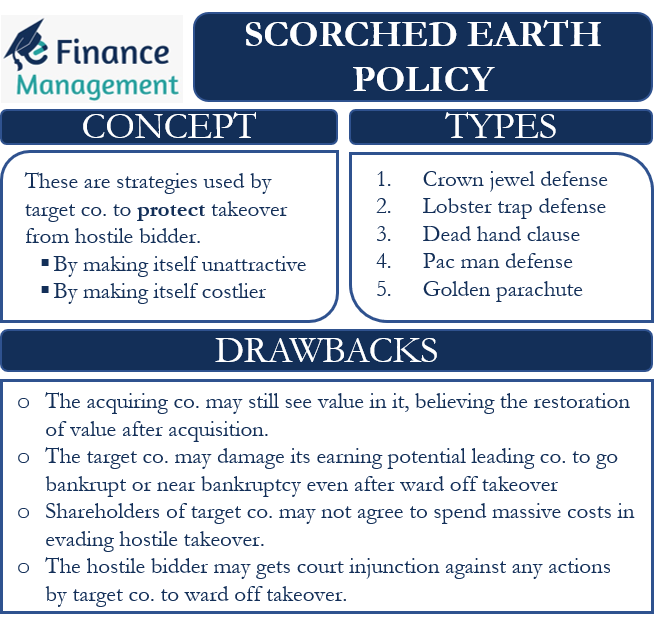

Scorched Earth Policy is not any environment protection policy. Instead, one would come across this term in case of a corporate takeover (hostile takeover). It refers to the strategies that a target company uses to protect itself from being taken over by a hostile bidder.

Or, we can say the techniques that a firm uses to make itself unattractive to the acquiring company (the hostile bidder), such as taking more debt, spoiling its image, giving senior management substantial compensation, and more. The idea behind using such strategies is to make the target company costlier (or worthless) for the hostile bidder.

The target company uses other steps and strategies to avoid a hostile takeover. However, when other strategies do not work or give the desired results, as a matter of lost resort, scorched earth policy or strategies are adopted by the target company. This term owes its origin to a military tactic, where soldiers destroy crops, plants, and other crucial resources to ensure the attacker does not get enough resources for survival.

Types of Scorched Earth Strategies

There are several ways in which a target company could make itself unattractive to the potential bidder. Some of the most important ones are discussed below:

Crown Jewel Defense

In this, the target sells its valuable assets or “crown jewel” in the open market or to a rival. Also, the target company may spin off those key assets to create a separate entity altogether. Something similar was the case in the merger of Sun Pharma and Taro. The Israeli firm (Taro) used strategies like selling its Irish unit and not disclosing financials to keep Sun Pharma away. This would reduce the value and charm for the hostile bidder, and the company can survive from such a bid.

Lobster Trap Defense

Such a defense aims to catch big targets while leaving small ones. In this strategy, the target firm may come up with a rule that prevents big shareholders from converting their securities into voting stocks. Basically, it ensures that large shareholders are not able to add to their voting rights. Such a strategy is useful only if a company issues convertible securities, such as convertible debentures, convertible warrants, convertible preference shares, and convertible bonds. Thereby the likely control from big stakeholders gets diluted.

For example, Company A wants to avoid a hostile takeover attempt from Company B. The former comes to know that an insurance firm owns about 12% of its voting shares. Also, the same insurance company owns convertible warrants that could give it 6% more voting rights. So, to ensure the insurance firm does not help the hostile bidder, Company A’s’ management adds a ”Lobster Trap” provision. This prevents the insurance firm from converting the warrants into voting shares, thereby adding voting rights in favor of the hostile bidder.

Dead Hand Clause

Such a tactic makes the target company more expensive to the hostile bidder. Such a tactic is useful if the acquiring firm already owns some stake in the target or when there is cross-shareholding. Now, the target company would issue the right shares to all (except to the bidder), and that too at a very less price. This would dilute the holding of the bidder substantially, and thus his effective control reduces.

Also Read: Hostile Takeover

We also call this strategy as ”poison pill”. In 2020, computer maker HP used a similar tactic to avoid a hostile takeover from Xerox.

Hostile bidders, however, can fail this strategy by electing a new board of directors. Also, the dead hand clause (or dead hand poison pills or dead-hand redemption) is a controversial tactic and may be illegal as well. For instance, the Delaware Supreme Court in 1998 called such defensive measures invalid.

Pac Man Defense

Pac man defense strategy derives its name from the Pac-Man video game. Here, a player is able to destroy the ghosts, who aim to destroy the player, by eating a power bullet.

Under this tactic, the target company carries actions that may surprise the acquiring company. For instance, the target company may take a massive loan, spend reserves unnecessarily, etc. Another tactic under it is buying the shares of the acquiring company.

For instance, if Company A is buying shares to acquire Company B, then to prevent being taken over, Company B would start buying back its shares, as well as buy shares of the Company A. One major drawback of this strategy is that it could prove extremely expensive for the target company. So the effectiveness depends on the ultimate objective and costs the target company is ready to bear or face.

Golden Parachute

Golden parachute tactic involves giving lavish compensation to the executives. The idea behind such a tactic is to make it expensive for the bidder to take over the target company.

So all these tactics lead to making the target company unattractive or costly for the bidder. So the bidder has a re-think whether it will still be a feasible proposition to go ahead or it should hold back or completely withdraw itself from any such hostile takeover.

Drawbacks of Scorched Earth Policy

There are four major issues in using scorched earth policy. These are:

- Even if the target company uses these tactics, the acquiring company may still see value in it. In such a case, the acquiring company would go ahead with the takeover, believing it would be able to restore the value after it completes the acquisition.

- If the target company is able to ward off the takeover attempts using these tactics, then in the process, it may severely damage its earning potential. This could make it really hard for the company to recover from that position. And, there are chances that the company could go bankrupt or near bankruptcy. For example, a software firm sells all its secrets to a rival to escape a takeover. But after the takeover fails, the same software company would lose its competitive advantage to the rival.

- Sometimes, shareholders of the target company may not agree to spend massive costs to evade the hostile takeover.

- There are always chances that the hostile bidder gets a court injunction against any possible actions by the target company to ward off the takeover.

Final Words

The scorched earth policy could prove very useful in case of a hostile takeover. It is usually the last option that a target company resorts to. But, when using such strategies, the target company needs to be very careful because it could easily go against it as well. If the hostile takeover fails, then the use of such tactics may lead to substantial irreversible losses. Also, there are chances that these tactics fail if the bidder gets an injunction against the target company’s defensive actions. Or the bidder still finds value in the proposed acquisition and goes ahead with its plan despite all such roadblocks.

Frequently Asked Questions (FAQs)

Scorched earth policy refers to the strategies the target company uses to protect itself from being taken over by a hostile bidder.

The company resorts to a “scorched earth policy” as the last option to avoid a hostile takeover by making itself unattractive and costlier for the hostile bidder.

– The acquiring company may still see value in the target company after the target company has adopted this policy.

– Target company may severely damage its earning potential, which may turn hard for the company to recover.

– Shareholders may not agree to spend massive costs in evading the hostile takeover.

RELATED POSTS

- Takeovers

- Poison Put – Meaning, How it Works and Example

- Poison Pill: Meaning, Pros & Cons, Types, Examples, and More

- Flip-over Poison Pill – Meaning, Benefits, Drawbacks, and How it Works

- White Squire Defence – Definition, Advantages, Disadvantages, and Example

- Pac Man Defense – Meaning, Pros, Cons, and Example