What is Venture Capital?

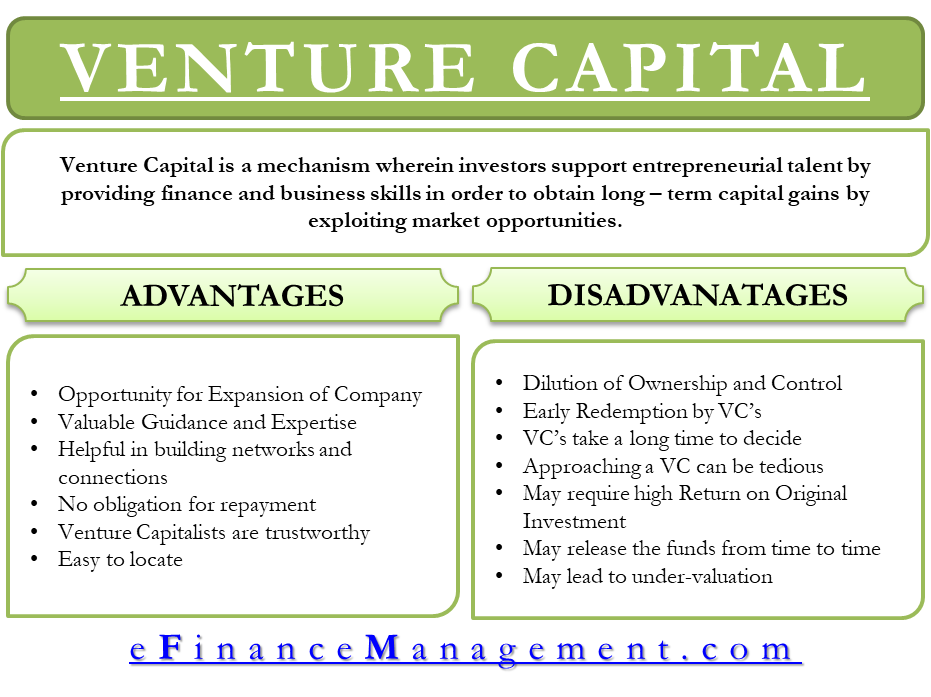

Venture Capital is a mechanism wherein investors support entrepreneurial talent by providing finance and business skills to obtain long–term capital gains by exploiting market opportunities. There are various Advantages and Disadvantages of Venture Funding.

There are various deciding factors that contribute to the decision of whether a company should go ahead with venture funding or not.

Advantages of Venture Capital

Opportunity for Expansion of the Company

Venture Capital provides the company with an opportunity to expand. This would not have been possible through other methods like bank loans. Bank loans require collateral, and there is an obligation to repay the loan. However, in venture capital, the investors themselves are ready to take the risk as they believe in the company’s long-term success. Therefore, venture capital financing is beneficial for start-ups with high initial costs and limited operating history.

Valuable Guidance and Expertise

Besides capital financing, venture capital is also a source of valuable guidance, expertise, and consultation. A member from the venture capital firm is usually appointed to the board of the start-up company. This allows the active involvement of the venture capitalist in the company’s decisions. As venture capitalists have experience building and expanding start-ups, their expertise and guidance can prove beneficial. They can help with building strategies, technical assistance, resources, etc., in order to make a business successful.

Helpful in building networks and connections

Venture capitalists have a huge network of connections in the business community. These connections could be advantageous for the start-ups to grow and become successful. They can help the start-up enter into alliances with potential customers or business houses.

No obligation for repayment

There is no obligation to repay the venture capitalist investors if the start-up fails or shuts down. Hence, venture funding is essential for start-ups. It does not leave the start-up with the burden to pay back, as is the case with bank loans.

Venture Capitalists are trustworthy

VCs are strictly regulated by regulatory bodies. For instance, In the USA, VCs are regulated by U.S Securities and Exchange Commission. They are subject to similar regulations as any other form of private securities investment. Also, know-your-customer (KYC) and anti-money laundering regulations may apply since a large number of venture capital funds are provided by depository institutions and banks. It’s a rarity to see a VC perform an unscrupulous activity.

Easy to locate

It is very easy to find and locate VC within minutes investors, as they are documented in various directories. This reduces the time, effort, and money involved in searching for venture funding. One can find a VC quickly and efficiently. For instance, you can get a huge list of venture capital firms by typing on any search engine.

Disadvantages of Venture Capital

Dilution of Ownership and Control

Venture capitalist provides huge capital to the start-ups in return for a stake in the equity of the company. If the start-up succeeds, then it helps them earn tremendous amounts of profit. VCs usually become a part of the Board. They actively participate in the company’s decision-making. VCs will want to protect their investments. If there is a difference of opinion between the VC and the start-up founder, then things can get chaotic. Any major decision requires the consent of investors.

Also Read: Venture Funding

Early Redemption by VC’s

A VC may decide to redeem the investment within 3 to 5 years. Their primary focus is to earn capital gains. Venture capital may not be suitable for an entrepreneur whose business plan will take a longer time to provide liquidity.

Long and Complicated Process

The start-up company’s owner should first present a detailed business plan. After that, the VC analyses the business plan in detail. Then, a one-on-one meeting is conducted to discuss the business plan in detail. Later, if the VC agrees to go ahead with the funding, then due diligence is done to verify the details. If the due diligence is found satisfactory, then only the VC will offer a term sheet. Therefore, venture capital funding is often found to be a lengthy process.

VCs take a long time to decide

Venture Capital funding involves a huge amount of risk. So, VC’s usually takes lots of time to decide whether they want to undertake investment or not. Venture funding may be a great source of availing funds for start-ups. However, the long wait before receiving the funds is a huge drawback.

Approaching a VC can be tedious

A lot of investment opportunities through uninvited emails overburden the VC’s. Due to this, a lot of business proposals go unnoticed. One of the ways to approach the VC is through a mutual connection.

May require high Return on Original Investment

Some VCs require high ROI within the next three to five years of investment. If your start-up needs more time to generate a high ROI, then opting for VC may not be the right choice as the expectation of higher ROI may cause a high level of stress.

May release the funds from time to time

Because venture funding involves a huge amount of capital, the VC may not release all the funds at the same time. Most of the contracts require the start-up company to reach certain milestones in order to receive the funding which they originally requested. This creates undue pressure on the start-up company.

May lead to under-valuation

Venture Capitalists are in a hurry to sell off their equity stake. Therefore, they may pressurize the company owner to list the company. This untimely listing of the company could result in the undervaluation of the company’s shares. This could prove to be a disadvantage for the company’s owner.

In comparison to other ways of raising capital, venture capital gives startup companies significantly more resources. Whether it be through a bank loan, crowdfunding, an angel investor, or equity financing, venture capital usually gives you the most funding.