Meaning of Merger

A merger is a process in which two or more existing companies voluntarily combine together to function as one new company. A new company comes into existence to gain a competitive edge in the market, improve the financial and operational strength of both the companies, expand the research and development program, expand the business into new areas, etc. However, we must understand that a merger is different from an acquisition. Under the merger, two or more companies combine voluntarily, while under acquisition, the acquiring company purchases the business of the target company. There are certain types of mergers, one of which is a Conglomerate Merger.

Types of Mergers

There are various types of mergers. They are as follows;

- Horizontal Merger

- Vertical Merger

- Conglomerate Merger

- Concentric Merger

- Forward Merger

- Reverse Merger

- Subsidiary Merger

In this article, we shall understand the concept of a conglomerate merger.

Meaning of Conglomerate Merger

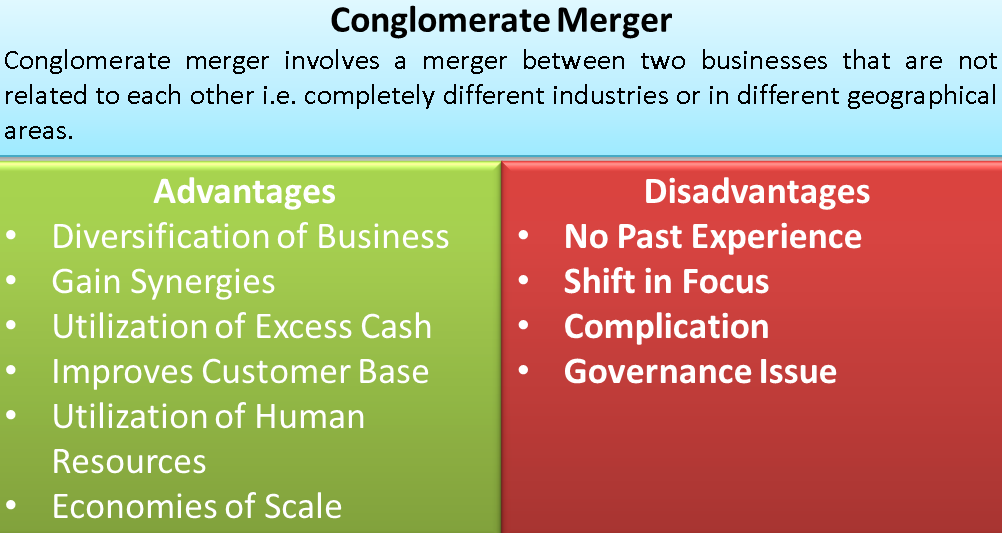

A Conglomerate merger involves a merger between two businesses unrelated to each other. The two companies are in completely different industries or in different geographical areas. Conglomerate merger is helpful for companies to extend their corporate territories, to gain synergy, expand their product range, etc. It is also termed Conglomerate Integration.

Types of Conglomerate Merger

It can be further divided into pure and mixed conglomerate mergers. When two firms with nothing in the common merge, it is termed a pure conglomerate merger. On the other hand, when the interest of companies merging together is a market expansion to gain more customers or expand their product range, it is termed a mixed conglomerate merger.

Conglomerate Merger Example

A firm engaged in the business of shoe manufacturing merges with a steel manufacturing firm, then it would be termed a conglomerate merger. The businesses of both the firms are different from each other and totally unrelated.

Also Read: Mergers Vs Acquisitions

Advantages of Conglomerate Merger

Following are the advantages of the conglomerate merger:

Diversification of Business

Conglomerate merger enables the company to diversify its business. It helps to overcome risks associated with the vulnerable market. If one business sector is declining, the business has the opportunity to overcome the unfavorable situation by performing well in the other diversified sector. It is also termed a conglomerate diversification strategy.

Gain Synergies

A combined entity always performs better than each individual entity. It brings synergies by increasing the sales and revenue of the combined entity.

Utilization of Excess Cash

When a business has excess cash but does not have enough opportunity to expand in its sector, then the business invests such excess cash into another company of a different sector to utilize the idle funds.

Improves Customer Base

With this type of merger, the company can cross-sell its products to the other company’s customers. This helps to build a broader customer base. This, in turn, helps to increase sales and profits.

Utilization of Human Resources

The business has the option to utilize the managers from different sectors in its business whenever the need arises. This leads to the best usage of human resources.

Also Read: Classification / Types of Mergers

Economies of Scale

It helps the business to achieve economies of scale. Various business costs like Research and development costs, cost of advertising, etc., are spread out to numerous business units. It helps reduce the production cost per unit and helps achieve economies of scale.

Disadvantages of Conglomerate Merger

Following are the disadvantages of the conglomerate merger:

No Past Experience

In a conglomerate merger, the companies merging together do not have any past experience with the functionalities of each other. This can lead to severe mismanagement in the organization.

Shift in Focus

In a conglomerate merger, two unrelated companies merge. Management requires a lot of effort to understand the new business sector, operations of the business, etc. Hence, companies shift their focus from core business activity to other business areas, leading to poor performance in all the sectors.

Complication

It leads to the merger of different human values and employees who have experience working in various industries. This leads to complications in human relationships and behavior.

Governance Issue

When two companies come together will different backgrounds, governance is a big issue. All the past customers with their accounts are transferred into the new company, which may be following different accounting methods. This creates a lot of problems for the management.

Thus, a conglomerate merger is useful for companies that aim to strengthen their operational ability and improve their financial condition by capturing a bigger market share and expanding their product range.

I really loved it

I’ll right away grab your rss feed as I can’t find your email subscription link or e-newsletter service. Do you’ve any? Please let me know in order that I could subscribe. Thanks.