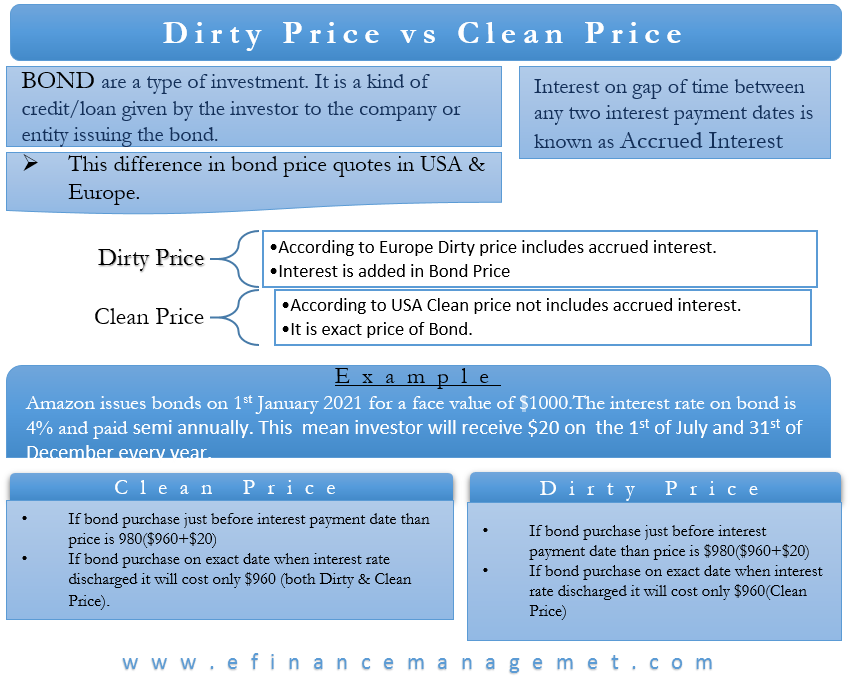

Understanding bond pricing is complex, sometimes even for experts. Markets quote bond prices in two different manners. They are dirty price and clean price. There is a difference in bond price quotes in Europe and the USA. European bond quotes are at their dirty price, while in the US, the bond quotes are at the clean price. The definition of clean price says that the clean price of a bond doesn’t include any accrued interest, while the dirty price of a bond does include accrued interest. In the following discussions, we would attempt to define and understand the difference between the dirty price vs the clean price. Further, to make more sense out of these definitions, let us approach bond pricing from the beginning.

Defining Bonds

Bonds are a type of investment. In simple terms, it is a kind of credit/loan given by the investor to the company or entity issuing the bond. This loan is for a fixed or specific period of time. Most types of bonds pay some interest on the principal amount invested at a regular frequency. We know this interest payment in the bond market as ‘coupon payment.’ Markets express this coupon payment in terms of percent of the bond’s face value. The issuer of the bond can make this coupon payment monthly, quarterly, annually, or semi-annually. Upon maturity of the bond, the investor receives the whole principal back.

Read Bonds and its Types to learn more about bonds.

Defining Accrued Interest

Just like in our bank savings account, the interest on a bond keeps building daily. It keeps building until the payment date. This time gap between any two interest payment dates is the accrual period. You can figure out the accrued interest on a bond by multiplying the value of each day’s interest by the number of days since the last payment. On the interest payment date, the bond’s accrued interest becomes zero again.

Clean Price vs. Dirty Price

The clean price is the exact price of the bond in the market, not including the accrued interest. As we discussed earlier, interest payment keeps building on a bond daily, and we know it as accrued interest. The clean price of a bond doesn’t include this interest which is built on the bond till today. Bonds in the US are quoted at this price.

Also Read: Bond Valuation

On the other hand, if we add the interest which has accrued to date on the clean price of the bond, it becomes a dirty price. So, if you purchase a bond between the two coupon payment dates, the interest which has accrued on the bond till that date will be reflected in its dirty price but not in its clean price. On the interest payment date of a bond, both the clean price and the dirty price will become equal. As there is no accrued interest on the bond.

Calculating Dirty Price vs Calculating Clean Price

Let’s say that Amazon issues bonds on 1st January 2021 for a face value of $1000. The published price The interest rate, or coupon rate on this bond, is 4% and is paid semi-annually on 1st July and 31st December every year. This means the investor will receive $20 on every 1st of July and 31st of December.

Clean Price:

Let’s calculate the clean price of the bond under two different scenarios.

- In Scenario 1, you purchase the bond just a day before its interest payment date. To this date, $19.6 has accrued as interest payment on the bond. The bond’s clean price is $960 only. However, the bond price that will be quoted to you is $960. Since accrued interest is extra and does not form part of the clean price, so, you would need to pay a total price of $979.9 ($960 + $19.9 of accrued interest).

- In Scenario 2, you purchase the bond on the exact date when its coupon payment is discharged. Since all the accrued interest on the bond has just been cleared, the clean price and dirty price will both equal to $960 only. And you need to pay only $960.

Dirty Price:

Let’s calculate the dirty price of the bond under the above two different scenarios.

- In Scenario 1, you purchase the bond just a day before the coupon payment date. The accrued interest balance to date is $19.9, so the bond’s dirty price will come out to $979.9 ($960 + $19.9 of accrued interest).

- In Scenario 2, you purchase the bond on the exact date when its coupon payment is discharged. Since all the accrued interest on the bond to add to this price is zero, the dirty price will remain equal to the clean price of $960 only.

It can be seen that in both the calculations, you need to pay the accrued interest on the bond to date to the seller. In our example, under scenario 1, you will receive full accrued interest of $20 the next day after purchasing the bond. But the seller has already taken away $19.9 from you. So, effectively you will get only $0.10 as interest on the bond, which is just one day’s interest payment. Rightfully so, because you have held the bond for just a day on this interest payment date. Your seller was holding it for the rest of the time. So he took away interest payment from you for those many days.