not responsible for repaying the debt. The lender can get the payment only through the lease payment. Thus, it is crucial for the lender to properly estimate the financial standing of the lessee.

Leveraged Lease Accounting

We can divide the accounting of this type of lease into three parts:

- Pre-tax income for the year.

- Tax credit and its amortization.

- The post-tax income of the year.

In terms of accounting, a leveraged lease comes under a capital lease. There are certain criteria, and the lease arrangement must fulfill one of those criteria to qualify as a capital lease. The criteria are:

- The duration of the lease arrangement should cover at least 75% of the total useful life of the asset.

- There is a choice for the lessee to acquire the asset at a rate less than its fair market value on the expiry of the lease arrangement.

- The lessee will have the option to get the ownership of the asset after the lease arrangement is over.

- The PV (present value) of the total lease payments under the arrangement should be more than 90% of the asset’s market value.

If the transaction adheres to one of the above criteria, then it is a capital lease. Otherwise, it is an operating lease. The accounting treatment of capital lease is similar to the asset’s purchase.

Leveraged Leasing vs. Leveraged Financing vs. Operating Leasing

Following are the differences between Leveraged Leasing, Leveraged Financing, and Operating Leasing:

- Number of Parties: The primary difference between the two is that leveraged leasing involves three parties – The lender, Lessor, and the Lessee. Whereas, in the leveraged financing and operating lease, there are only two parties – the lessor and the lessee.

- In leveraged leasing, the responsibility for payment rests with the lessee to the lender. In leveraged financing and operating lease, the responsibility is with the lessee to the lessor.

- The lender enjoys the right on the asset under leveraged leasing, but in the leveraged leasing and operating leasing, the lessor has the right on the asset.

- Unlike leveraged leasing, the structure and process of leveraged financing and operating leasing is simple and straightforward.

- In leveraged leasing, the lessor invests some money and borrows the remaining. In leveraged financing and operating leasing, the lessor manages 100% of the funds.

- There is also a difference in the accounting treatment of leveraged leasing, leveraged financing, and operating leasing.

Final Words

The leveraged lease is a complex financial vehicle and, thus, is useful when buying high-value assets. Such a lease is beneficial for the lessor because the risk is less, and there is a tax benefit. Moreover, the risk of non-payment by the lessee also does not devolve on the Lessor.